Elevate Your Trading Game with StocksToTrade

Unlock the secrets to successful trading with our exclusive webinars, powerful AI and algorithm-enhanced tools

Stay Ahead of the Curve with our AI and Algorithm-Enhanced Tools

Oracle Scanner

The Oracle Algorithm sifts through 15,000 stocks every second, searching for 5-to-1 risk ratios, generating 15 trading opportunities a day.

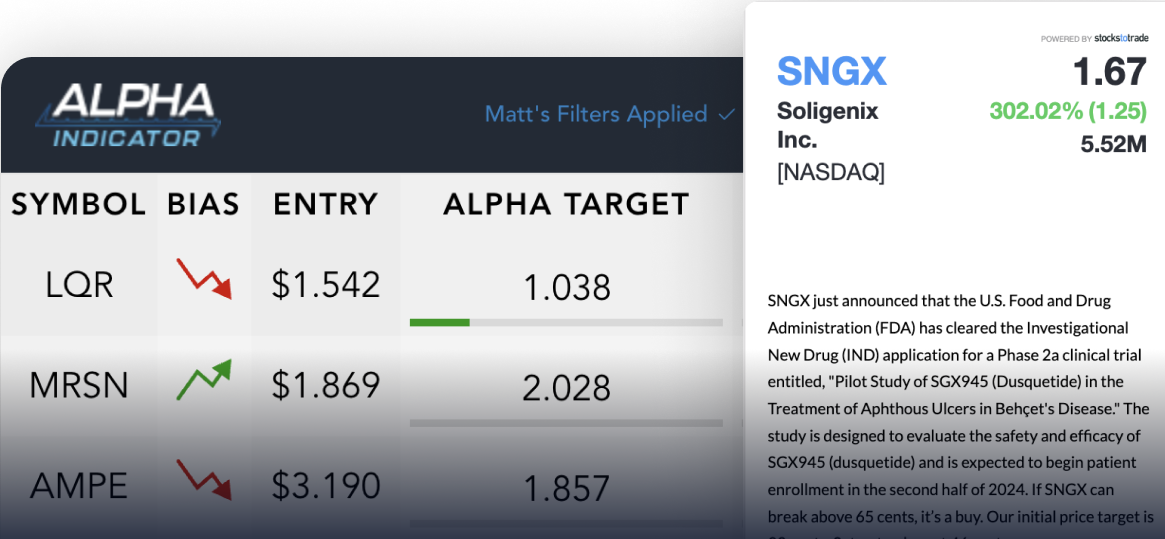

Alpha Scanner

StocksToTrade trainer Matt Monaco built this algorithm to match his successful trading strategy, and identify "dark" price anomalies happening inside the stock market in real time.

IRIS Analytics

StocksToTrade lead trainer Tim Bohen designed this AI system around his meticulous trading style — it's able to forecast explosive stock moves days and even weeks into the future!

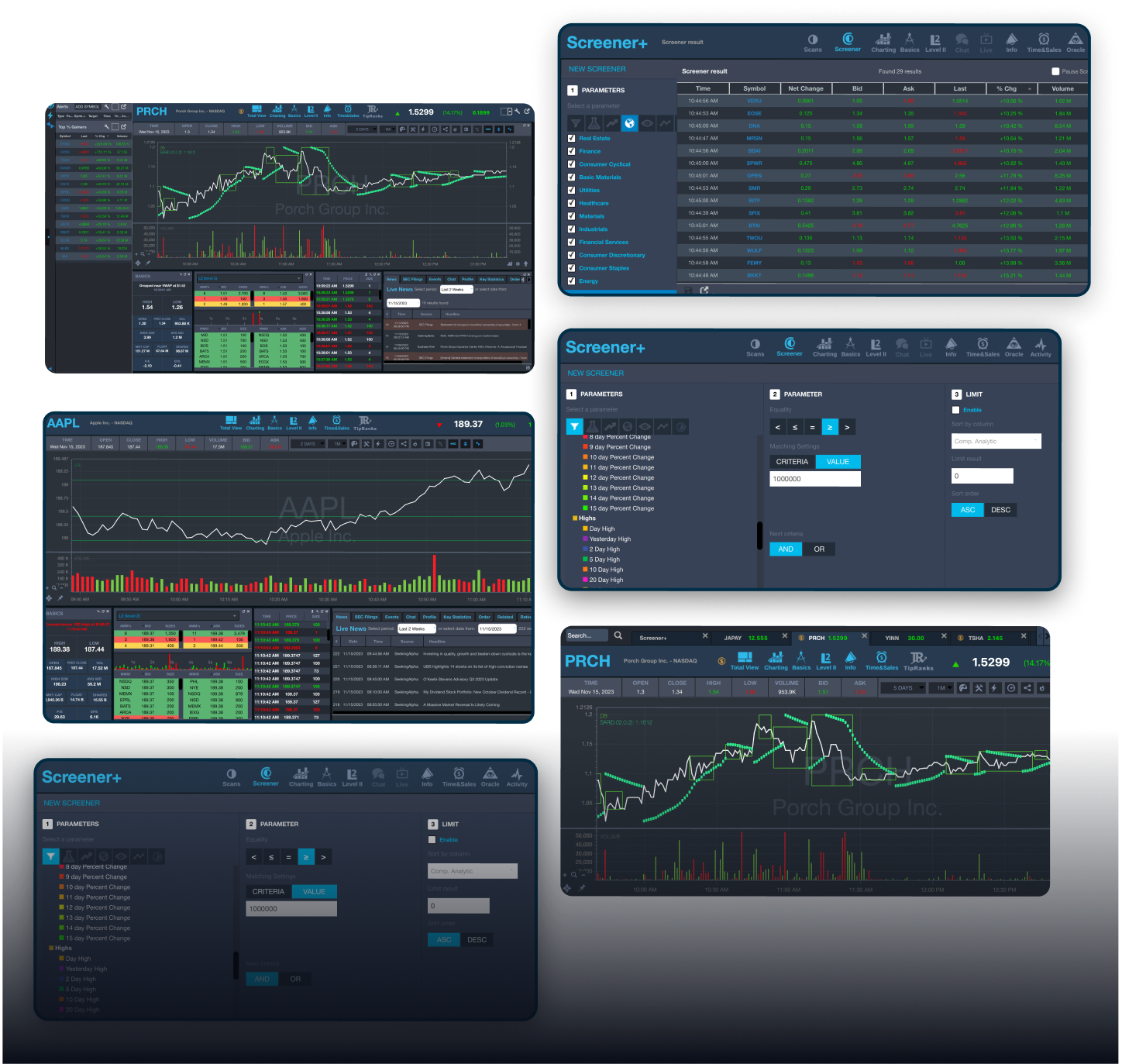

See What Our Real-Time Stock Screener Can Do

Not sure how to use the screener? Check out our quick guide.

Powerful scans, custom-built with penny-stock traders in mind.

Thousands of complex search variables made beautifully simple.

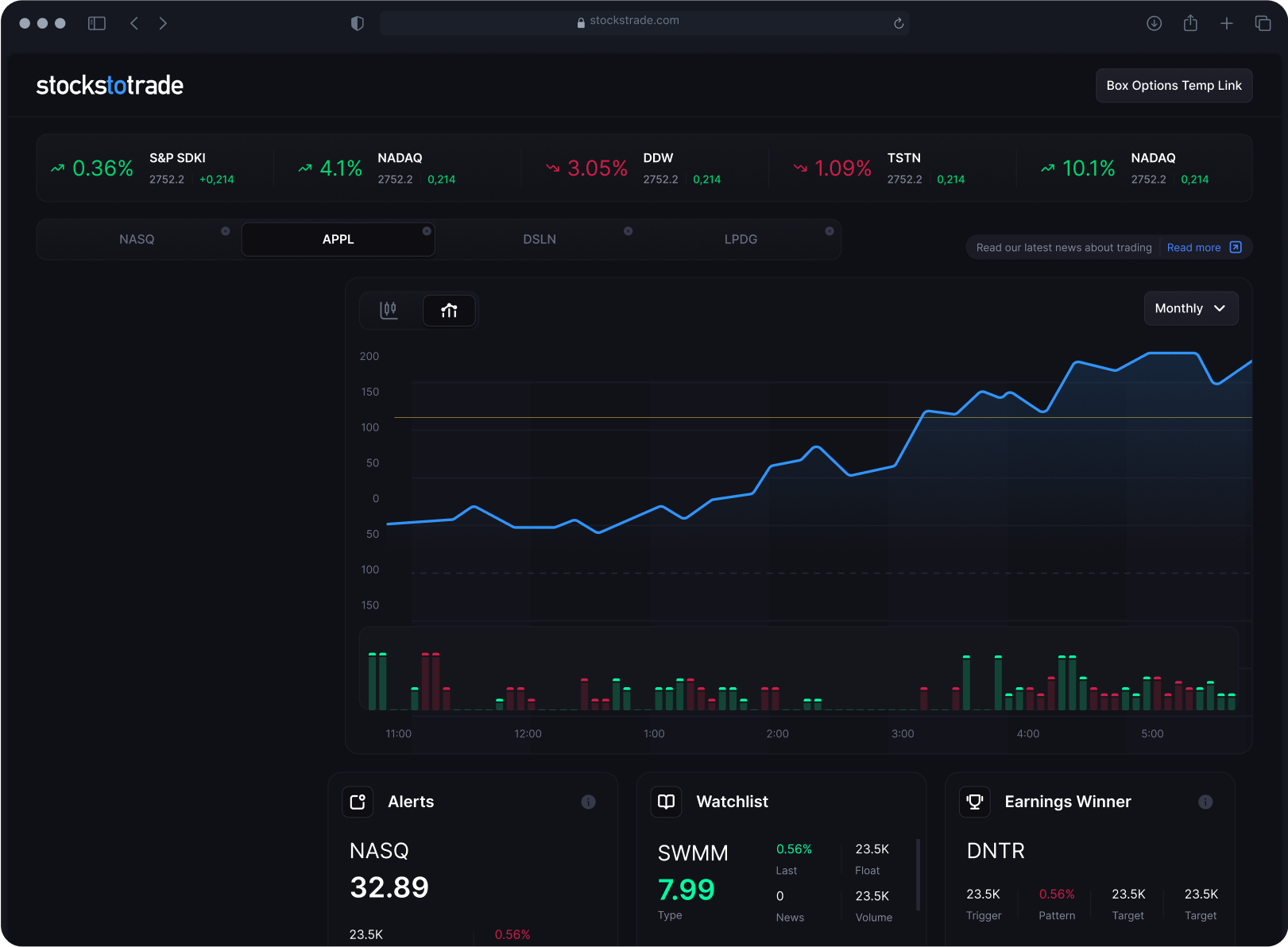

A custom-built trading algorithm, Oracle, alerts users to buy or sell stocks at specific prices.

Look-up financial reports, fundamentals and SEC filings on the main dashboard.

Enjoy modern charting with drawing tools and countless indicators.

Enjoy modern charting with drawing tools and countless indicators.

Realistic paper-trading in sync with market data to provide accurate fills.

Extremely fast level 1 data (option for level 2) across all major US markets.

Meet the Trainers Behind StocksToTrade

Tim Bohen

With over a decade of trading experience, Tim is a seasoned trader and a passionate educator, ready to help you navigate the trading world.

Matt Monaco

A young and vibrant trader, Matt brings a fresh perspective and innovative strategies to the table.

Bryce Tuohey

Bryce's enthusiasm for trading is contagious, and he's committed to helping new traders find their path to success.

By the Numbers: See how StocksToTrade has empowered traders worldwide.

1.8 Million

Trades Made

115,000

Traders Helped

2,642

Winning Oracle Picks

21,437

Active Members