Almost every stock brought up in yesterday’s SteadyTrade Team morning webinar lacked one critical component for a trade…

This is one of the most crucial indicators I look at.

Without it, it doesn’t mean you can’t trade a stock…

But you have to adapt your expectations and risk tolerance.

Because without it, a lot of setups are failing.

So read on to find out how you can avoid getting caught in one of these dead trades…

Why Setups Are Failing

Before a stock can rip higher and bring everyone the profits they’re looking for…

Trading a stock without it is like going fishing without bait on your hook. You might catch something…

But chances are slim to none. Why even bother going out if you don’t have the right equipment?

Trading a stock with no volume is the same thing. It might make a move, but the odds are so low, why take the risk in a trade?

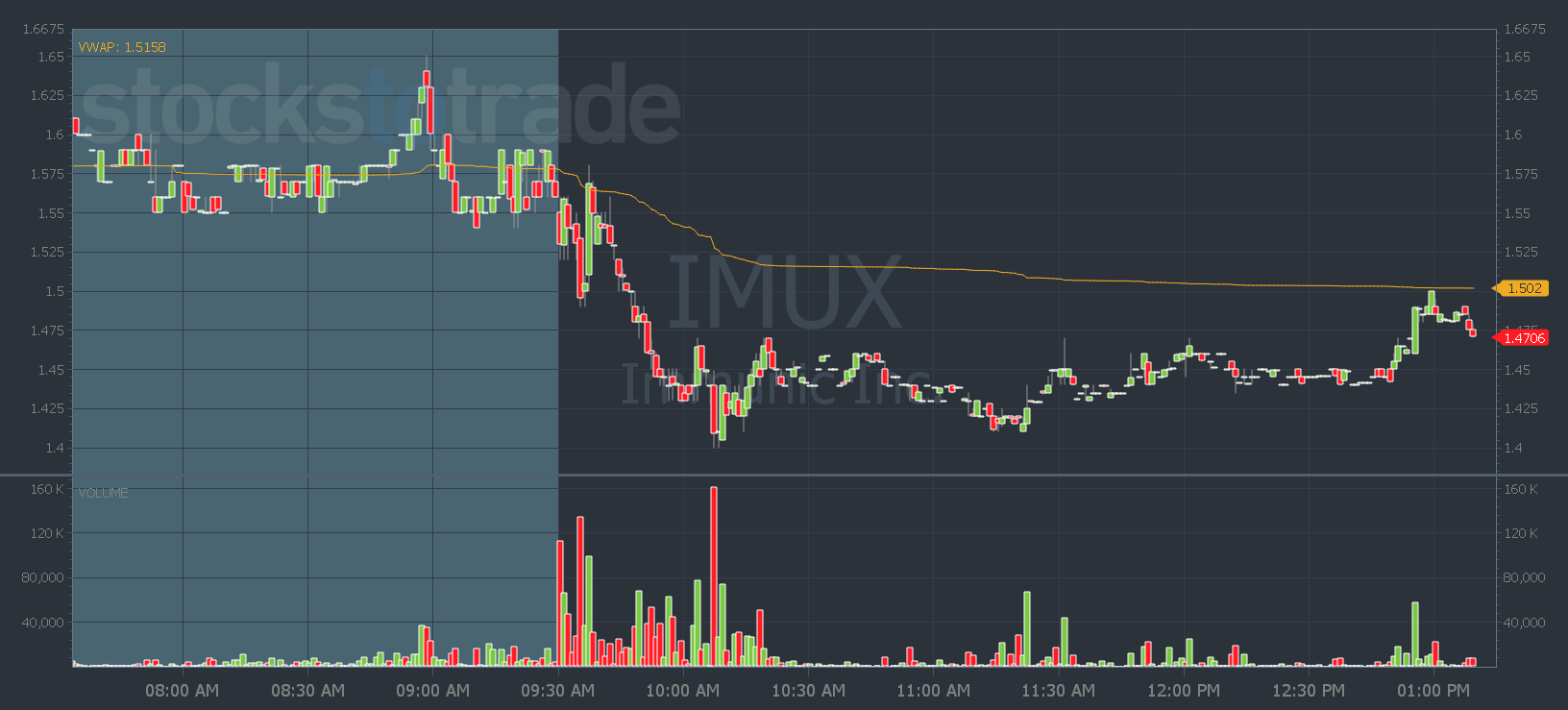

Look at Immunic, Inc. (NASDAQ: IMUX) yesterday morning. It was a premarket gapper. But it had no volume to push higher.

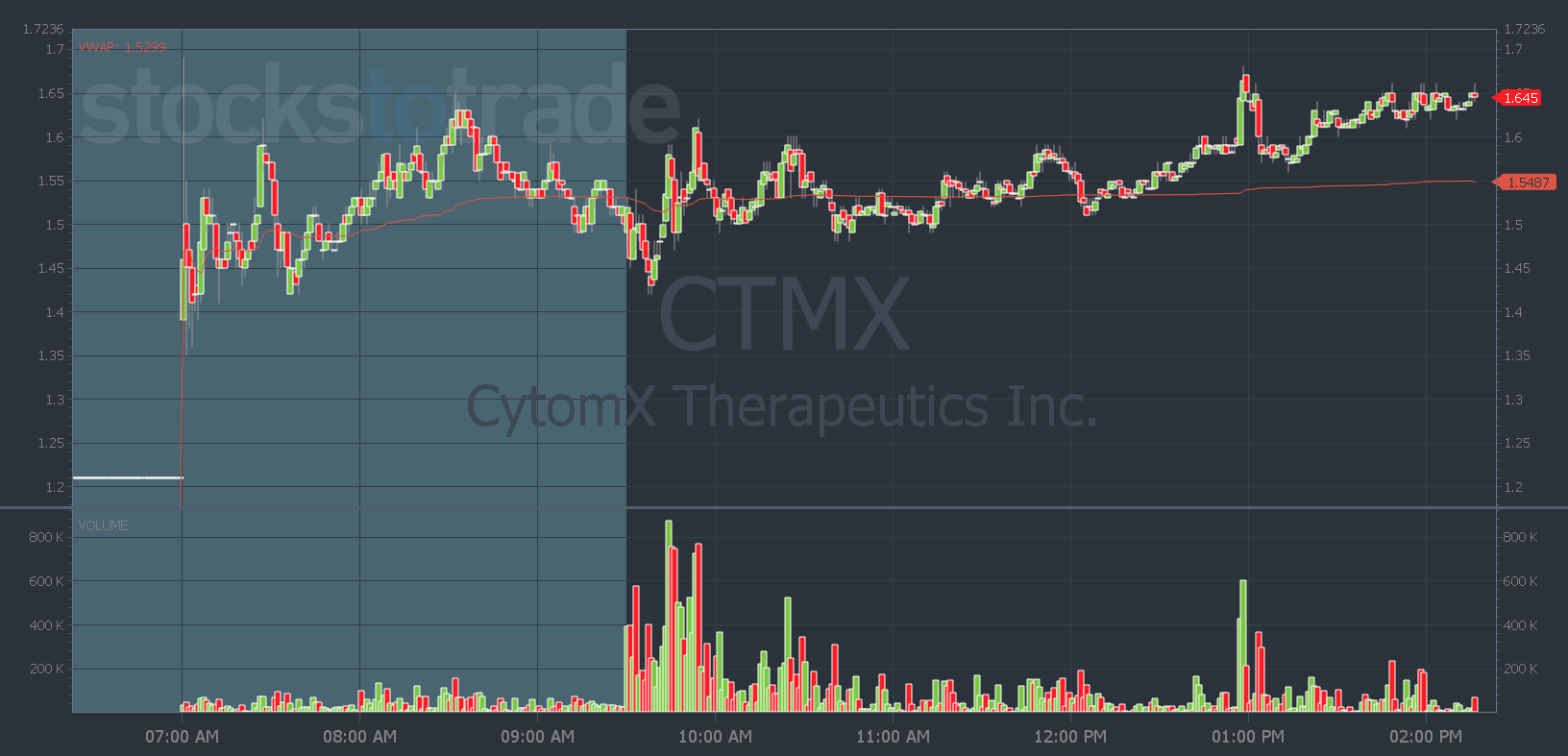

CytomX Therapeutics, Inc. (NASDAQ: CTMX) had low volume in the morning even though it had cancer news.

And it struggled to even pick a direction…

By midday, CTMX had barely traded half of its float.

That’s not the kind of volume and price action we want to see when a stock gaps up on cancer news…

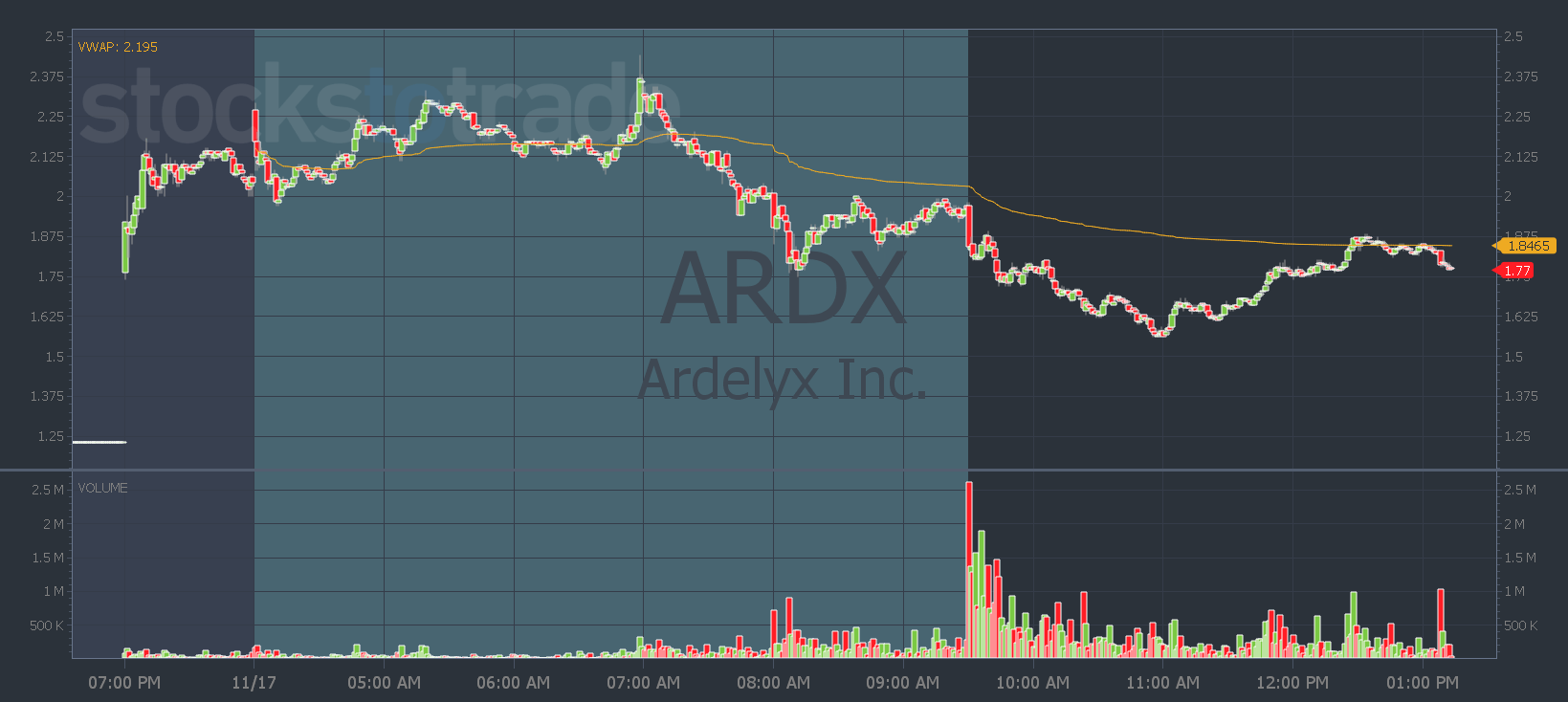

Yesterday morning, most traders were excited about Ardelyx, Inc. (NASDAQ: ARDX).

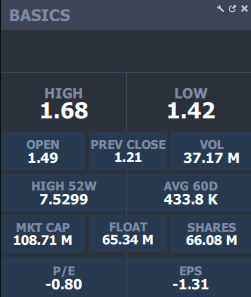

It has a massive float of 185 million shares. But it was on Oracle, it had news, and it was gapping up…

But it also had a high float and low volume — it was basically the best of the worst.

So in my morning webinar, I said to wait until 9:45 am or later.

And that it was only a trade if it could get over $2.30. Otherwise, we ignore it and avoid a loss…

And the plan kept members and me safe from a failed spiker…

By midday, ADRX had traded 105 million shares, but compared to its huge float, it wasn’t enough to push the stock higher.

That’s why one of the best indicators to determine if a stock can run is high volume.

And it’s why I love low floats so much — they don’t need as much volume to create massive moves. But there haven’t been as many lately…

So before you take a trade in a low-volume stock today, ask yourself if you’re going fishing without bait.

If you want my trading plans to get you off on the right foot — join me in Pre-Market Prep!

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade