How do you know when to strictly enforce your trading rules and trade conservatively? And when to give yourself more leeway and be more aggressive?

There are a lot of variables to consider before you adapt your rules.

But because I have 15 years of experience, I know how to recognize hot and cold themes and patterns in the market…

I can make quick decisions based on what I see. Then I let SteadyTrade Team members know the safest plan…

Yesterday felt frothy after October CPI numbers came in under analysts’ expectations, but it doesn’t mean you can throw rules out the window.

In fact, one of my rules kept members safe two days in a row.

Today I’ll share why I strictly enforced it yesterday. Plus we’ll dig into how the life cycle of a penny stock and a chat pumper are similar so you can make better trade plans in the future…

Penny Stock And Chat Pump Life Cycles

I haven’t written about the penny stock life cycle in a while. So in case you don’t know, here’s a brief refresher…

Penny stocks are in business to sell stock. Most don’t have a real product.

So they make money by pumping our press releases … And when the stock price goes up on ‘good’ news, they dilute or do toxic financing.

That usually kills the stock’s momentum, sends it off a cliff, and burns anyone who holds shares because they believed the news.

So the stock is hot while it’s running on news and traders experience euphoria. But when the party’s over, the stock is cold and dead.

The life cycle of a chat pumper is similar…

Chat pumpers buy up shares of a stock, then alert their followers and sell into them.

So when the chat pumper has a lot of sheep that buy on their alerts, stocks can have huge runs.

But after the pumpers murder all their sheep, their alerts go cold.

Then they get new sheep and they get the juice back.

So you’ll notice that there are periods when chat pumps are hot and can move stocks. Other times, the alerts mean nothing.

Right now, chat pumps have no juice.

How do I know?

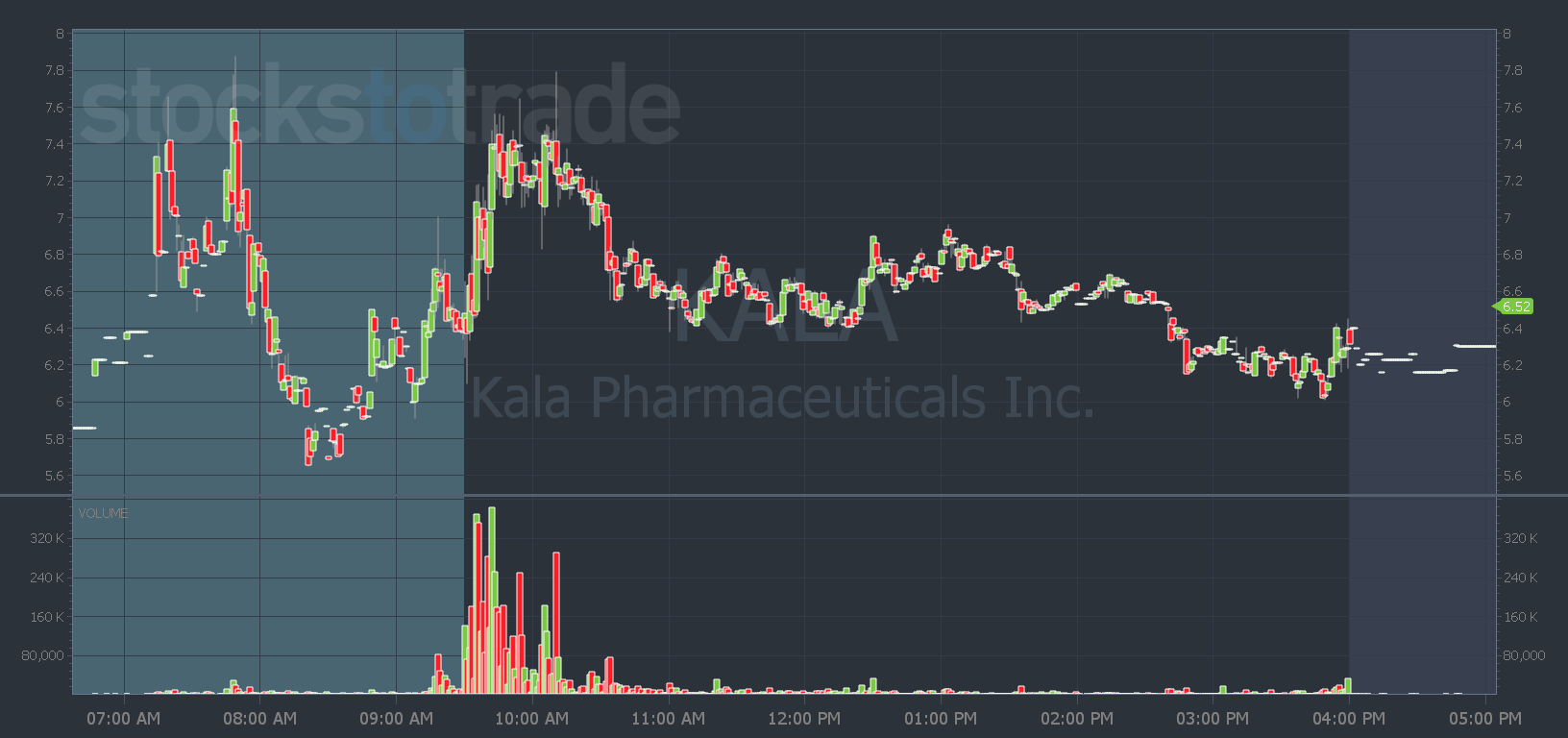

Did you see Kala Pharmaceuticals, Inc. (NASDAQ: KALA) on Wednesday?

It was a chat pump in premarket. But after the chat guy bought it, it went up like 10 cents. I said everything changes if it gets back to the high of the day.

But it couldn’t break it … And we didn’t get the dip and rip.

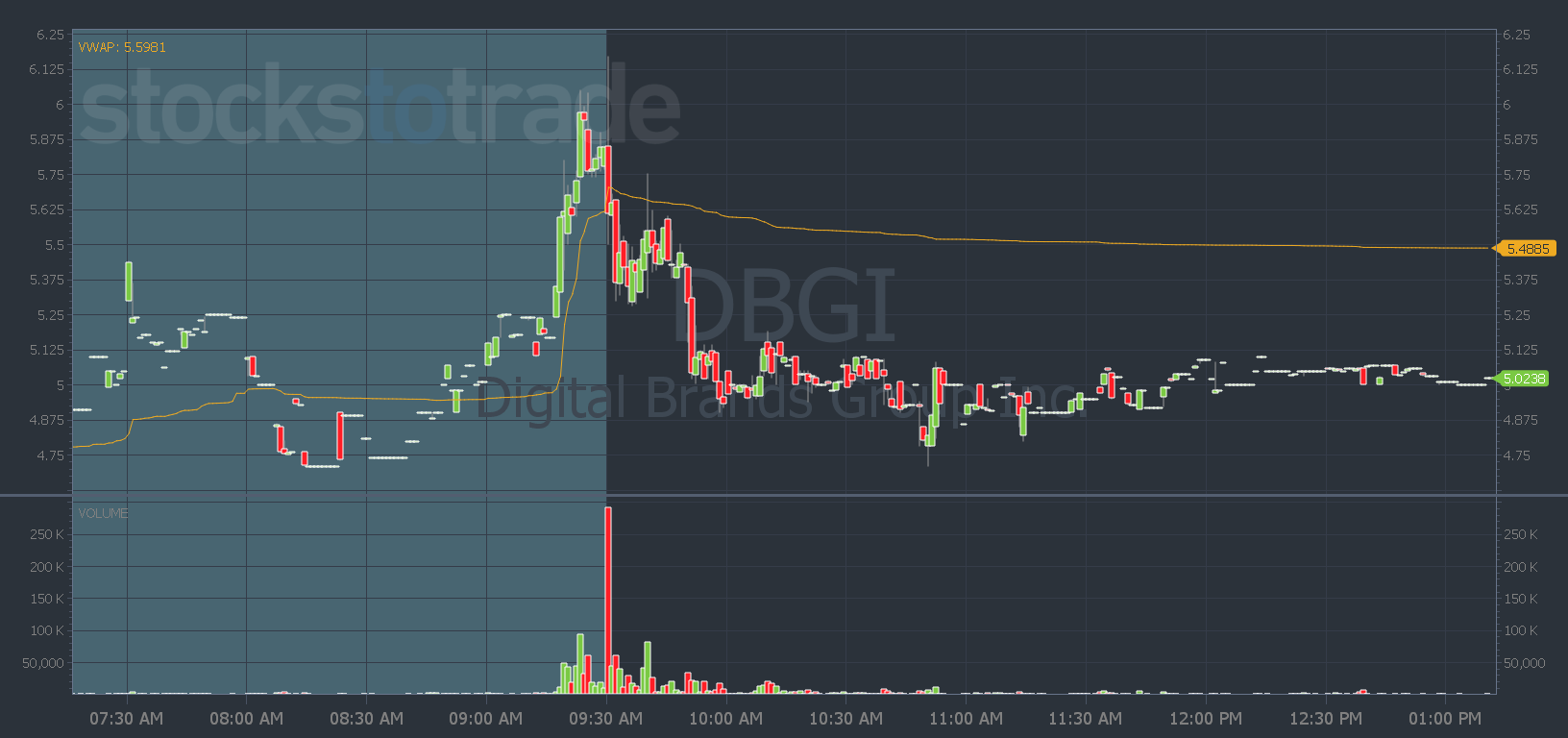

So when Digital Brands Group, Inc. (NASDAQ: DBGI) became a chat pump yesterday, I warned SteadyTrade Team members…

I said I like that DBGI has a micro float. But KALA’s failure the previous day shows me that chat pumps have no juice.

So it was strictly a post-9:45 a.m. dip and rip. This is one of my main rules for trading chat pumps because nine out of 10 fail at the open.

And again, having the plan and enforcing the rule kept SteadyTrade Team members safe…

So before you jump in a premarket runner, ask yourself if the pattern your trading has been working. Or if the stock has news, has it been a good catalyst in the current market?

Is the stock you’re trading part of a hot market theme?

These are the types of in-depth conversations we have every day in the SteadyTrade Team.

If you’re ready to learn all the intricacies and nuances of trading — join today.

Not ready for the high level of education that comes with twice-daily webinars and all my resources? Then join StocksToTrade Advisory to get top tickers to watch in Pre-Market Prep.

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade