Everyone would love to catch $8-per-share moves and nail entries and exits…

But to do that, you first need to know how to spot the right levels.

It takes time…

You can’t learn everything about trading overnight. But I’m here to help you speed up your learning curve…

So today I’ll break down why one of my picks from last week’s watchlist turned out to be a beautiful trade opportunity…

And I’ll share a stock I’m watching for a similar setup. Read on!

Speed up your learning curve with twice-daily live webinars — apply for the SteadyTrade Team here.

How to Catch an $8-Per-Share Move

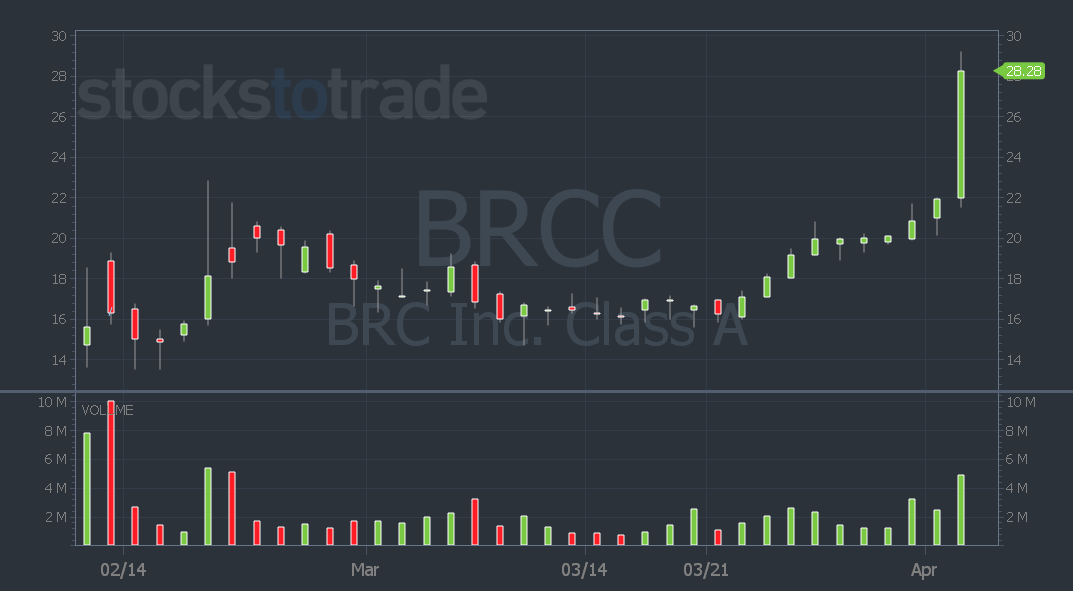

If you’re reading this, you also get my weekly watchlist every Sunday. Hopefully, you’re opening and reading it. Because on March 27, BRC Inc. (NYSE: BRCC) was my weekly watchlist feature…

It was on watch for a breakout over the $20 key psychological level.

It consolidated around that level for a few days…

Then last Thursday, BRCC made its move. The company announced it opened a new coffee shop in Georgia. And that’s when the volume and buyers came in.

How could you have traded this?

The best entry was to buy the break above $20.20 — the high from the three consolidation days, using the $20 breakout level as your risk.

You could have day traded it on Thursday and caught an almost $2 per share move. That’s not bad…

But you also could have taken a swing trade.

BRCC never broke below the $20 breakout level. And when it made new all-time highs yesterday, that’s when it really popped! Check out the chart…

How you trade these key level breaks depends on your risk tolerance and experience.

But before you can trade them, you need to know how to spot key levels — and understand why they’re important…

Yesterday was another chance to take advantage of important chart levels. I broke it all down in my SteadyTrade Team morning webinar…

