Part-Time Trading: Where Losers Become Winners

There are never enough hours in the day to get everything done, especially if you are holding down a full-time job while and trading. Beginners especially think that you have to trade 24/7 to be successful at trading. In truth, most traders also have full-time jobs.

Making part-time trading and full-time job work together requires some creative juggling. You can make it work if you have the organizational skills and a healthy dose of persistence and discipline. In this scenario, always remember that the trading part of the equation is part-time. If you attempt to hold down two full-time careers, one is sure to suffer.

Trading Strategies for the Part-Timer

The misinformation, unrealistic spin and downright lies floating around the digital space is overwhelming. When you’re putting together the best trading strategy for you, keep this in mind, and clear your head of any garbage that people have been trying to sell you every time you google “trading”.

Make sure you choose a trading strategy that is established—don’t try to re-invent the wheel right off the starting blocks. Find a strategy that is geared toward part-time trading, not full-time trading, and make sure it suits your level of risk and your personal traits.

Traders do not necessarily have to spend hours each day reading reports, analyzing companies, and compiling complicated spreadsheets. Trading is buying shares of a stock with the intention of selling for a profit within minutes or hours. Literally millions of people trade stocks while holding down a full time job.

Download a cheat sheet of this post.

Stay Sober

These days, supplementing your nine-to-five income is sometimes more of a necessity than a luxury. But these situations can lead to a significant amount of stress that you need to carefully balance, especially with respect to beginners.

The overwhelming feeling that you need to make money can cloud your judgement and backfire very negatively. The more successful traders are those who—despite any financial stress—resist the emotional pull and refrain from getting caught up in the trading frenzy. Calm and collected leads to better and faster decision-making.

Ask for Help

Realizing how stocks work is the first step. Don’t be afraid to get help from professionals. If you find yourself saying “I don’t know what to do,” it probably means you didn’t prepare enough, but it may also mean that you have reached the limits of your existing knowledge, and possibly your ability to Google that knowledge. Reach out to a forum that you’ve vetted for credibility and ask for recommendations from others in the business (but steer clear of gonzo advertisers).

Find a Market that Fits Your Schedule

Chances are, you will be preoccupied with your job during the day, with endless meetings and deadlines. If you are worrying about your trades instead of concentrating on your job, it may not work out well for either. So find a market that fits into your schedule.

Choose a market or platform that allows you to virtually trade 24/7. Of course, there are times with high-trading volume that are ideal: You may want to carve out a lunch time each day or time before and/or after work to do some trading. If you have the option, schedule your lunch around the highest trading times so you can monitor and trade your stocks, if needed.

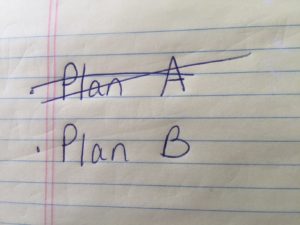

Always Have a Backup Plan(s)

You still need to do your research and plan accordingly. Every successful executive has a plan A, a plan B, and usually a plan C. When one trading strategy doesn’t work for you, have a second one already chosen to replace it. Do your homework in advance. Not only should you be ready to put a Plan B into motion, but you also should have already done the homework so you understand how the plans differ, and why.

Always keep a trading journal. You can’t track your progress if you don’t know what you were thinking when you made a certain decision that was particularly successful—or dramatically failed. You have to understand your own moods as well as your thought patterns in order to move forward.

Methodical traders are usually considered the best traders. Don’t haphazardly fly by the seat of your pants.

Methodical traders are usually considered the best traders. Don’t haphazardly fly by the seat of your pants.

Be the Captain of Your Ship

Trading should be approached as a business, and you are the captain of your ship in this respect. You are the boss and the employee, which can be a challenging relationship to balance if you lack the right kind of discipline and commitment. It doesn’t usually work to approach this as a hobby. It’s a regular part-time job; not a game to play when you have nothing else to do. Right off the bat, you need to decide how much time you are willing to commit and set clear goals to that end. Many people do a great deal of homework before they trade, but just studying the stock and seeing what is trending is not really preparation. Take your preparations further with paper-trading first.

Losers are Smart and Cool

This is not a stop-and-start world. It keeps spinning whether you want it to or not; as does the world of stock trading. Be persistent, get the small mistakes out of the way, but learn from them.

The best traders in the world are also the best losers. Losing is part of the game, and the risk is all yours. (In fact, many people also research the biggest stock losers on a daily basis, and that makes them winners!)

So, do your homework like your life depends on it, and then drop the drama and trade with a cool head. If you stress out while in the act of trading, you are asking for trouble.

Whatever you decide, always remember, if you go into trading unprepared, you may as well be sitting at a slot machine.