How can you decide which stock should be your top watch?

It can be tough when there are a bunch of runners with news gapping up…

But it’s even more important to pick the best potential stock on slower days.

And there’s one indicator I look for to help me do that…

It helps me decide whether a stock stays on my watchlist, or gets booted off.

And it can prevent you from taking an unnecessary loss due to trading a low-odds setup.

It’s not an exact science though, as you’ll see in my examples…

But it can be a good indicator of whether I want to watch the stock, or if my focus will shift to another higher-odds setup…

See how you can get my top stock to watch daily by attending my FREE event — RSVP here.

How to Choose the Best Stock to Trade

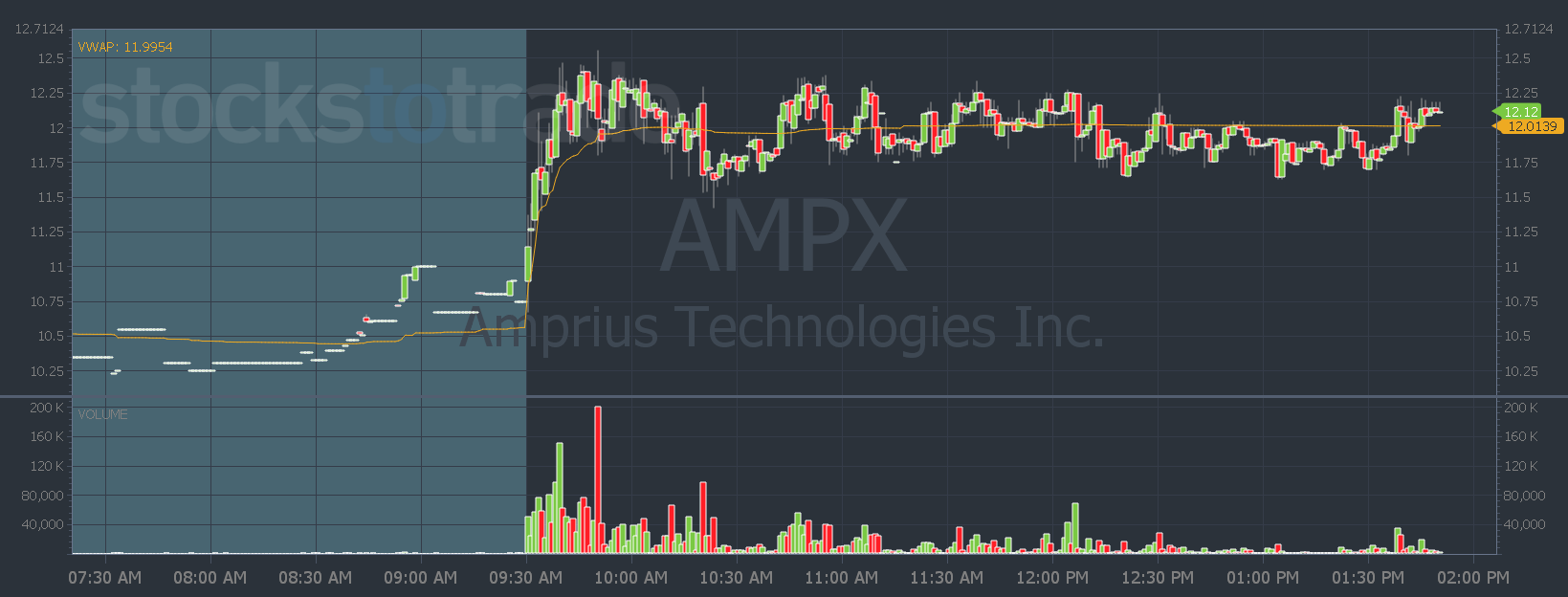

I featured Amprius Technologies, Inc. (NYSE: AMPX) and Microvast Holdings, Inc. (MVST) on my weekly watchlist.

But yesterday in the morning SteadyTrade Team webinar, I didn’t mention them much.

That generated questions from members about why I hadn’t mentioned them…

The number one reason they weren’t on the top of my radar was that they were trading low volume.

Every day I look for the highest volume stocks. Because those have the most potential for explosive moves.

Especially on a day like yesterday…

The markets were gapping up but the premarket trading action was still meh.

There weren’t a ton of low-float big gainers with news. So on a day like that, I’m even more focused on stocks I think everyone will be watching.

Yesterday that was Motus GI Holdings, Inc. (NASDAQ: MOTS).

It has a low float of fewer than 3 million shares. And it rotated the float a few minutes after the market opened. Plus, it had news.

We got a nice spike out of the gate and I thought it could run more and make new highs throughout the day.

In short, it was a higher odds setup than the lower-volume stocks.

But AMPX was my second top watch … It had a bigger dollar-per-share move than MOTS. But it was a lower-odds setup because of the volume.

So while the morning move looks good in hindsight, I don’t like to play guessing games.

That’s why I pick key levels to trade off. In the watchlist, I said to watch AMPX for breaks above $12.50, because that’s the level I think the volume will come in.

That didn’t happen. And you can see from the chart that AMPX couldn’t pick a trend direction. It just chopped sideways along VWAP.

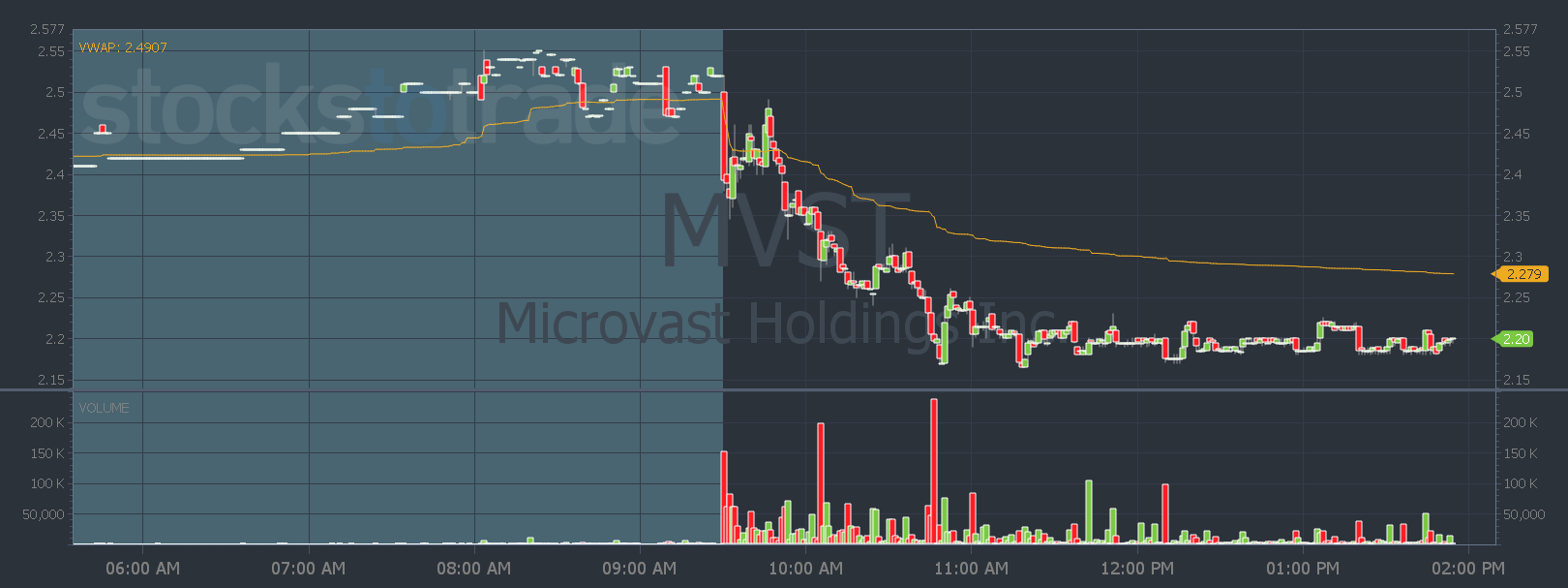

Avoiding MVST because of low volume was also the right move…

The stock completely failed after the open.

That’s what happens when a stock has a 170 million float and only trades 4 million shares by midday.

And it’s why the trading volume relative to the float is often a deciding factor for me on which stock becomes my number one watch.

Want to know which stock is my number one watch every day?

Attend my upcoming FREE event.

I’ll show you how to find the biggest potential runners — even on red market days!

Have a great day everyone. See you back here tomorrow.

Tim Bohen