I tried to contain my excitement yesterday on Pre-Market Prep when I saw a beautiful premarket spiker with military contract news…

It had traded two times float rotation in premarket.

It was a chat pump … It’s in the artificial intelligence sector…

… And it had a January jump effect chart.

It checked 11 out of 10 boxes — no, that’s not a typo.

It was a watch for all of our patterns … So why was I containing my excitement?

Because many traders hear my enthusiasm about a potential play and they get too eager to enter…

And once they’re in a position they overstay expecting a big move. They think it has to go higher…

If that sounds like you, your habits would’ve likely left you with a loss in yesterday’s big runner.

So today, I’ll show you what to do instead…

How to Control Emotions

Now you know all the reasons I was excited about BigBear.ai Holdings, Inc. (NYSE: BBAI) yesterday…

It checked a lot of boxes. And I love the news — the government always pays its bills.

But at the end of the day, BBAI is still just a low float stock with a chat pump…

We know what these stocks are — they’re just four-letter tickers we use as a trading vehicle.

So you can’t let your emotions and excitement get the best of you…

You have to keep your head on straight and make a plan.

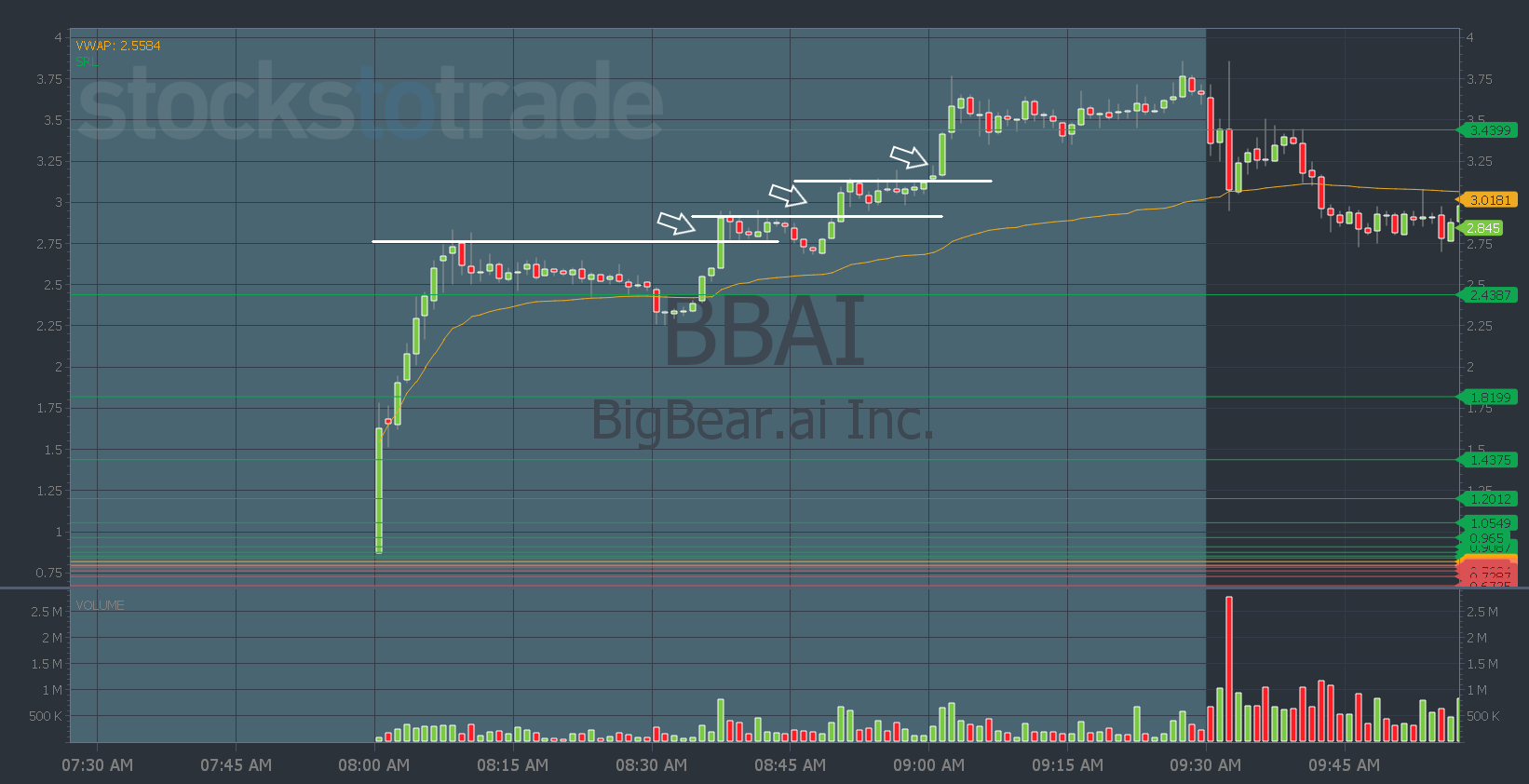

In BBAI yesterday, I reminded traders of the buy in pre, sell in pre rule. After all, the stock had great premarket price action…

You could’ve bought breaks of the premarket highs all the way up and sold before the open.

But when it comes to trading after the open, traders who are struggling or are inexperienced should’ve been in BBAI before 9:45 a.m.

Savvy traders wait for the patterns to develop.

And no matter how excited you are about a potential trade, you should always:

- Follow a plan.

- Have a risk level.

- Stick to your stop.

- Use the Oracle levels.

BBAI didn’t have the morning dip and rip I was hoping for. It didn’t give us an afternoon move either…

It just consolidated sideways along VWAP all day. So there was no reason to trade it.

But if BBAI is still hanging around this morning and doesn’t dilute with an offering — it’s still in play.

Just respect the rules and have a plan!

I can give you all these lessons, chart examples, and remind you of the rules…

But at the end of the day, you’re the one in control and pushing the buttons.

Find a way to control your emotions, build the right mindset and habits, and you’ll be better prepared to make a strong trading plan and stick to it.

Here are some resources to help you do that:

- How to Control Your Emotions When Trading Stocks

- FOMO & Why Getting Comfortable With Loss is So Important

- 7 Successful Trader Habits

- Trading Psychology: Guide to Master Your Mind in 7 Steps

And don’t forget — you can learn a thing or two about executing successful trades from a multi-millionaire trader this Wednesday. RSVP here!

Have a great day everyone! See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade