Yesterday markets swerved lower on negative news…

On Tuesday, Federal Reserve Governor Lael Brainard said the Fed could take more aggressive steps to reduce its balance sheet. (That could include selling off some of the $8 trillion it holds in bonds.)

And that the Fed’s prepared to take strong action to drive down inflation.

Meanwhile, the Russia-Ukraine crisis continues to impact the commodities market. And shortages are driving up food prices.

There are a lot of factors at play. And the markets don’t like the uncertainty…

That’s why yesterday morning felt like it might be a quiet day. But in the SteadyTrade Team, we found plenty of opportunities…

Two bread and butter patterns, and a 95% runner. Here’s how we spotted them…

Use this tool to find top trades — even when the overall markets sell-off.

How to Find Top Trade Opportunities

Don’t let the market doom and gloom get you down.

If you focus on the right repeatable patterns and breaking news plays — there’s always an opportunity. Look at yesterday for example…

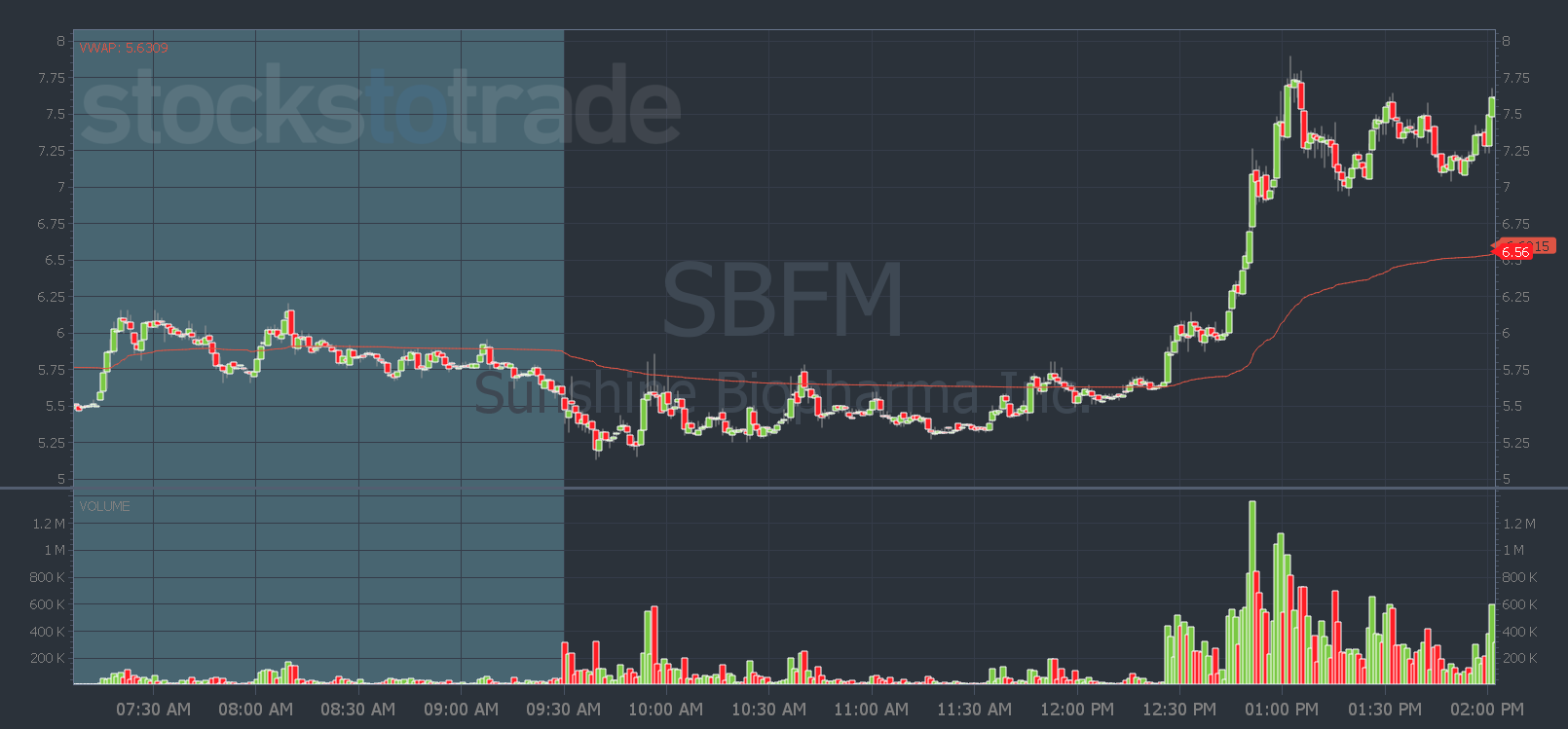

In the morning SteadyTrade Team webinar, my top watch was Sunshine Biopharma, Inc. (NASDAQ: SBFM). Here are my notes…

Now compare that to the intraday chart:

You can see the levels and plan worked beautifully. And you didn’t have to wait for the $6.50 level to break — if you watch for patterns!

You could have entered early when it had an afternoon VWAP-hold high-of-day break around 12:30 p.m. Eastern.

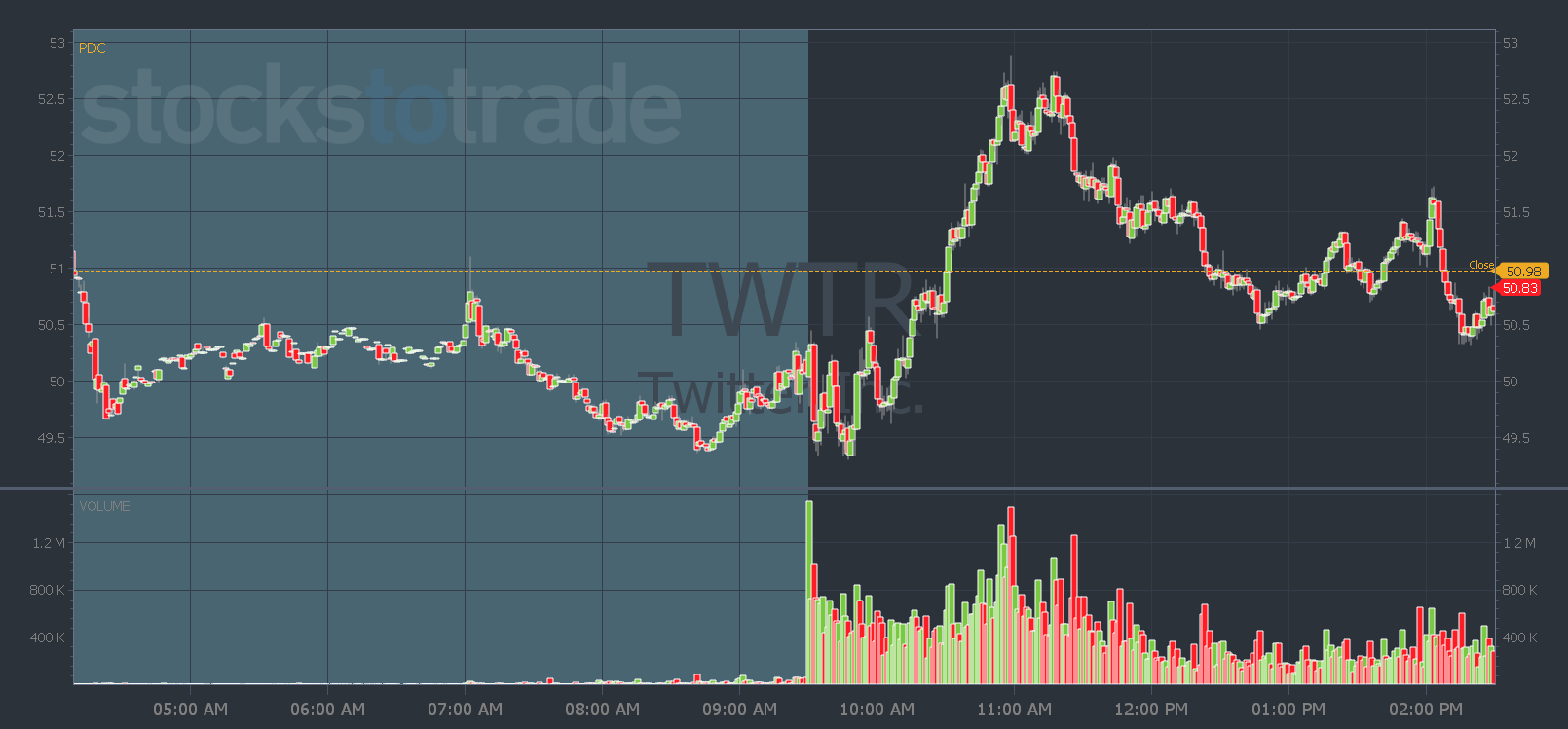

Another top watch yesterday was Twitter, Inc. (NYSE: TWTR). In the morning, I said watch it for a weak open red-to-green move. If you took it, you could have caught a $1.50 per share move…

Those are just two examples of the power of focusing on repeating patterns. And like I said on Tuesday, watch for key levels.

But there’s another way you can capitalize when the markets plunge…

Watch For Breaking News

Yesterday there was also a big opportunity in StocksToTrade’s Breaking News Chat…

The team alerted Advent Technologies Holdings, Inc. (NASDAQ: ADN) in premarket. The company announced an agreement with Hyundai.

The PR says, “Advent and Hyundai aim to deliver green energy solutions to current high carbon applications, using fuel cell technology.”

Sounds buzzwordy, right?

High gas prices are top of mind for almost everyone…

EV stocks have been hot. And it’s a small-cap company that announced news with a larger, well-known company. That’s usually bullish news. And it created a great trade opportunity.

Check out the chart…

But that chart doesn’t even show the rest of ADN’s move. It went to almost $4 — a 95% gain!

The VWAP-hold HOD break pattern and the weak open red-to-green move are two patterns I cover in my ebook. And we look for them every day in the SteadyTrade Team.

We also cover key levels to look for in some of the hottest runners. And we scour the Breaking News Chat for

Listen, I know trading resources cost money. But in the long run, not using the best trading tools can cost even more in lost opportunities, frustration, and wasted time…

These trades are just three examples of how resources like Breaking News and a mentor can improve your trading.

Not to mention the time and frustration they can save you.

So join the SteadyTrade Team today! And get StocksToTrade’s Breaking News Chat so you don’t miss out on incredible opportunities like ADN.

Have a great day, everyone. I’ll see you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade