There’s one thing traders do that can increase their likelihood of getting stopped out of a trade…

And let’s face it, getting stopped out — whether it’s for a loss or a small gain — is annoying.

Taking losses and sticking to your stops is part of the game…

And crucial to making it as a trader long term.

But if you can cut out this one habit that can increase your chances of getting stopped out…

You can put your trading on the right track.

So here’s the habit you need to cut out of your trading and two tips to help you do it…

How To Reduce The Chances Of Getting Stopped Out

As a trader, it’s crucial to consider the timing of your entry and the potential risks that come with it…

The problem is, most new traders see a stock spiking at the open and they jump right in.

But trading right at the market open increases your chances of getting stopped out.

It’s the most volatile time of the day so stocks can experience wild price swings.

Now, that doesn’t mean entering right at the open is bad — but you have to accept the risks so you can make more informed decisions and adjust your trading strategy accordingly.

If you don’t want to accept the risks and you’re sick of getting stopped out of trades, use these two tips…

Wait For 9:45 a.m. Or Later

I’ve written about the advantages of waiting until after 9:45 a.m. a lot lately — so I don’t think I need to give a big lesson again here…

You can read this blog post and this one to learn more.

Using this rule can help you avoid volatility at the market open. And it can give a stock more time to set up a pattern…

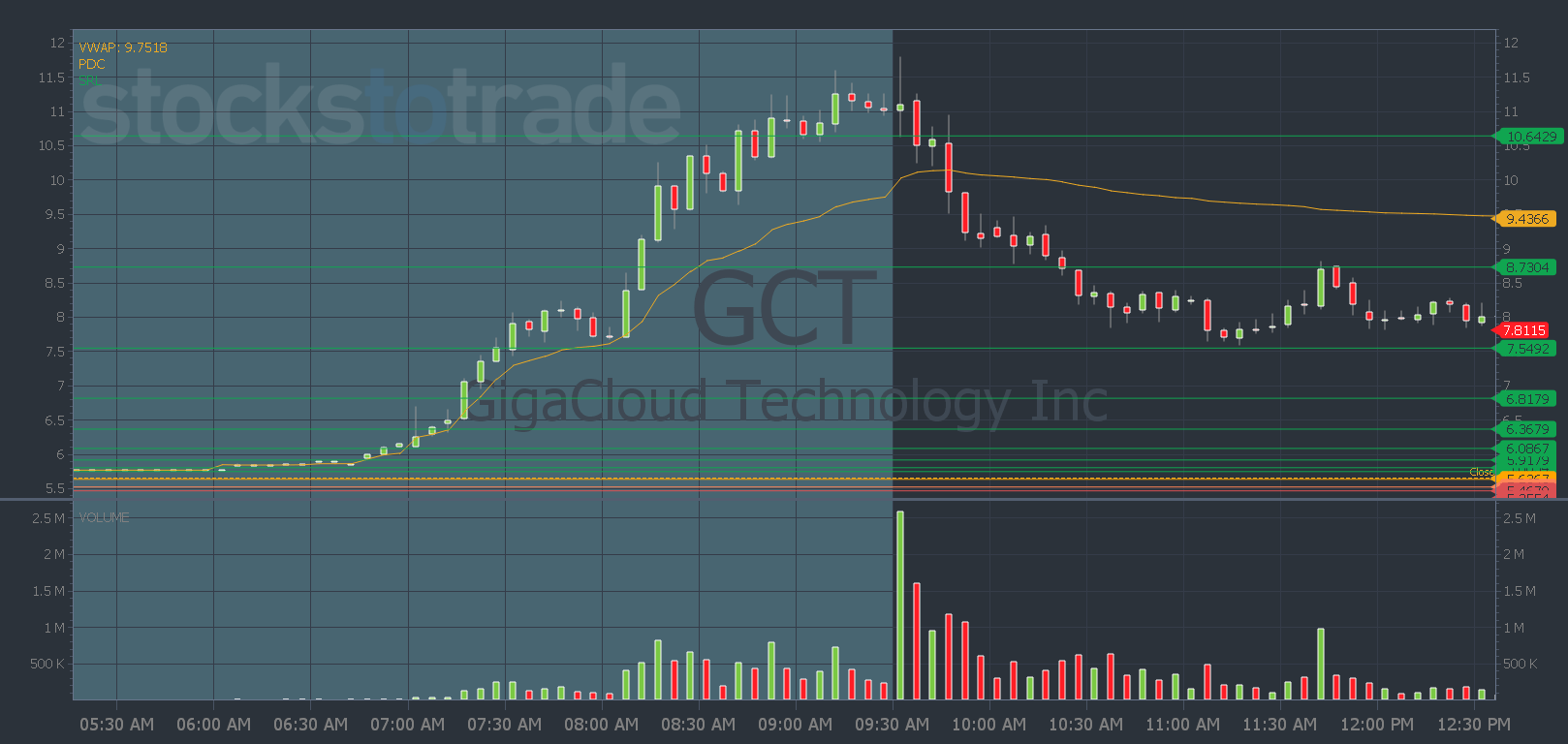

If you chased the entry I laid out in my plan for GigaCloud Technology Inc. (NASDAQ: GCT) yesterday, you would’ve gotten stopped out.

But if you waited until 9:45 a.m. you could’ve prevented a loss and saved a day trade.

GCT chart: 1-day, 5-minute candle — courtesy of StocksToTrade.com

The next thing that can help you avoid getting stopped out unnecessarily is to…

Look At The Stock’s History

You can avoid taking unnecessary trades and getting stopped out by looking at a stock’s history…

Look at the long-term chart — if it’s a multi-day runner, look at the multi-day intraday chart.

Is the stock a former runner? Does it have the potential to spike?

And if you’re looking for an entry in a multi-day runner, go back and see how it moved on the other days of its run…

Does it spike right at the open? Or does it tend to pull back and have dip and rips … Or red to green moves?

When you’re armed with this knowledge, you can make more calculated trading plans including potential entries and exits.

Whether you decide to trade right at the open or not depends on your risk tolerance.

If you’re comfortable with the possibility of getting stopped out early and your risk level, then go ahead and take a trade.

But if the idea of being stopped out early doesn’t align with your risk tolerance — or you can’t afford to waste a day trade — you may want to reassess your entry strategy and find a better fit.

Stay in touch with what’s happening in the market and my tickers and plans here.

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade