The markets were off to another shaky start to the week.

Yesterday, the major indexes went back and forth from red to green as traders and investors tried to anticipate corporate earnings. And the next interest rate move the Fed is making…

But while others are throwing darts blind-folded —we’re executing on big money plays and reaping the rewards…

…more on that in a second.

But first I have to get this off my chest: now’s not the time to gamble or take shots out of desperation.

It’s time to stick to the repeatable penny stock patterns we know and love. So let’s look at how doing that can help you capitalize on the best setups and avoid the worst of the worst…

Plus, I’ll share some market survival tips…

Winners vs. Losers

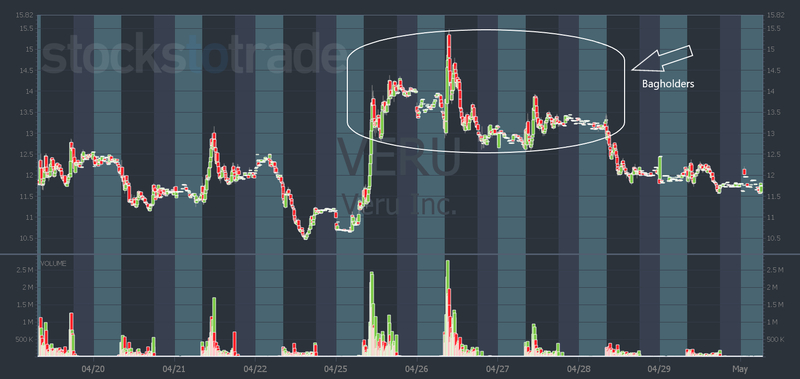

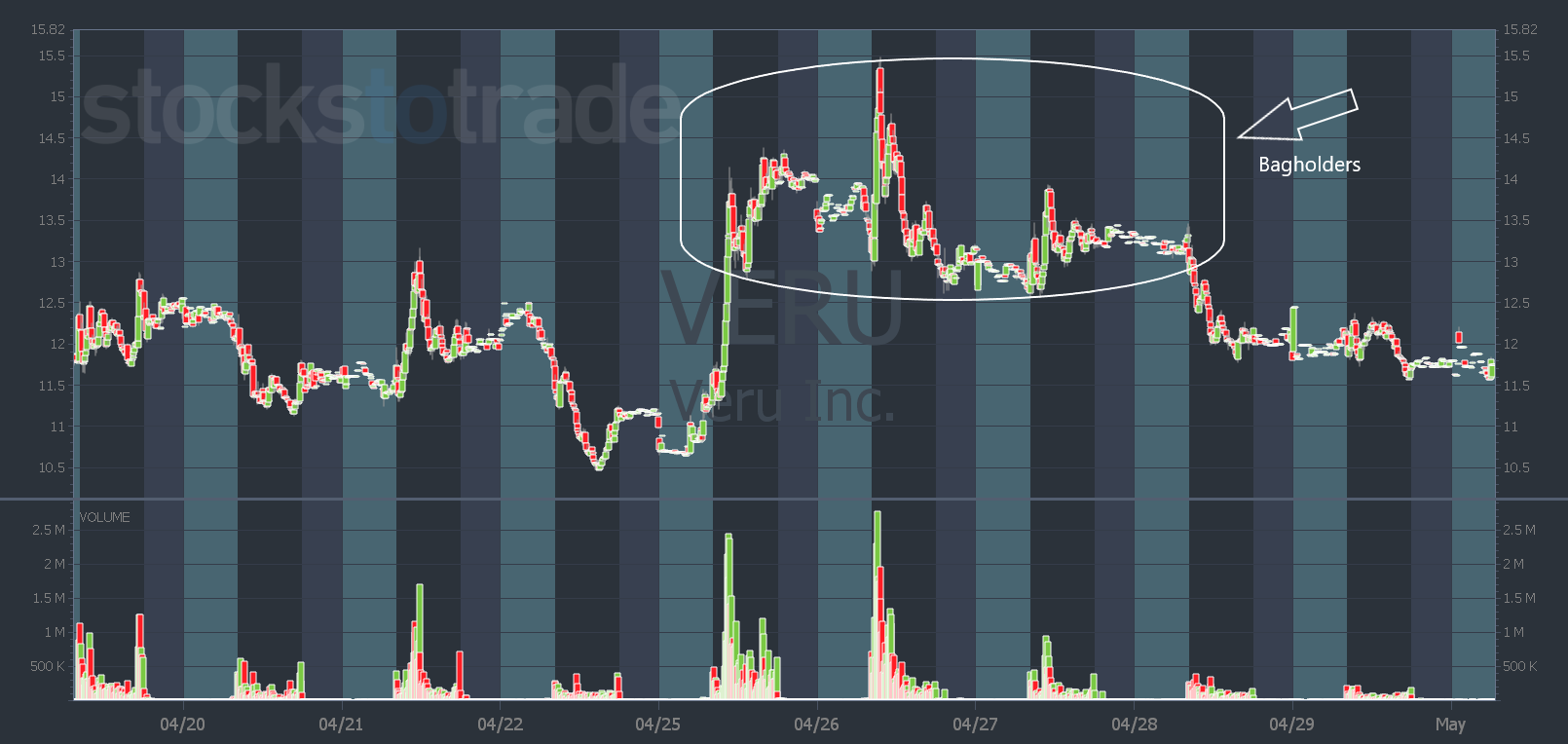

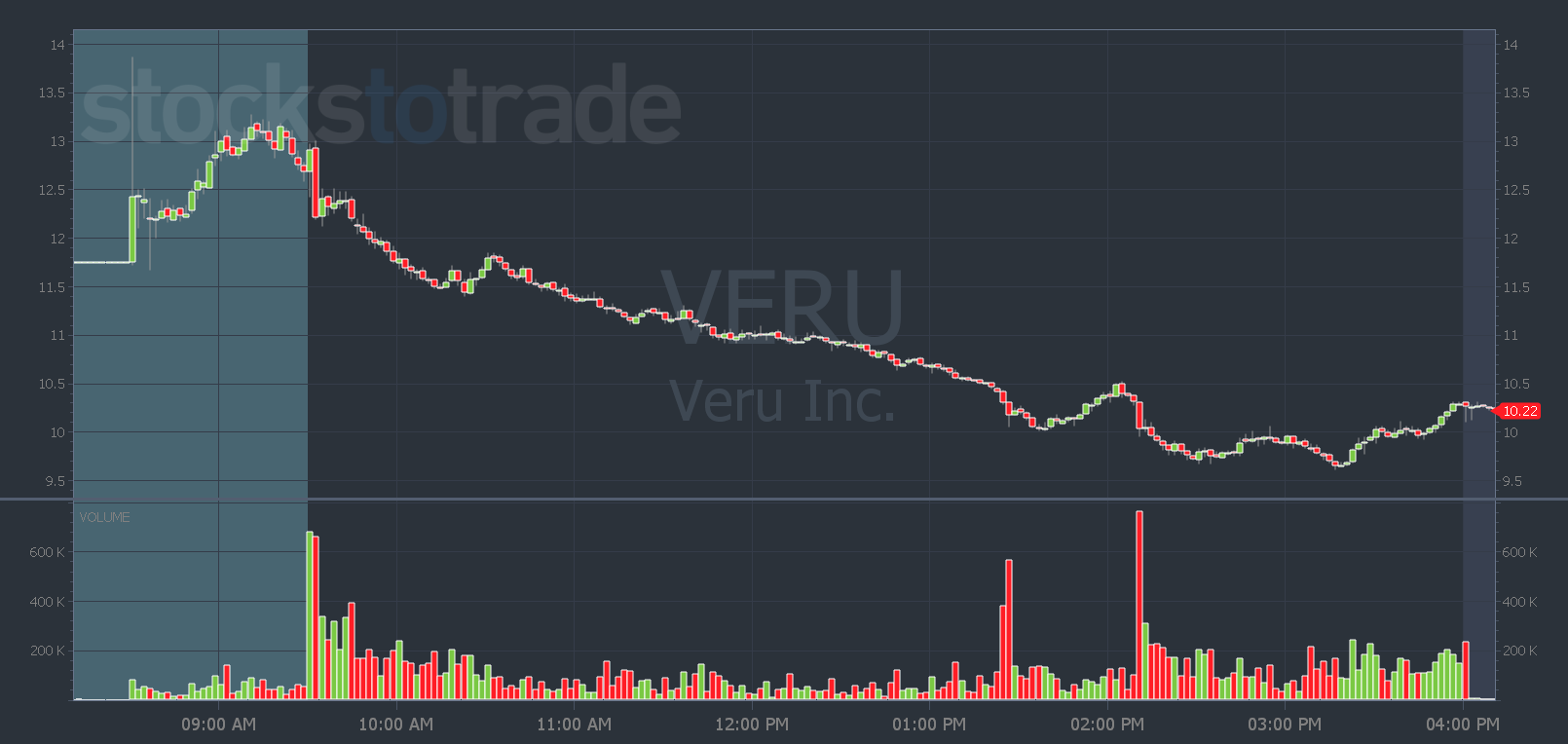

Veru Inc. (NASDAQ: VERU) has been in play for about a month and it keeps hanging around … Yesterday, it spiked in premarket and some SteadyTrade Team members were eying it as a potential buy…

But I warned them that because of resistance around $13 to $13.50, the better play was to wait until the afternoon.

I wanted to see the stock near or above that level before planning a trade. In my opinion, if you bought before then, you’re just begging to get sold into by the bag holders in the $13 range from last week…

So it’s no surprise to me that its premarket high was right around that level. Then it failed all day…

My plan to wait until the afternoon kept traders safe from this disgusting chart…

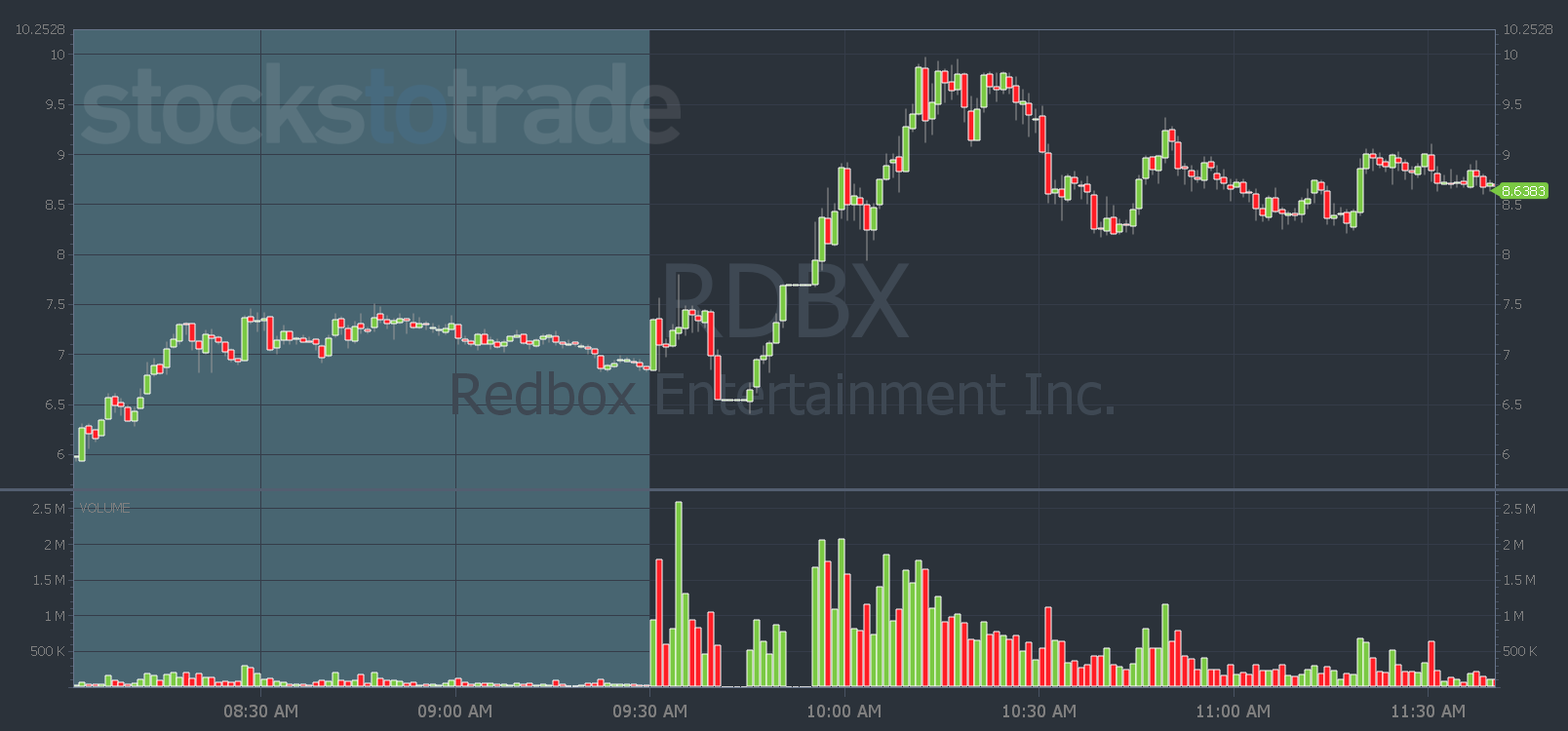

Now, the winning trade from yesterday was Redbox Entertainment Inc. (NASDAQ: RDBX).

This was the classic squeeze candidate from Friday. Oracle nailed the dip and rip style levels yesterday morning. It displayed a signal of $7.57 and a target of $9.55. Check out the chart!

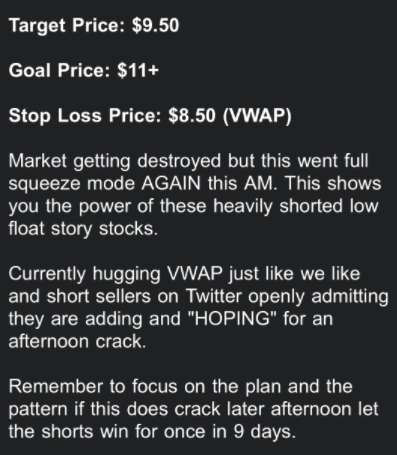

As RDBX held up through the day, I talked about it in my live Daily Double Down video for DMP subscribers. And I alerted ABCD subscribers to the potential afternoon play:

Now, look at the chart in the afternoon … It hit a high of exactly $11!

These plays show you the power of having patterns and strategies. And how sticking to them can get you through even the toughest market conditions. Here are a few more of my top tips…

Three Ways to Trade and Avoid Gambling

Traders shouldn’t be gamblers — it’s better to take calculated risks. Gambling is betting on something where you have no control over the variables. What traders try to do is control the variables…

You can control the stocks you watch, the patterns you trade, and where you buy and sell.

And there are ways you can improve your odds. Here are a few of my top tips:

- Focus on what’s working in the market and for YOU! Right now, I think afternoon trades are safer right now. But if trading in the morning is working for you then focus on that. There’s no one right way to trade.

- Stick to day trades. There are tons of day trading opportunities right now. Swing trading is riskier since ‘real’ stocks tend to follow the overall market more closely. In this market, day trading’s awesome — swing trading suuucks! Watch my day trading 101 video series here.

- Be selective in your trades. Being selective might mean you don’t trade every day. You have to be OK with that. And if you want to be aggressive, accept the risks and stay disciplined enough to stick to your stop.

If you want help finding your best trades — get hot tech tools like Oracle. It finds 20 of the hottest potential stocks in play every day. And it’s built right into the StocksToTrade Platform.

And our ABCD algorithm is coming soon! Don’t miss it!

See you all back here tomorrow!

Tim Bohen

Lead Trainer, StocksToTrade