Banking stocks soared yesterday morning on news that First Citizens BancShares, Inc. (NASDAQ: FCNCA) would buy failed Silicon Valley Bank.

Stocks of First Republic Bank (NYSE: FRC) and Western Alliance Bancorporation (NYSE: WAL) gapped up 30% and 6% percent respectively.

But I had my eye on another banking stock as my number one watch … It was up 12% by the time the market opened…

And the trading plan I spoon-fed traders worked out beautifully.

But I didn’t just like it because it was a bank stock that was gapping up…

There was something else much more important.

I’ll tell you what it was. Plus, I’ll show you my plan, and how it turned out.

An Important Market Concept

The two best days to trade penny stocks are Fridays and Mondays. That’s when I see the most predictable setups.

Many of the best setups are Friday afternoon short squeezes. Then on Monday, those stocks offer great potential for more followthrough.

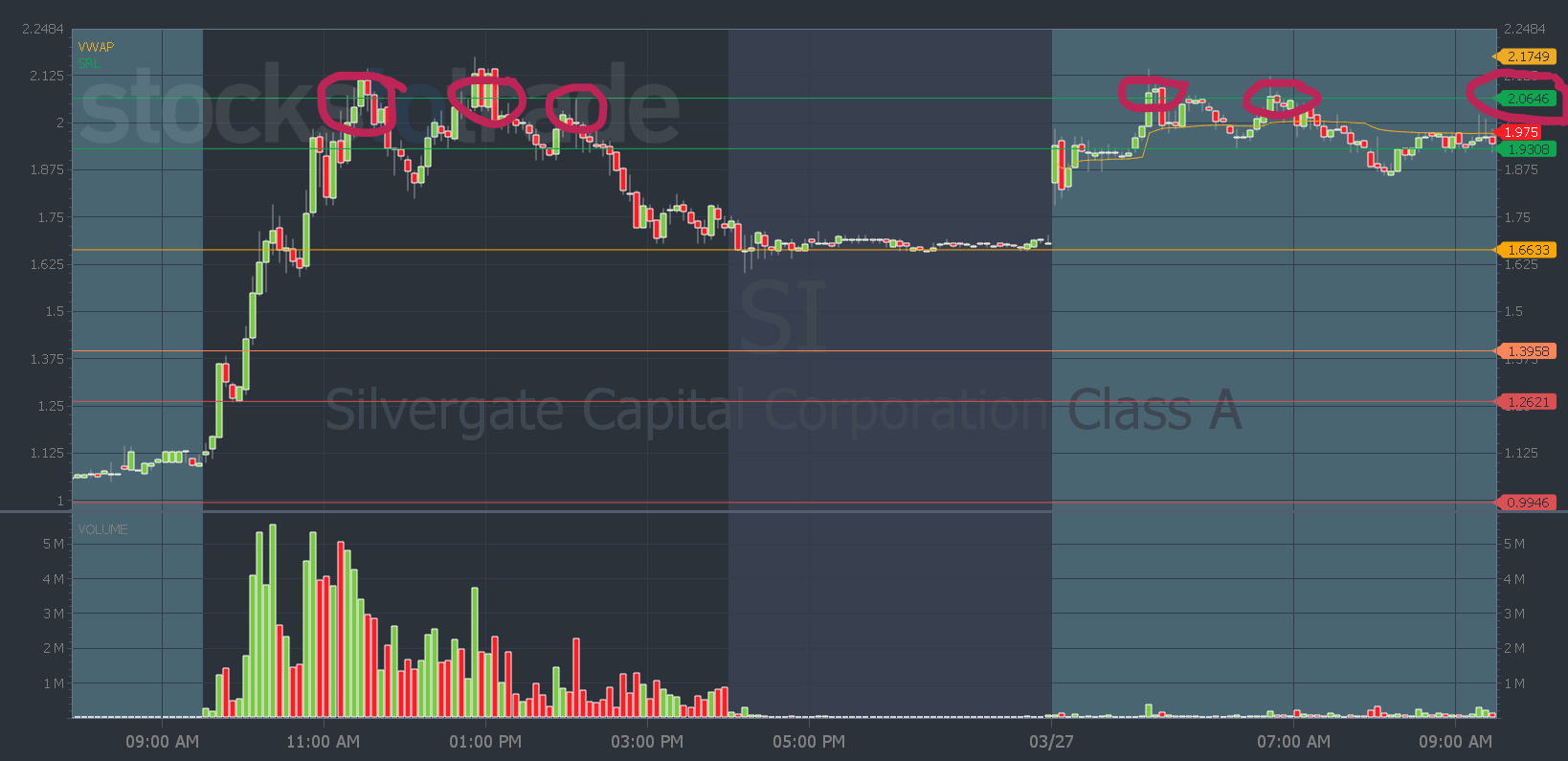

That’s what led me to pick Silvergate Capital Corporation (NYSE: SI) as my number-one watch yesterday…

It was a big squeezer on Friday. Then yesterday we got the gap up in premarket so I was looking for the followthrough move through a key level.

In Pre-Market Prep, I went over why SI was the best play on Friday … And the technical level that was important…

And look at how that level aligned with the Oracle support and resistance level…

Since that was a significant area of resistance, that’s the level I wanted to see the stock break above in my trade plan for it yesterday…

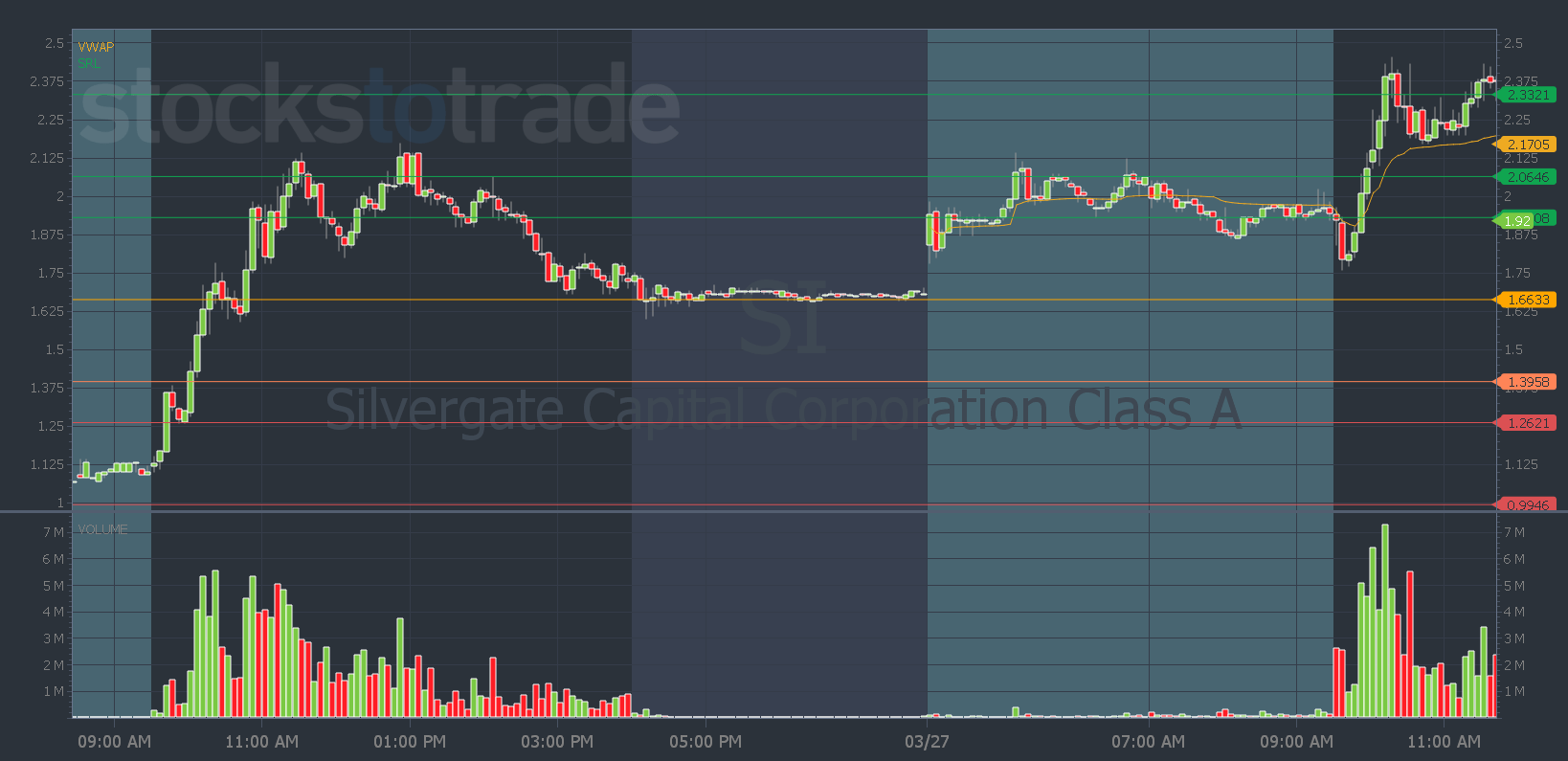

I was looking for a break above $2.06 with a target of the mid to high $2s.

And the stock topped out at $2.45, which was right around the next Oracle resistance level…

Even during uncertain markets — Fridays and Mondays continue to be my favorite days to trade.

And looking for big runners on Fridays can often help you find Monday’s best potential play.

So anything you can do to change your schedule to have Fridays and Mondays available to trade — I think you’ll be able to see the majority of the best setups out of the entire week.

Then you can use the Oracle support and resistance indicator built into StocksToTrade to help you plan your trade. Your trial comes with a ton of bonuses too — check out the details here.

Want to save yourself the time of finding the best potential trades and the levels to trade off? Click here to see how I use StocksToTrade’s proprietary algorithm to pick my top daily watch and make a plan — plus, how you can get my daily pick and trade plan delivered to your inbox every morning.

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade