Circuit Breakers in the Stock Market: Key Takeaways

- Find out the how, what, and why of circuit breakers in the stock market…

- Learn about trading halts and volatility and why it matters for everyday traders like you…

- Discover when circuit breakers kick in during the trading day — and which stocks they affect the most…

See how mentorship can help you trade in any kind of market with the SteadyTrade Team

Trading halts aren’t exactly fun — but when you day trade certain types of stocks, you’ll likely run into them at some point. We call these halts circuit breakers in the stock market — and they’re unpredictable. So how do you plan for the unpredictable? Let’s get into it!

Table of Contents

- 1 What’s a Circuit Breaker in the Market?

- 2 How Do Circuit Breakers Work?

- 3 Benefits of Market Circuit Breakers

- 4 Types of Circuit Breakers

- 5 What Triggers a Circuit Breaker?

- 6 Market Volatility Regulations

- 7 What Happens at Each Breaker Level Threshold?

- 8 FAQ

- 9 Are the Rules the Same for Single-Stock Circuit Breakers?

- 10 Is the Options Market Also Halted When a Circuit Breaker Gets Triggered?

- 11 Conclusion About Circuit Breakers

What’s a Circuit Breaker in the Market?

The stock market has been through its share of panics. In 1929, U.S. markets fell by 13% and 12% in consecutive days. In 1987, the Dow Jones Industrial Average lost more than 22%.

Panic selling only leads to more panic. Before circuit breakers, this frenzy could have big consequences.

Circuit breakers halt stock market trading in certain conditions. Most often, this has to do with stocks trading too low or too high.

How Do Circuit Breakers Work?

Let’s start with a little stock market circuit breaker history…

After the 1987 crash, the SEC instituted the first market-wide circuit breakers. These triggered at various levels.

But these circuit breakers didn’t quite work during the ‘flash crash’ of 2010. The market crashed and rebounded by 9% within five minutes. This was due to the kind of market manipulation that Michael Lewis writes about in “Flash Boys” … one of my favorite books!

(As an Amazon Associate, we earn from qualifying purchases.)

After the flash crash, exchanges adopted circuit breakers for individual stocks. The NYSE and Nasdaq stocks in the S&P 500 were first on the circuit breaker list…

Circuit breakers are enforced on all stocks today. You can see them at work everywhere from intraday stock halts to the market-wide halts in March 2020.

For the most part, they work…

But critics say they increase volatility and limit liquidity. Either way, they’re a fact of trading life. Let’s look on the bright side…

Benefits of Market Circuit Breakers

First, the obvious — circuit breakers limit risk. And anything that makes managing risk easier is good by me.

That’s the same reason I have my 9.45 rule. I say this a lot…

Unless you’re a pro, don’t enter a new trade before 9.45 a.m. Eastern.

There are plenty of reasons for this. Avoiding halts on premarket volatility is a big one.

Circuit breakers only work during regular stock market trading hours. Stocks can swing wildly in after-hours and premarket trading…

When a stock’s up past its volatility limit, it will trigger a circuit breaker at the market open. If you’ve ever been stuck in a halt, you know it isn’t fun.

The best strategy is to avoid them when you can.

That said, there are strategies for trading a stock that’s halted.

If the halt isn’t part of your trading plan, exit as quickly as possible!

If a stock gaps up out of a halt, it will usually slam right back down. If it gaps down, it will usually shoot back up.

The way it will go is a crapshoot.

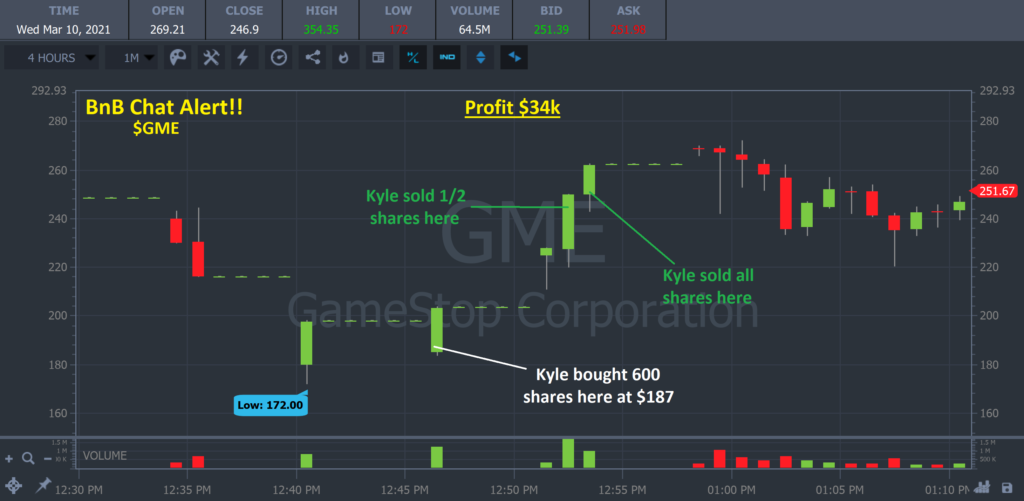

That said — skilled traders can sometimes benefit from a circuit breaker halt. Check out this GameStop (NYSE: GME) trade by Kyle Williams. He runs StocksToTrade alert service Breakouts & Breakdowns along with Jack Kellogg and Mariana Hincapie.*

GameStop (NYSE: GME) Breakouts & Breakdowns alert on March 10 chart, 1-minute candles — courtesy of StocksToTrade.com

He played this move like a classic dip and rip pattern…

Even as he traded it for $16,854 and $17,550 for a total of over $34,000.**

I never want you to trade from alerts. Breakouts & Breakdowns is how you can learn the process for trading big moves — from incredible traders Jack, Kyle, and Mariana.

Try StocksToTrade with Breakouts & Breakdowns today — two weeks is just $19.

Types of Circuit Breakers

Our stock markets have two types of circuit breakers. Some apply to individual stocks and some affect the whole market.

There are also related complications to consider…

If you’re a short hovering over a market crash, you might want to wait for the short-sale rule (SSR) to expire.

The SSR is also called the alternative uptick rule of 2010. This circuit breaker doesn’t just halt trading for a few minutes — it can affect short selling in a stock for more than a day!

It’s triggered when a security’s price declines by 10% or more from its previous closing price. Typically, the stock will suffer from volatility halts along the way…

Let’s say a stock is priced at $1 at the close on Monday and hits 90 cents Tuesday. The SSR will kick in when it hits this 10% decline.

It doesn’t matter what time this happens. The SSR will be in effect the rest of Tuesday and all of Wednesday.

This means short sellers can only enter the trade ABOVE the current best bid. Sorry short sellers, you can’t kick a stock when it’s down!

The history of the SSR is also a great argument for the need for circuit breakers in the stock market.

The original SSR was repealed in 2007 after the market’s move to decimalization made it obsolete … Or so its critics said. After the 2008 bear market, the SEC rethought its position and instituted the current SSR.

Market-Wide Circuit Breakers

Market-wide circuit breakers (MWCB) are a timeout for the entire market. They either halt trading for 15 minutes or the rest of the day.

Think of MWCBs like firefighters during a building evacuation. When there’s a fire, something primal kicks in…

It doesn’t matter what’s ahead of us or what we’re leaving behind — we’re going out that door!

An MWCB gives traders a moment to collect themselves. Maybe they use this as an opportunity to come up with a strategy other than survival…

Think of our firefighter analogy again. This is sort of like when they remind people to evacuate in an orderly fashion. But if they stay in their positions, that’s where the metaphor falls apart.

When the market crashes, speculation and panic take over. The circuit breaker helps make sure the market’s safe when the dust clears.

Some investors want to preserve their capital at all costs…

This may mean that they pull all of their money out of the market. If you’re trading with money you can’t afford to lose, it doesn’t make a difference if you’re losing 10% or 30%. Saving some is better than none.

MWCBs help traders make rational decisions. The market’s 2020 recovery shows these regulations are doing something right.

Single-Stock Circuit Breakers

A range of events can trigger single-stock circuit breakers — from volatility to big news to SEC investigations.

Volatility halts are probably the ones you’re most familiar with.

- Like MWCBs, single-stock halts only happen during regular trading hours.

- Unlike MWCBs, these circuit breakers get triggered by prices moving down OR up.

These single-stock volatility halts follow the SEC’s limit up-limit down (LULD) rule. This rule first debuted in 2012 and affects all stocks.

It defines limits within which stocks can safely trade. When a stock trades outside of its price threshold for 15 seconds or more, that triggers an LULD halt. These halts usually last for five minutes but can go to 10 or more.

When trading resumes, the current price will become the new LULD reference point. If the price fluctuates above or below the threshold again, it will trigger another halt.

I mentioned before how single-stock volatility halts mostly occur at market open … The big premarket movers that we’re scanning for every morning sometimes end up halted.

When that happens, my best advice is to take the stock off your watchlist or wait until the afternoon to trade it.

You might not like that answer, but you’ll like getting stuck in a halt even less!

Volatility halts are the easy ones to plan for. News halts are harder.

Sometimes a stock will be moving on rumors, and the company will feel a need to respond. This is one situation where a news halt may occur…

The ones you want to avoid are SEC trading suspension halts — aka the caveat emptor stamp.

The SEC has stopped the stock from trading for some unspecified reason. You can bet it isn’t good.

What Triggers a Circuit Breaker?

Let’s look at some examples.

If we’re talking about all stocks — the market-wide circuit breakers in effect today — they’re rare.

How many times have circuit breakers stopped the whole stock market from trading? We’re at a grand total of five times. Four occurred in March 2020.

In 2013 the rules on MWCBs tightened. Before then, a Level 1 halt would only come into effect for a registered drop of 10% or more. The 9% decline of the 2010 flash crash didn’t register.

The revisions also changed the index that MWCBs track. Before 2013, the Dow Jones Industrial Average (DJIA) set the pace.

The DJIA tracks 30 of the biggest companies in the U.S. Critics say it doesn’t reflect the overall market. For context, the DJIA didn’t include Apple (NASDAQ: APPL) until 2015.

Now, MWCBs track the S&P 500, an index of 500 large-cap stocks on U.S. markets. And they kick in starting at a 7% decline from the previous day’s closing price.

A lot of events can trigger single-stock circuit breakers. Volatility halts affect traders the most.

Check out this Breaking News Chat alert on Virpax Pharmaceuticals (NASDAQ: VRPX) in August.

Virpax Pharmaceuticals Inc. (NASDAQ: VRPX) Breaking News alert on August 17 chart, 1-minute candles (Source: StocksToTrade) | Past performance is not indicative of future results.

You can see that early halt right at the market open. The company released FDA-related news premarket, then it was off to the races.

The stock pulled back out of the halt — remember the 9.45 rule — but soon recovered. Afternoon momentum was big enough to trigger another halt.

Check out Bryce Tuohey’s VPRX trade recap in this video*…

Market Volatility Regulations

MWCBs kick in at three levels — we’ll get into this below.

Single-stock circuit breakers are a different story. There are four levels for halts on individual stocks.

The big stocks — your S&P 500 and Russell 1000 blue-chips — have a short leash. Their pricing threshold is 5% during most of the day and 10% during opening and closing times.

Staying above or below these levels for 15 seconds will trigger a halt.

Anything else priced 75 cents per share up has more room to run. Restrictions come into play when they reach 10% and 20% changes.

The true penny stocks under this level can run as much as 150% before they’re halted. At most points in the day, the brakes are on when they go up or down by the lesser of 75% or 15 cents.

Level 1

For MWCBs, Level 1 is triggered when the S&P 500 falls 7% below its previous close. The halt will last 15 minutes.

From 3.25 p.m. Eastern until close, this restriction won’t apply.

Level 2

Level 2 kicks in at a 13% decline. Otherwise, everything is the same as Level 1.

Level 3

Level 3 is the true apocalypse event. Stocks drop by 20%, trading halts for the rest of the day, and the talking heads have another disaster to analyze.

What Happens at Each Breaker Level Threshold?

We’ve only ever had Level 1 market-wide trading halts. Judging by March 2020’s madness, MWCBs are doing their job.

FAQ

For those at the back of the class…

Are the Rules the Same for Single-Stock Circuit Breakers?

The rules are different for market-wide and single-stock circuit breakers. The rules also vary from one stock to another.

Is the Options Market Also Halted When a Circuit Breaker Gets Triggered?

Unfortunately, there aren’t any loopholes here. Whenever a circuit breaker is triggered, trading in options will also be halted.

Conclusion About Circuit Breakers

Circuit breakers aren’t everyday events … But you better know how to handle them when they rear their ugly heads.

Just like in a real-life emergency, the first thing you should do is stay calm. Follow your trading plan.

Have you been caught in a trading halt? How did it affect your trading? Let me know in the comments!

Disclaimers

*Results are not typical and will vary from person to person. Making money trading stocks takes time, dedication, and hard work. Most who receive free or paid content will make little or no money because they will not apply the skills being taught. Any results displayed are exceptional. We do not guarantee any outcome regarding your earnings or income as the factors that impact such results are numerous and uncontrollable. I’ve also hired Kyle to help in my education business.

Never attempt to copy or mirror the trades discussed on this website or any alerts. Attempting to do so may result in substantial financial losses. Instructor’s alerts are not provided in real time. For that reason, it is highly unlikely you will be able to buy the stocks at the same entry price, or sell the stocks at the same exit price, to achieve the same or similar profits obtained by the instructors.