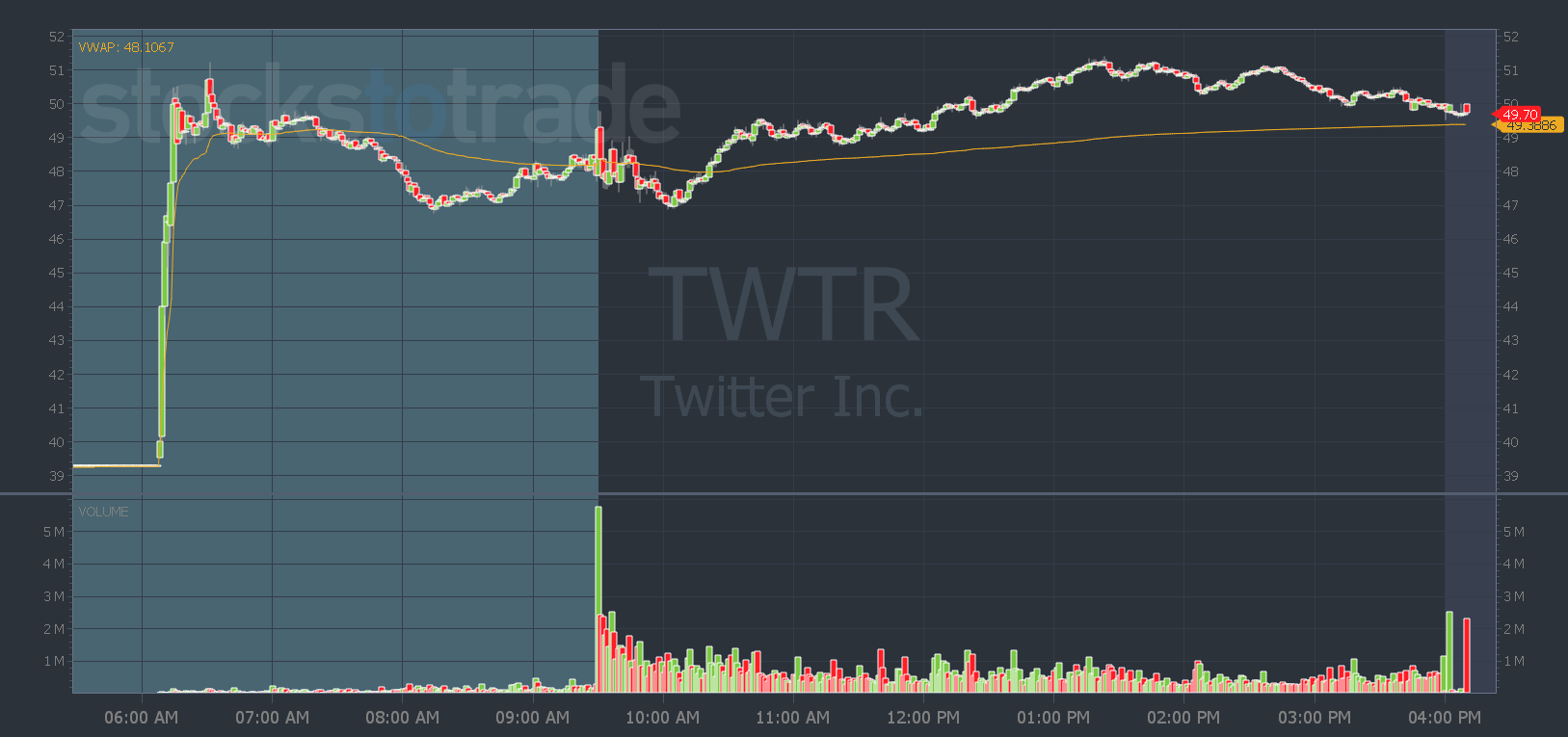

Twitter, Inc. (NYSE: TWTR)

I’m a big Tesla, Inc. (NASDAQ: TSLA) and Elon Musk fanboy. So I found the news about Musk’s 9% stake in TWTR compelling and interesting.

Did I let my positive bias affect my decision to make Twitter, Inc. (NYSE: TWTR) my number watch yesterday? Maybe…

But that doesn’t mean I jumped right into a trade.

Instead, I made a plan…

I loved TWTR’s high volume in premarket — it traded its 60-day average volume by 9 a.m. Eastern.

Plus, it was one of my chart patterns. It had a big gap, showed resistance at the $50 whole dollar level, and it had a nice premarket low to risk off of.

My plan was to buy a break above $50 with risk at VWAP.

TWTR closed right around that $50 level. So, just like BRCC, this could offer a swing trade opportunity.

You can see from my two examples that there’s potential to profit if you know the right key levels to use. So here’s how you can spot them…

How to Find Key Levels

Learning which chart levels are important comes down to screen time, studying, and experience. You’ve gotta study charts until your eyes bleed!

Start with the basics and understand technical analysis.

Learn about support and resistance.

Then dig deeper and learn the short-selling side of trading. Even if you don’t plan to short sell, understand how short sellers think. Where would they enter? What level do they use as a risk?

You can also use StocksToTrade’s Oracle to help you with buy signals and resistance levels. (Oracle showed $49.80 as the buy signal for TWTR, but I prefer whole dollar levels.)

You also have to consider share structure — like outstanding shares, float, and short interest.

I have 15 years of trading experience, so I know when big former runners are heavily shorted.

And when a stock “hangs around,” that’s a sign of trapped shorts.

If you don’t have those years of experience — join the SteadyTrade Team.

Let me help you learn how to spot key levels, plan good trades, and use the right entries, exits, and risk levels.

If you missed BRCC and TWTR yesterday, they’ll always be another one. Prepare for it now.

Have a great day, everyone. See you all back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade