Valentine’s Day is here again! We hope you remembered something special for your sweetie on this international day of romance.

Uh oh … are you spiraling into a panic? Did you forget?

Don’t sweat it. This year you can get a little creative: There’s still time to pick up a few hot stocks that your partner might love.

Even if you’re good to go for Valentine’s Day, there are some tantalizing stocks that just might arouse your interest. Read on …

Table of Contents

- 1 Stock Trading on Valentines Day

- 2 7 Stocks to Watch this Valentine’s Day

- 2.1 #1 Zix Corporation (NASDAQ:ZIXI): undefined

- 2.2 #2 Cronos Group Inc. (NASDAQ:CRON): undefined

- 2.3 #3 Ubiquiti Networks Inc. (NASDAQ:UBNT): undefined

- 2.4 #4 Starbucks Corporation (NASDAQ:SBUX): undefined

- 2.5 #5 Zynga Corporation (NASDAQ:ZNGA): undefined

- 2.6 #6 HyreCar Inc. (NASDAQ:HYRE): undefined

- 2.7 #7 Garmin Ltd. (NASDAQ:GRMN): undefined

- 3 Take Advantage of StocksToTrade Features

- 4 Conclusion

Stock Trading on Valentines Day

Valentine’s Day this year falls on a Thursday, so the stock market will be open. You can dive into a regular, full day of trading.

Yep, the market’s open. You’d be surprised at the number of people who wonder if the market is open on Valentine’s day.

Sorry, lovers: Money doesn’t stop for love. So if the holiday falls between Monday and Friday, the market will be open.

Maybe Cupid’s a capitalist after all.

History of the Market on Valentines Day

Valentine’s day is the day of love, but does that love seep into stocks?

Unfortunately, no. Data for the S&P 500 dating back to 1928 suggests that the stock market sees a down day on Valentine’s Day around 60% of the time.

Now, let’s be clear: That doesn’t mean you can’t trade the day. Just because the overall market tends to be down doesn’t mean you can’t find trades.

Keep reading for tips on how to do just that.

Keep your Heart Out of Valentines Day Investing

‘Follow your heart’ can be great advice when it comes to love or life, but it’s definitely not the best advice when it comes to trading.

What’s love got to do with trading? Absolutely nothing. You need to base your trading decisions on analysis and logic. Never trade because of emotional knee-jerk reactions.

You’re not a robot — you will have emotional days. That’s OK. That’s exactly with you build a structured plan. You plot out every move: what you’ll trade, which setups you’ll take, how you’ll manage risk, and more.

So when the market does something crazy out of the blue, you know what to do. Stick to your plan. Keep your emotions out of it.

This V-Day, and every trading day, leave the romance for your partner and trade like a machine.

7 Stocks to Watch this Valentine’s Day

Now for the fun part. We’ve compiled a list of 7 stocks that could be awesome additions to your watchlist.

#1 Zix Corporation (NASDAQ:ZIXI)

Zix Corporation is a market leader in the email security field.

They’ve developed cutting-edge technology to encrypt electronic communications and use the software-as-a-service (SaaS) model to earn monthly and annual fee-based revenue.

Earlier this year, the company acquired AppRiver, a company that provides cloud-based cybersecurity services.

The market’s excited about the cross-selling opportunities that come with the new acquisition, and also the general growth-trajectory of Zix itself.

The excitement regarding this stock is evidenced in the chart, with a clear ongoing uptrend where the stock has so far gained over 50% since the start of the year.

The excitement regarding this stock is evidenced in the chart, with a clear ongoing uptrend where the stock has so far gained over 50% since the start of the year.

#2 Cronos Group Inc. (NASDAQ:CRON)

Cronos Group is a Canadian pot stock listed on the Nasdaq.

In recent times, we’ve seen the medical and recreational marijuana sector go gangbusters.

The market’s excited about the prospects regarding the uptake of legalized marijuana.

Canada has legalized it at a national level, U.S. states are opening up more and more and there are great international growth opportunities.

