Day Trading Hours: Not All Hours Are Equal

So when is the best time to trade stocks? Are day trading hours for you?

If you’ve been trading for a while, you might have noticed that certain times of day are much more exciting than others. There’s a lot of activity during the first hours of the market’s open, and then the afternoon is pretty dull, with the exception of Fridays, when things pick up markedly.

There’s a bit of psychology to it, but most of it is pure practicality.

The pre-market trading hours don’t see a lot of activity unless there’s some huge news, but the first few hours of trading when the regular market opens is another story. This is when the bulk of activity takes place. Trading during the afternoon is about as dull as it gets, and usually it’s better just to have a long lunch …

But what about different days of the week, or holidays, and seasons in general?

For instance, it’s a fairly logical (and popular) strategy to buy West Texas Intermediate (WTI) crude oil contracts in the spring because these futures contracts usually peak in the summer season when driving increases.

It also seems logical to jump in on stocks that appear poised to benefit from the massive rush to buy Christmas presents.

Download a PDF version of this post as PDF.

Early Birds and Night Owls: What’s Best?

The overachievers in the day-trading world will be up to trade in the pre-market hours, between 8 am and 9:30 am EST, before the regular market opens, for regular people. It’s not really a prime time for beginning traders because there’s very little activity during these hours unless there is major news to move things. There also isn’t much liquidity as a result. Many stocks just show stub quotes during these hours.

The pre-market indications for stocks can be tricky. Stocks might appear strong during the pre-market period and then reverse in regular market hours. But these extended hours also present some unique opportunities for trading, getting you in the right games early (if you know what to look for). After all, this is where you can take advantage of surprise press releases or major news events while others are sleeping.

The morning hours, right when the market opens until about 11 am, are generally considered the best time for trading, and probably when you’ll end up seeing the bulk of your gains. It means that you have to get up early and do your research before the regular market opens. The biggest moves with the biggest potential gains in a short period often come between 9:30 and 10:30 am EST. Many professional day-traders stop trading around 11:30 because that’s about when volatility and volume start to decline.

The toughest time to make money is lunchtime, between 11:00 am and 2:00 pm. This is when the market starts trading slower, because … well, everyone’s actually having lunch. It’s not a great time to find good setups because they can fall apart quickly.

Some traders prefer to trade during the last hour of the regular market, from 3:00 pm to 4:00 pm. This hour can see a lot of big activity, including sharp reversals. Closing auctions can drive prices right at the end of regular trading, and it’s possible to make big gains here.

Swing trading, or end-of-day trading, after the regular markets close at 4:00 pm is popular for those who can’t trade during the day. The swing trader will buy at the market’s close and then hold overnight.

Days of the Week: Why Friday Rocks

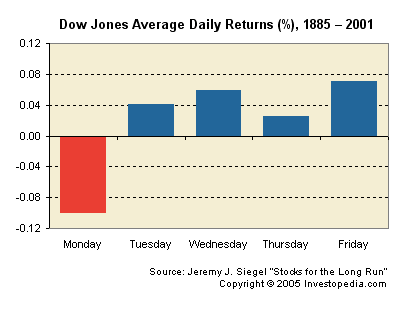

We like Friday best because we’re in a strong bull market. According to Zack’s, Friday is the best day of the week for the S&P 500, and the second-best day for the Nasdaq Composite (when we’re in a bull market). But overall, bull or bear, Wednesday is considered a key trading day. Why? S&P 500 performance data shows that, after 25 years, average returns have been better on Wednesday.

Stocks also perform better the closer we get to the end of a month because people tend to get paid right around then.

Consider this:

If you want to make money on seasons and holidays, you’ll need a fair amount of patience and a pretty solid understanding of consumer behavior. Not only is the shopping season particularly unkind to some stocks that you might have thought would greatly benefit, but trading itself sees a lull in activity, especially during holidays. People are taking vacations and breaks from trading. That makes for a more volatile and less liquid market, and price actions can be exaggerated.

According to Zerohedge, the fourth quarter of years ending in a ‘7’ has “historically exhibited the worst performance of any semi-annual period of the decadal cycle”. Zerohedge invites us to consider this track record:

- 2007:“Just” a 10% drawdown, but also a cyclical market top

- 1997: Asian Crisis…swift 17% drawdown

- 1987: “The Crash”…20% decline, with a 41% drawdown

- 1977: Cyclical bear market…9% decline, with a 15% drawdown

- 1967: Up 5% for half, but 12% drawdown, all in the 4th quarter

- 1957: Straight down from July…13% loss, with 20% drawdown

- 1947: Mostly unscathed…2% gain, with ”just” a 7% drawdown

- 1937:Major bear market…Down 29% with 41% drawdown

- 1927: Roaring bull…9% drawdown, but a gain of 21%

- 1917:Cyclical bear market…22% decline, with a 31% drawdown

- 1907: Cyclical bear market…24% decline, with a 35% drawdown

Just remember, for traders, it doesn’t matter—bull or bear, there’s money to be made.