It was another quiet day in penny stock land yesterday morning … You may be wondering if it’s time to look for short-selling opportunities…

But is short selling a good strategy?

Personally, I’m a market optimist. There’s usually at least one long setup per day. We saw some nice runners before the end of the day yesterday…

And I think new traders should focus on gaining consistency going long before they dive into short selling.

But if you’re an experienced trader and have developed consistency going long, there’s nothing wrong with expanding your trading playbook.

And if you want to learn, I’d rather teach you a safe way to short sell than have you try to short any stock that’s up like idiot fintwit short sellers…

So today I’ll give some short-selling basics. Then we’ll dive into what I think is the best short-selling strategy in 2022…

Mark Croock uses his shadow trades strategy to go long or short. If you missed his event last night, watch the replay here.

How to Short Stocks

Shorting a stock is when you open a position by borrowing shares from your broker. Then you sell them into the market when prices are high.

When you short a stock, you hope the stock price will go down…

So you can close your short position by buying the stock at a lower price. And return the shares to your brokerage.

Get an in-depth breakdown of short selling here.

Sounds simple enough, right? It’s basically the opposite of going long.

But some annoying hiccups can come along with shorting, including massive risks…

First, your broker has to have the shares for you to borrow. And they won’t always have them.

Second, you need a margin account to short sell. And your broker can have a margin requirement that can limit the position size you can take. That’s not always great for traders with small accounts.

Third, there are fees for borrowing the shares. Typically, you’re only charged if you hold a stock overnight. But check with your broker first to be sure of any potential charges.

Lastly, shorting is risky. There is the potential for infinite losses. And your account can blow up faster than you think when a low float stock starts spiking…

So never short a low float stock on its first green day. There are potentially safer ways to short sell stocks…

What Does a Short Pattern Look Like?

Yesterday, the Breaking News Chat team alerted me to two short reports on stocks…

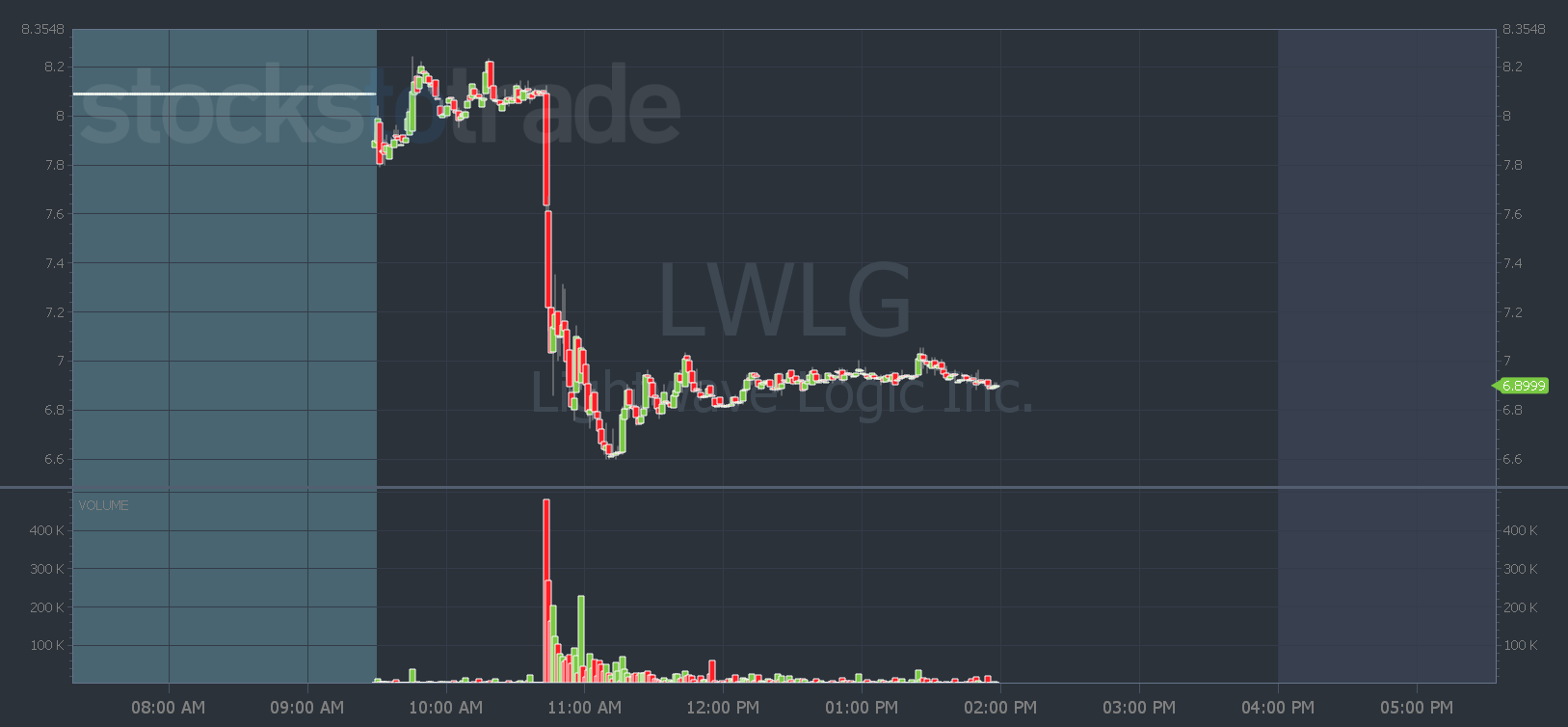

Kerrisdale Capital claims that Lightwave Logic, Inc. (NASDAQ: LWLG) stock rose 10x over the last year…

While the company only “generated a total of about $6 thousand in revenues” and “hasn’t ever come close to commercializing anything.”

You can read the full short report here.

Here’s what LWLG’s chart looked like yesterday…

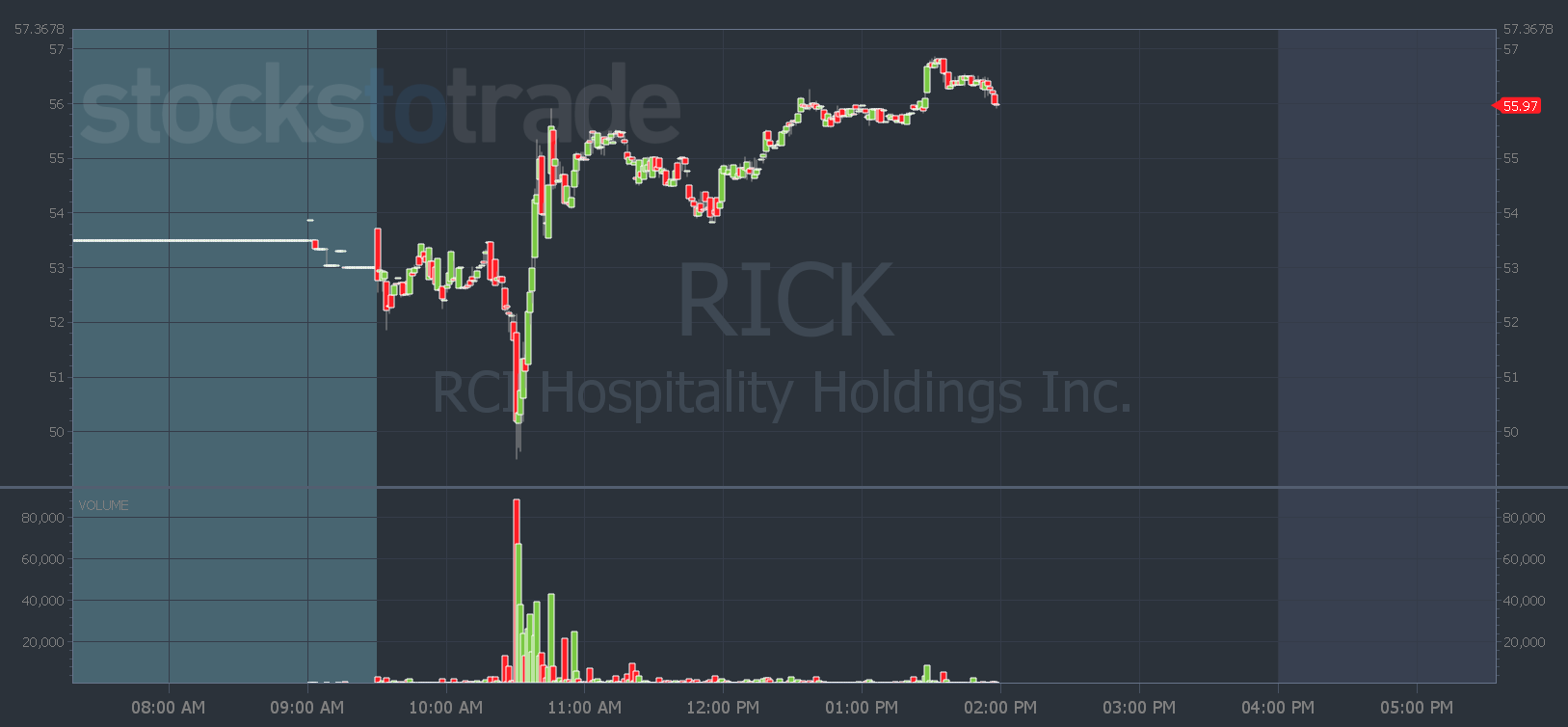

The next short report was from The Bear Cave. Their investigation claims that RCI Hospitality Holdings, Inc. (NASDAQ: RICK), which owns gentleman’s clubs, “faces allegations of illegal behavior.”

It also claims that “the company continues to have accounting concerns.” Get all the details here.

Despite the negative report, RICK bounced back and made new daily highs yesterday…

You can see from those mixed results that just like a “good news” PR doesn’t mean a stock’s an automatic buy, bad news doesn’t mean a stock’s an automatic short.

Just like when you go long, your shorting edge should be with your pattern and strategy and checking all the boxes…

Stick to higher float stocks that move slower than low floats. That way if it goes against you, you can get out and hopefully avoid an account blow up.

And if bad news, a short report, or bad earnings hit, make your trading plan based on key emotional levels.

Listen, a lot of these big tech stocks are heading back to realistic prices after two years of gains.

And with the right strategies, you can potentially capitalize when stocks break through key emotional support levels and traders become fearful.

Watch the video below to see my breakdown of how to short sell a tech stock with bad earnings…

Have a great day everyone. See you back here on Money Monday.

Tim Bohen

Lead Trainer, StocksToTrade