The sector shows a lot of promise, so having a pot stock or two in your portfolio could be a good idea.

Cronos is one of the biggest names in pot stocks and has had a monster rise in price throughout 2018 and the start of 2019. We could see big things out of this one.

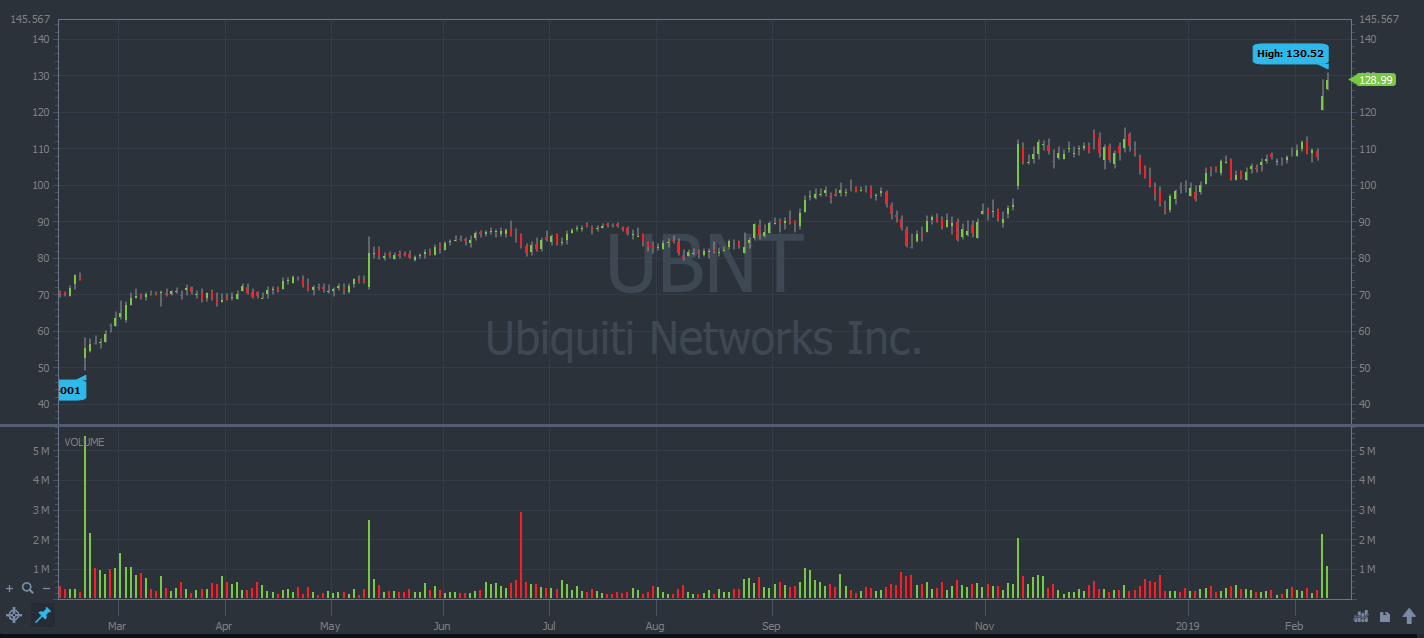

#3 Ubiquiti Networks Inc. (NASDAQ:UBNT)

Often, the best companies to invest in aren’t the flashy, exciting companies everyone’s talking about.

They’re often the boring, quiet firms that produce the little things that the world needs every day. Think cardboard boxes, garbage bags, truck parts.

UBNT is that kind of stock.

The company, Ubiquiti Networks, produces WiFi and network infrastructure to help power the ever advancing network of wireless communication in today’s world.

The past year has seen the company produce surprising revenue growth, which has caused the stock to drift higher in a very clean, consistent uptrend.

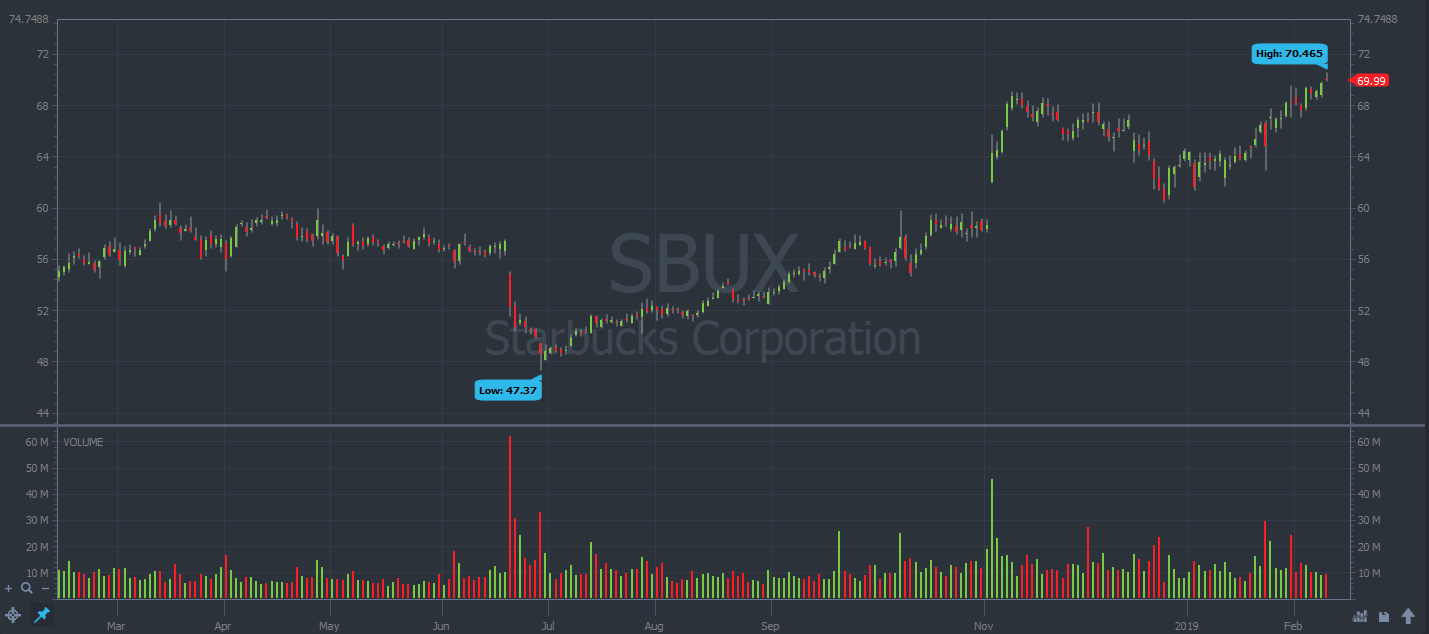

#4 Starbucks Corporation (NASDAQ:SBUX)

Everyone knows Starbucks, right?

The household name coffee brand that seems to have locations everywhere. The home of the Frappuccino and the Pumpkin Spiced Latte, among many others.

Coffee is big business. 64% of Americans drink at least one cup of coffee per day, and that number’s growing.

Starbucks profits handsomely from the American (and global) demand for a daily caffeine fix, but that’s not the only reason to consider investing in the stock.

Recently, the company reported sales were up, margins were also up, and as a result, company earnings were up.

That’s the main reason we have some interest in SBUX. We call this type of opportunity an earnings winner.

Earnings winners are a type of trade setup we look for. They’re categorized by when a stock reports positive earnings which excite the market, causing a stock to spike in price.

That initial earnings spike can lead to longer-term price moves. Keep an eye on SBUX!

#5 Zynga Corporation (NASDAQ:ZNGA)

Zynga is a silicon valley tech company that creates social games.

You might recall posts by your friends on Facebook pressuring you to start playing games like “Farmville” and “Words with Friends.” Zynga is the creator of a lot of those type of games.

The company listed in 2011, but quickly hit the skids and for years, disappointed the market.

