Let’s talk about the big runner of the week…

Because I was hating on this stock all day on Monday. Then all it did was go higher…

I finally changed my tune when it was closing near its daily highs.

Luckily for me, I didn’t hold onto my bias about the stock and its BS press release…

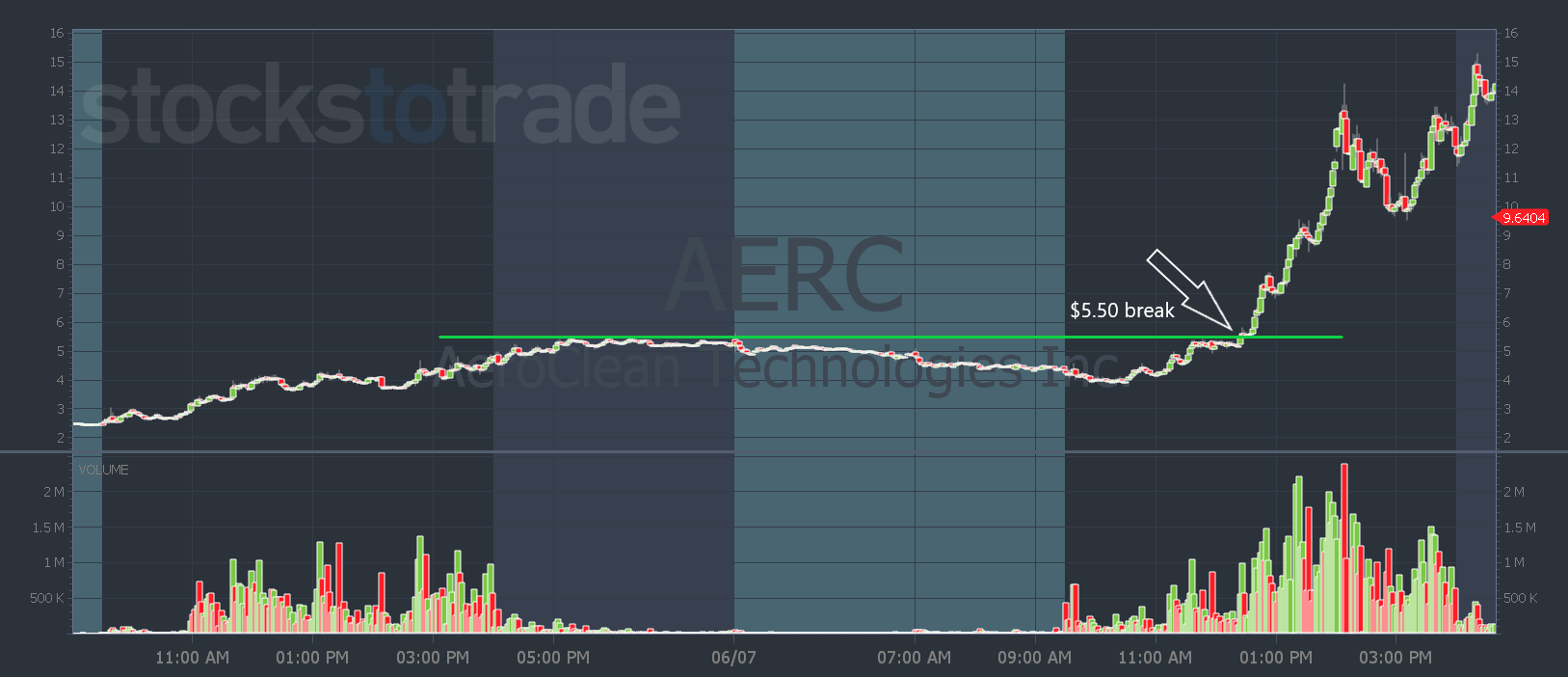

Because on Tuesday it had a glorious short squeeze and skyrocketed over 225% from its opening price to its high of the day.

But that move is over … If you missed it, you missed it.

Now you have to be ready to find and execute a trade on the next one. There are two ways to do that…

The first way is to understand how and why these patterns work.

The second way is a little easier…

See how I find afternoon trades the easy way here.

Why Short Squeezes Work in the Afternoon

In my morning SteadyTrade Team webinar a member asked why short squeezes like AeroClean Technologies, Inc. (NASDAQ: AERC) work so well in the afternoon.

