A couple of weeks ago people were complaining about the market being slow…

But low-float runners disappearing was just part of the hero’s journey…

They wandered off into the wilderness like the hero often does.

We all wondered where they had gone … We remembered them, but they were gone…

Then one day the sound of trumpets and thunder are in the air … And from over the hill, the hero returns.

Whispers spread among the market…

Then a crazy old man (that’s me) runs around screaming “I have seen Palisade Bio, Inc. (NASDAQ: PALI)! Low Floats have returned!”

That’s what I mean when I say it only takes one.

One ticker to spark momentum…

Like Cosmos Holdings Inc. (NASDAQ: COSM) did for true penny stocks — PALI did for low floats a few weeks ago. I told you they were back.

Now the prophecy has been fulfilled.

What does it mean for trading this week? That’s what we’re digging into today…

Low Floats Are Back!

Once one ticker kicks off momentum, stocks can really get moving.

That’s because traders are always looking for the next big runner and trade opportunity.

But Top Ships Inc. (NASDAQ: TOPS) and Ra Medical Systems, Inc. (AMEX: RMED) won’t necessarily be the only low floats with patterns to trade…

These two big gainers could spark a low-float hot sector.

The momentum could also spill over into shipping stocks like TOPS…

United Maritime Corporation (NASDAQ: USEA) is one that already ran last week and has been hiding in the weeds.

Or we could see more low-float healthcare stocks like RMED perk up.

And don’t sleep on XPeng Inc. (NYSE: XPEV). It’s not a low float stock but it’s an earnings winner, and Oracle absolutely nailed the levels on this all last week. Oracle gave a signal entry of $10.50 on Friday and the stock went up to $12.88.

Oracle also nailed the entry on TOPS on Thursday, so use it as a guide for your trades.

AHHH! TOO MANY STOCKS!

What To Look For In Low Float Runners This Week

When it comes to trading trash low-float short squeezes, paying attention to support and resistance levels is key.

That’s how Oracle determines its entries for stocks, and the key resistance areas to watch.

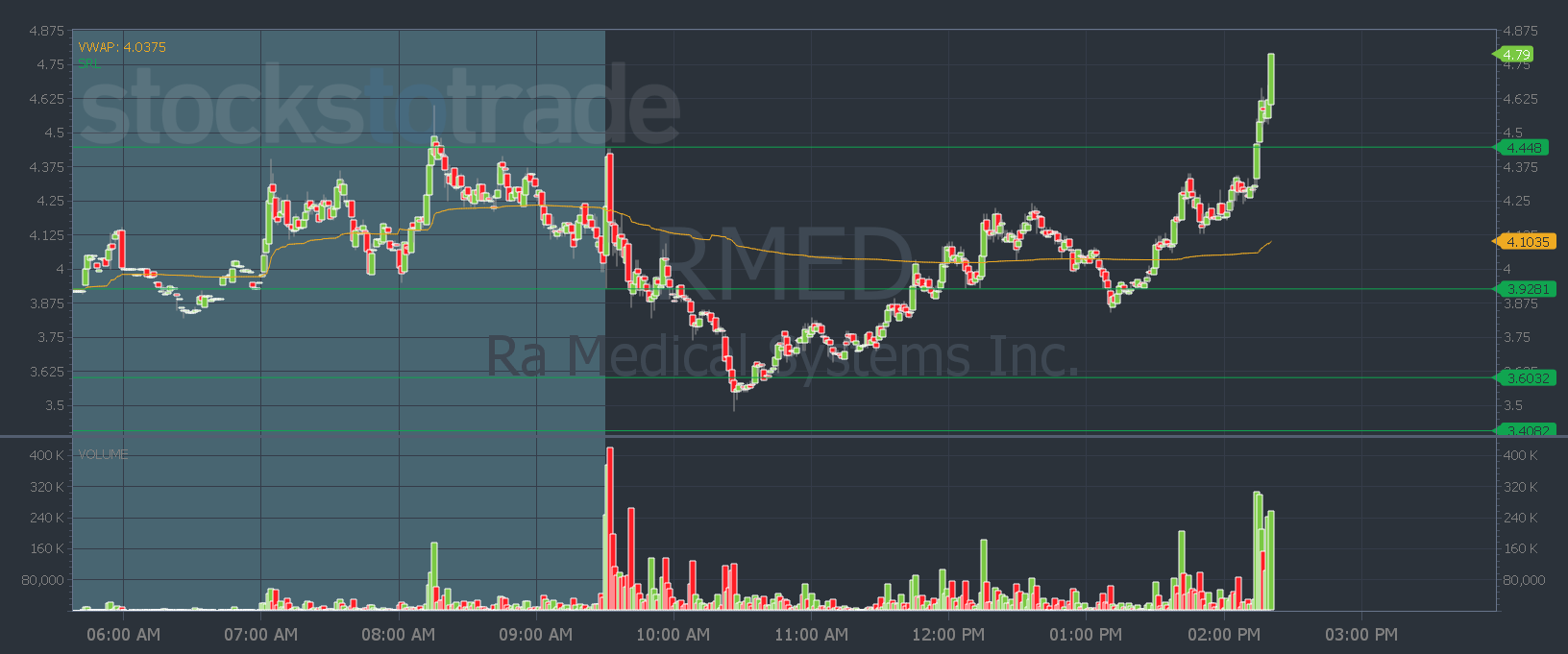

In RMED on Friday, Oracle had a signal price of $4.45. It didn’t break that level in the morning, but the stock slowly ground its way back up and broke it in the afternoon…

Some of these squeezes are happening in the morning, and other times they’re in the afternoon. So set alerts to help you stay on top of all the plays.

This week, I’ll also look for stocks with news. That’s what can send these stocks soaring.

Especially if it’s a low-float biotech with cancer news. Or a tiny company announces a partnership with a large well-known company.

We want to see news people care about…

And when shorts think a stock “is up too much” and they start guessing tops — that’s when we squeeze them.

If you’re having a hard time keeping track of the runners and focusing on the best plays, join me in Pre-Market Prep all week.

We’ll cover the top tickers to watch and I’ll give you all my best trade ideas.

Have a great Money Monday, everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade