There aren’t as many good trading opportunities as you think there are…

A big problem new traders face is that they eagerly get to their computers each morning to see the biggest movers.

Then they anxiously wait for the market to open so they can start placing trades.

And before they know it they’ve lost on three trades and it’s only 9:45 a.m.

They’re already frustrated … Wasted all their day trades for the week if they’re under the PDT…

And when a good opportunity does come along, they’re too burnt out to take it or have no day trades left.

They fell victim to overtrading.

But there’s a simple way to avoid this scenario. I’ll share it with you below…

The Simple Way to Avoid Overtrading

There are actually two things that can help you avoid overtrading…

The first and most important one is to have a trading plan. (See, I told you it was simple.)

When you have a trading plan and stick to it, you’ll find you trade a lot less often.

It forces you to wait for key levels for entries.

And when you do enter a trade — you know exactly where you’ll sell when it goes against you, and where you’ll take profits.

So you don’t waste a lot of time going in and out of trades taking tiny gains or a bunch of papercut losses.

That’s what happens to traders who don’t have a plan.

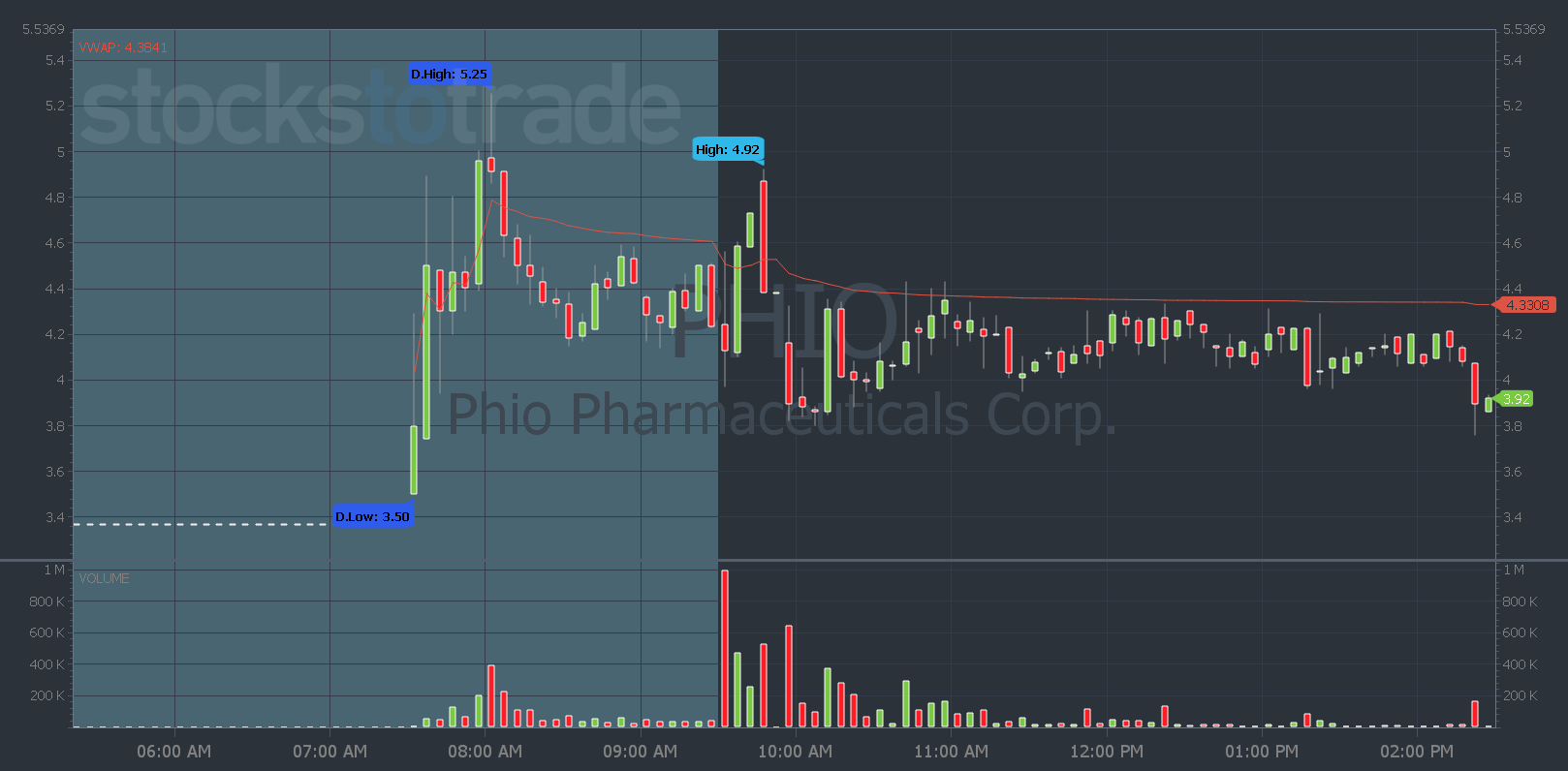

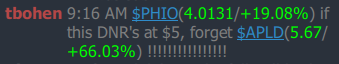

Phio Pharmaceuticals Corp. (NASDAQ: PHIO) is a good example of how having a plan can stop you from taking unnecessary trades…

I liked it in premarket yesterday and my plan included an entry if it broke above $5.

But PHIO didn’t break $5…

The plan kept me and SteadyTrade Team members safe from a loss and from taking an unnecessary trade.

The second thing that can help you avoid overtrading is patience…

Stop trying to anticipate moves — that’s playing a guessing game.

Instead, be patient and wait for your entry. I just showed you how waiting for the key level to break could’ve prevented a losing trade in PHIO yesterday. But you can apply patience to many strategies…

If you like to buy breakouts, wait for the level to break before entering. (Get my five tips to avoid false breakouts here.)

If you like to dip buy, wait for the stock to prove it can hold a support level before you enter.

If you like the afternoon VWAP hold, high of day break pattern — wait for the stock to break the high of the day.

When you wait for the right entry instead of anticipating moves — it can cut down the number of trades you take.

And cutting down the number of trades you take can also reduce the number of losing trades you take. Because you’ll only be focused on trading the highest odds setups.

Get my top daily pick and trade plans delivered to your inbox here.

If the entry signal doesn’t get hit, you don’t have to take a trade.

And if you want you want my thoughts on the market, tickers, and the patterns to look for in the hottest runners — watch my Market Update videos three times per week here.

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade