Microsoft Corporation (NASDAQ: MSFT) is laying off thousands of workers.

Amazon.com, Inc. (NASDAQ: AMZN) started cutting its workforce in November. And yesterday it announced 18,000 more jobs are on the chopping block.

And The Goldman Sachs Group, Inc. (NYSE: GS) laid off 3,000 workers in one day this week.

Those news headlines sent all three major indexes down over 1% yesterday.

But if you used all that negative news and overall market doom and gloom to keep you out of trading, I have to ask…

Which market are you trading in?

Because in the SteadyTrade Team, we identified two huge percent gainers. And if you traded these stocks — you probably had a good day.

Here’s the why and how behind two good trade ideas…

Heading

Despite the weak performance of the major indexes yesterday — in penny stocks, we saw two stocks gain over 69% and 184%.

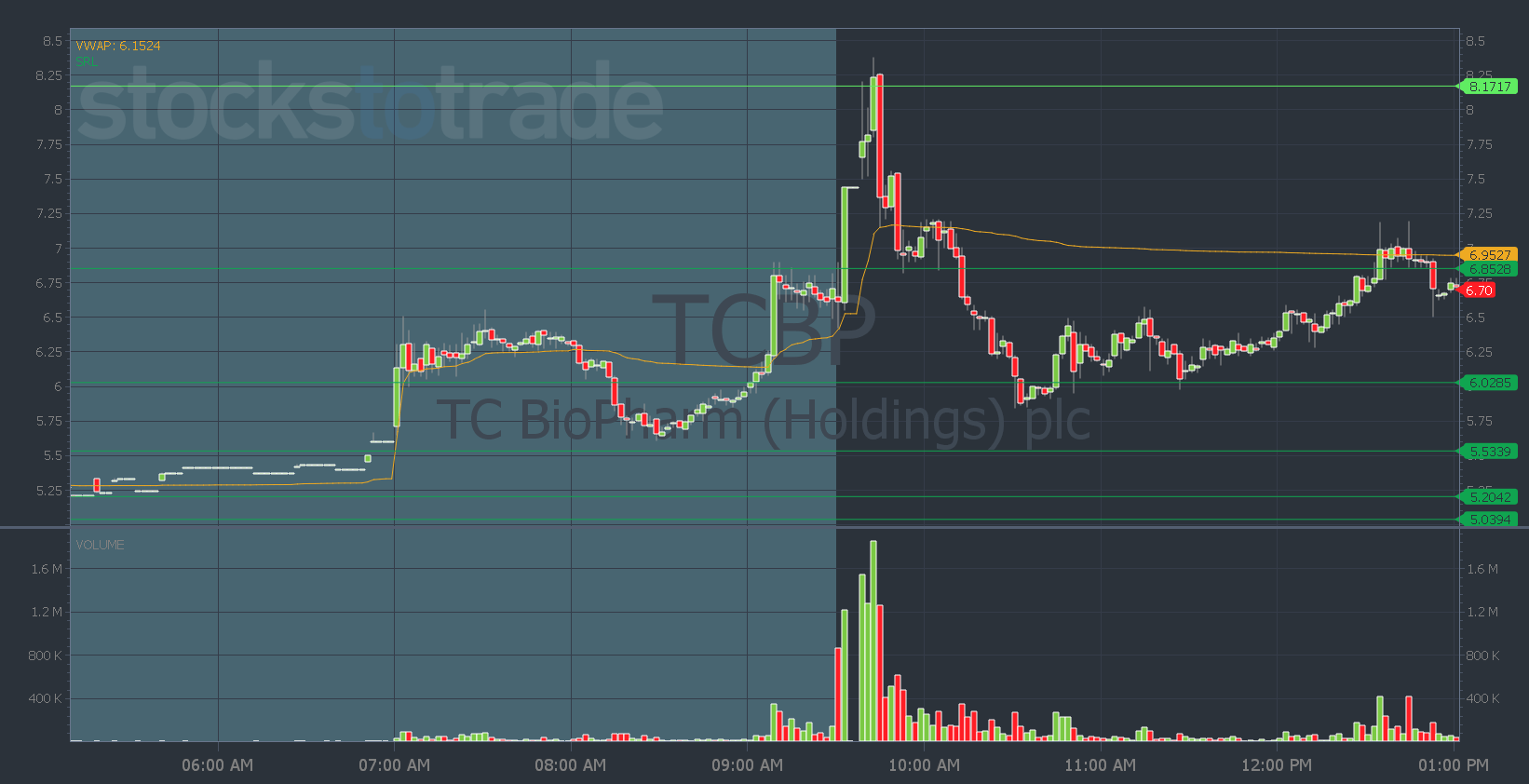

The first one I talked about at length in my morning SteadyTrade Team webinar, was TC Biopharm (Holdings) Plc (NASDAQ: TCBP).

It was a day two chat pump survivor that was gapping up. And what do we know about chat pumps?

We know the chat sheep are in it from the day before — I think the chat guy pumped it at around $5…

And we know they don’t sell. Chat sheep have no interest in learning a process, a pattern, or using risk management. They just blindly buy and hope for the best…

Yesterday, it worked out.

Life was probably great for them when they woke up to a $1 per share gain from their entry.

I figured a lot of them would even probably add to their positions on the gap up.

So my plan was an entry at the $6 whole dollar resistance level. And a goal in the mid to high $7s. (Get my next premarket trade alert and plan here.)

The move happened fast in premarket — basically right when I sent my alert. If you were quick you could’ve bought in pre, and sold in pre.

But after the market opened, following the dip and rip move using Oracle’s support and resistance lines worked beautifully. See how you can get Oracle working for you here.

A day two chat pump survivor can have these big moves because shorts get squeezed.

But you also don’t have the selling pressure from chat sheep because they’re all up on their positions.

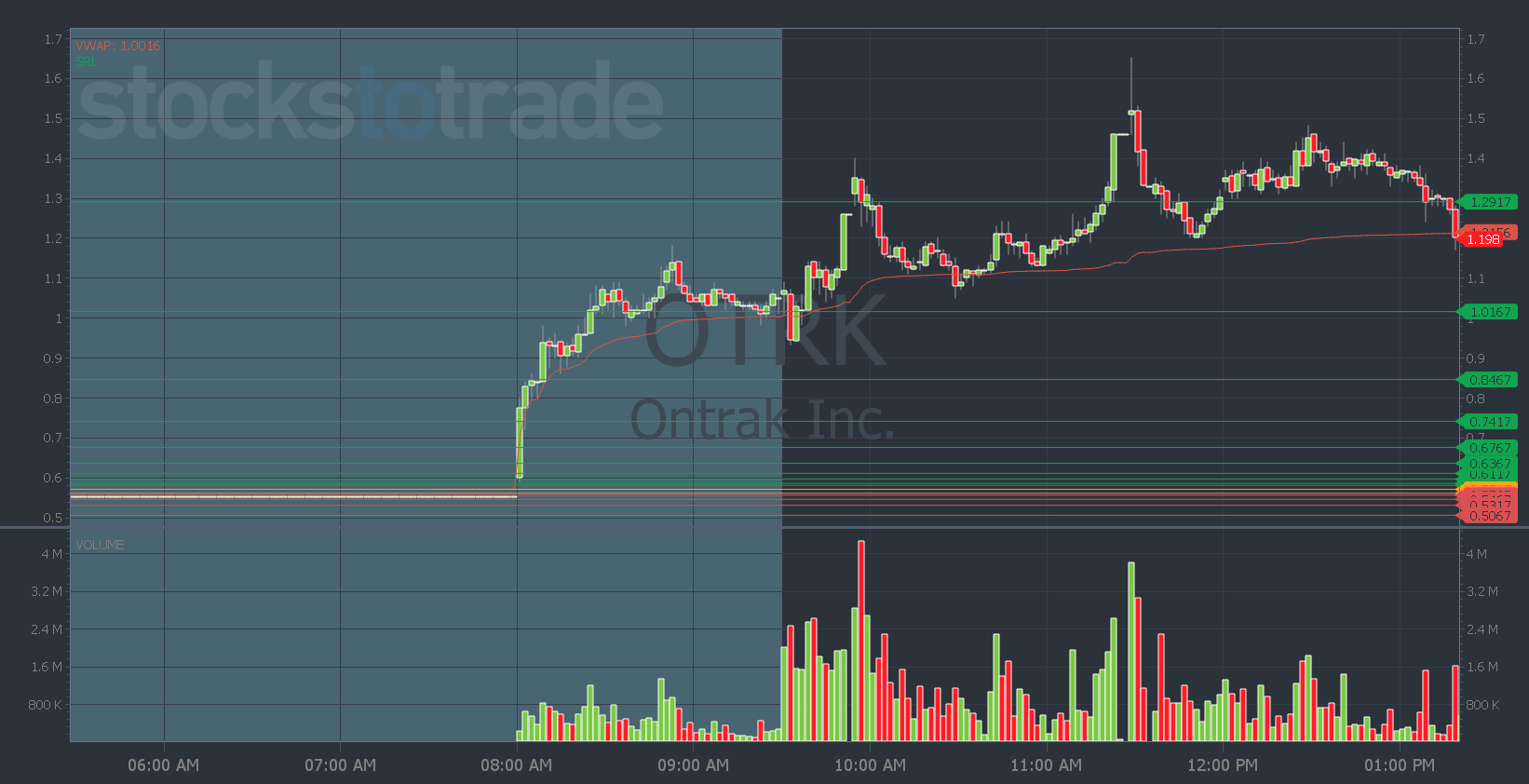

Ontrak, Inc. (NASDAQ: OTRK) was yesterday’s chat pump du jour.

It had a kinda low float, news, and a January jump chart.

So I said in Pre-Market Prep, to watch it for a dip and rip, or afternoon VWAP hold and use the Oracle levels.

The morning dip and rip trade idea worked. And later in the morning, you could’ve traded the break above the Oracle levels and morning high.

With OTRK’s lower price point, you can take a meaningful position size so you can see account growth over time.

If you want in-depth lessons like this live every morning — join me in the SteadyTrade Team.

If you can’t make the time commitment for twice daily webinars, join StocksToTrade Advisory.

I’ll give you three market update videos every week to help keep you in tune with the market and what stocks are in play.

Have a great day everyone! See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade

P.S. If you missed Tim Sykes’ and Mark Croock’s event last night — you can catch the replay here.