That was until recently, where the company has been working on a turnaround.

They’ve focused on maximizing their current products, rather than developing new ones. They’re slowly pivoting away from ad-based revenue to earning fees from the userbase.

They’ve also been acquiring smaller operators in the currently hot social gaming sector.

All of this has resulted in the company putting out exciting earnings results recently.

This sets up another earnings winner play, similar to what we wrote about with Starbucks. It’s definitely one to watch.

#6 HyreCar Inc. (NASDAQ:HYRE)

HyreCar is an interesting business that connects car owners with people looking to drive for services like Uber and Lyft.

A car owner will register with the company, then locate an aspiring rideshare service driver through the app to rent their car to.

The owner and aspiring rideshare driver will meet and exchange keys before the driver does their rounds for the day.

HyreCar handles everything else, collecting the payment for the car owner, insuring the car, and settling disputes between parties.

Uber and Lyft are commonplace all over the world now. HyreCar tags along on that trend but also allows car owners to earn an income from the object sitting in their driveway.

An innovative business for sure, but will it take hold in a massive way? Who knows, but we think HYRE is a stock to watch!

#7 Garmin Ltd. (NASDAQ:GRMN)

Garmin is a large player in the wearable tech and smartwatch market.

The company competes with powerhouse firms like Fitbit and Apple with its iWatch.

With the larger players in the industry being so dominant, well-known and well-capitalized, Garmin has had to get innovative with their product line.

The company has made a number of exciting innovations with its fitness trackers and portable GPS devices and have recently added contactless payment technology to many of their devices.

The company has made a number of exciting innovations with its fitness trackers and portable GPS devices and have recently added contactless payment technology to many of their devices.

The products sound great, but what really attracts us to the stock is what’s happening on the chart.

Currently, GMRN has made a run up to test the all-time high of 70.77. If the stock is able to break through this level on heavy volume and hold above it, we could be in for a fantastic breakout play.

Take Advantage of StocksToTrade Features

The stocks we’ve listed probably seem exciting. Who knows, perhaps you’ll end up trading some of them.

If that’s the case, make sure you’ve got all the tools you need to trade intelligently.

Smart trading means being able to analyze, enter a trade, manage your risk and watch the market with as minimal headaches as possible.

That’s exactly what our trading platform StockToTrade does.

We developed the StocksToTrade software to make the trading day as simple and streamlined as possible, by giving traders everything they could want in an elegant package, at the click of a button.

StocksToTrade is the one-stop shop for an active stock trader’s needs. Here are just a few of the powerful features:

- Real-time scanning capabilities to deliver you trading opportunities in real-time.

- Access to just about every stock traded in the United States, including the OTC markets and pink sheets.

- Beautiful, yet highly customizable charting features to make watching stocks enjoyable.

- A massive library of technical indicators to place on your charts.

- And many more premium features to give you the ultimate trading experience.

Once you check out this platform, you’ll see why so many traders start their day with StocksToTrade. Grab your 14-day trial for $7 to see what the buzz is all about.

Conclusion

From all of us at STT, happy Valentine’s Day.

Remember to give your heart to your loved one this day, but keep your heart away from all of your financial decisions — especially those risky trading decisions!

The market tends to decline on Valentine’s Day. If that happens, don’t let it bum you out. Take the day off to study trading techniques. Hone your watchlist. Whatever you do, don’t trade just for the sake of trading. Be smart and calculated about your market moves.

Interested in any of the 7 stocks we featured here? Don’t make a move without first punching them into your trading platform, do your analysis, and then maybe you’ll add them to your watchlist. Whatever you do — always do your own research!

If you don’t have a trading platform that allows you to keep watchlists, then it’s time to upgrade. StocksToTrade is an elite-level trading platform that allows you to keep unlimited watchlists. Come and check it out with a 14-day trial for just $7!

What’s more exciting to you on Valentine’s Day: a romantic dinner with your partner or trading your favorite stocks? Be honest! Share your comments below.