To understand why it works so well on the long side, you have to understand the short-selling strategy that creates the move…

The parabolic short strategy is obsolete. (SteadyTrade Team members can learn more about shorting strategies in this webinar.)

But apparently, shorts don’t know that… Because they’re still getting blown up trying to use this strategy. AERC proves my point…

Anyways, with the parabolic short-selling strategy, you take a short position based on the thesis that the stock will keep going higher.

Confusing, right? If you use risk management, it makes no sense… (which is partially why it’s obsolete.)

But the idea behind it is that you’re shorting it with a plan to add higher. Essentially, you’re scaling into a short position.

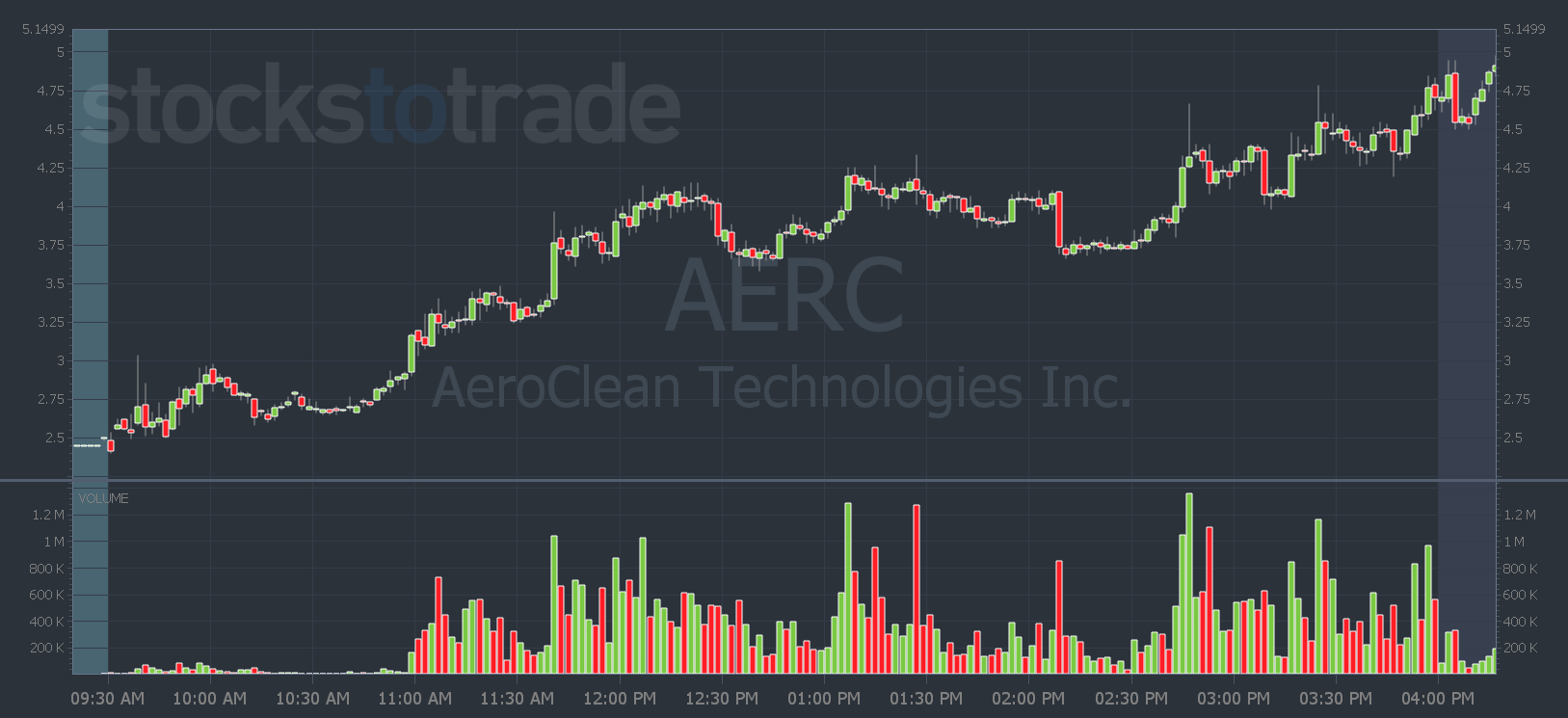

So when a stock like AERC starts to spike as it did on Monday, you might short 100 shares at around $3.50. Then you might add 100 shares at $4, and more at $4.50 … You can see all the long top wicks on the chart…

Because the more parabolic — meaning straight up — a stock goes, the more shorts think it will pull back really hard and they can buy to cover to get out. Then they’ll make bank bro, and they can brag to all their friends.

The problem with that is, in the post-2016 world shorting is an overcrowded strategy. Stocks don’t pull back like they used to. Instead, they consolidate sideways.

And shorts add into any pops. Just like they did on day one in AERC.

Then when the stock opens red the next day, they think they’ve got the trade in the bag. And they start hammering it even harder…

Now, the shorts are in full size. They’ve maxed out their buying power and margin…

Then the stock has an uptick. And they get nervous…

Then it breaks above the opening price. So they up their risk to the red-to-green level…

…Now the stock goes from red to green.

Suddenly more shorts are nervous and they have to buy to cover to get out.

That creates a wave of buying where it’s shorts hitting market orders and outbidding each other to get out.

And that’s why most short squeezes happen in the afternoon.

Because the longer shorts have to watch a stock consolidate, grind back, and then continue to make new highs, the more nervous they become…

Then they finally have to accept they’re wrong and exit the trade. And if they don’t, their broker will do a margin call and force them out.

That’s what makes afternoon moves so powerful.

So if you don’t have time to trade in the morning, this setup is for you…

How to Find Afternoon Trades

Watching and waiting for these explosive moves can take a big chink of time out of your day.

If you don’t have the time to devote to watching screens all day, consider setting alerts at key levels in recent runners.

But an easier way to find them is to have me alert you to them…

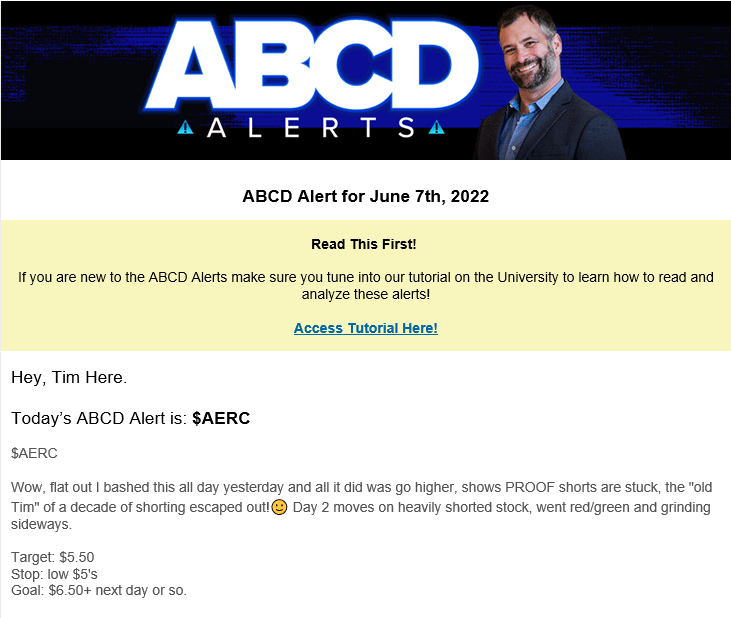

I sent a trade alert for AERC right to subscribers’ inboxes on Tuesday around noon Eastern…

Not an ABCD Alerts Subscriber? Click here to do something about it!

I knew AERC was heavily shorted the day before. Because short sellers were thinking what I would’ve been thinking 7 or 8 years ago…

The stock was ‘up too much’ on dubious news about air purification.

But once AERC went from red to green and volume came in, I knew there was a potential play.

The trade idea worked out even better than I anticipated…

If you would’ve taken a $1,000 position at my target entry, you could’ve sold an hour later and made roughly $700. If you held another hour, you could’ve made over $1,100 — that’s double your money!

Even if you were conservative and traded my idea to a T … You still could’ve made almost 20% on your trade. Not bad for a so-called ‘ugly market.’

Moves like this happen over and over again because of all the reasons I explained above…

And it’s why I love trading penny stocks.

If you want to discover how to capitalize on moves like AERC — get my next afternoon trade idea alert here.

Have a great day everyone. See you all back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade