The term pump and dump is typically associated with OTC penny stocks.

Stocks listed on over-the-counter exchanges are subject to the same regulations and rules as listed stocks.

So it makes it easier for companies to create shares, hand them out to promoters for free or for pennies, then dump them into the open market.

But this scheme isn’t strictly reserved for OTCs.

They can happen in listed stocks too.

And in Friday morning’s SteadyTrade Team webinar we just uncovered the latest one…

Read on to see what these charts look like, how to trade these stocks, or why you might want to avoid them…

What Is A Pump and Dump?

Basically, a pump and dump is what it sounds like, promoters pump up a stock through promotions, emails, or on social media … Then they dump shares as the stock goes up.

But they don’t just wait for buyers to come in and lift the stock price, they also buy shares to make it look like others are buying…

They constantly go in and out of positions to create the illusion of volume and buyers.

Then as everyday folks see it go up after they received an email or saw it on social media — they get FOMO and buy in.

Most of the people who get scammed don’t know how to trade. They believe whatever the promoters tell them about the stock. So they hold when it starts to tank…

And they inevitably get burned and lose a crap ton of money.

Watch our most watched episode of the SteadyTrade podcast for a look behind the curtain of market makers and manipulators.

My interview with JJ was eye-opening — even for me as an educated trader.

So should you trade these kinds of stocks and take advantage of the run up? Or avoid them altogether? That’s up to you … But do your due diligence…

How to Trade Pumps

These stocks are the sketchiest stocks of all. But if you’re experienced and good at cutting losses, you can dip your foot in if you’re comfortable.

I’m not saying this is for sure a pump and dump — you can never tell for sure…

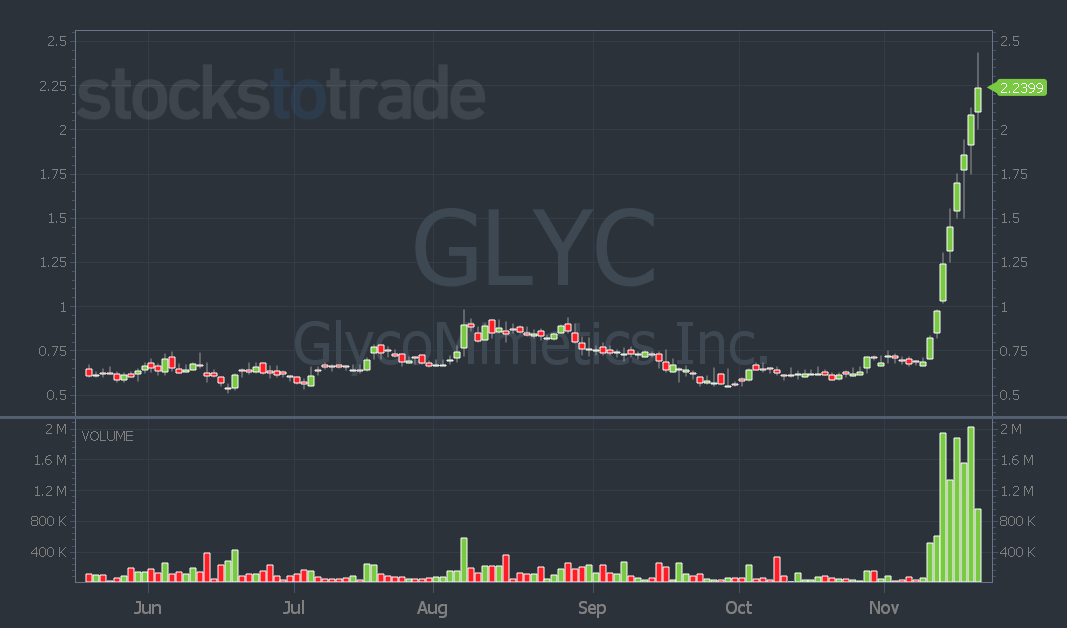

But look at the GlycoMimetics, Inc. (NASDAQ: GLYC) chart. It sure seems like something fishy is going on…

Over the last eight days, all it does is gap up, go higher, and close near the high of the day.

It doesn’t look normal.

But if you want to trade it — respect the price action and trade the patterns. (Get my top 10 Trading Patterns ebook for free when you join Pre-Market Prep here.)

Look for weak open red-to-green moves or breaks above the previous day’s high…

But don’t take your eyes off it or walk away from your computer. Because the bottom could fall out at any moment.

That’s just one of the…

Reasons to Avoid Pumps

Once the promoters are done pumping the stock, the dump can create a massive selloff.

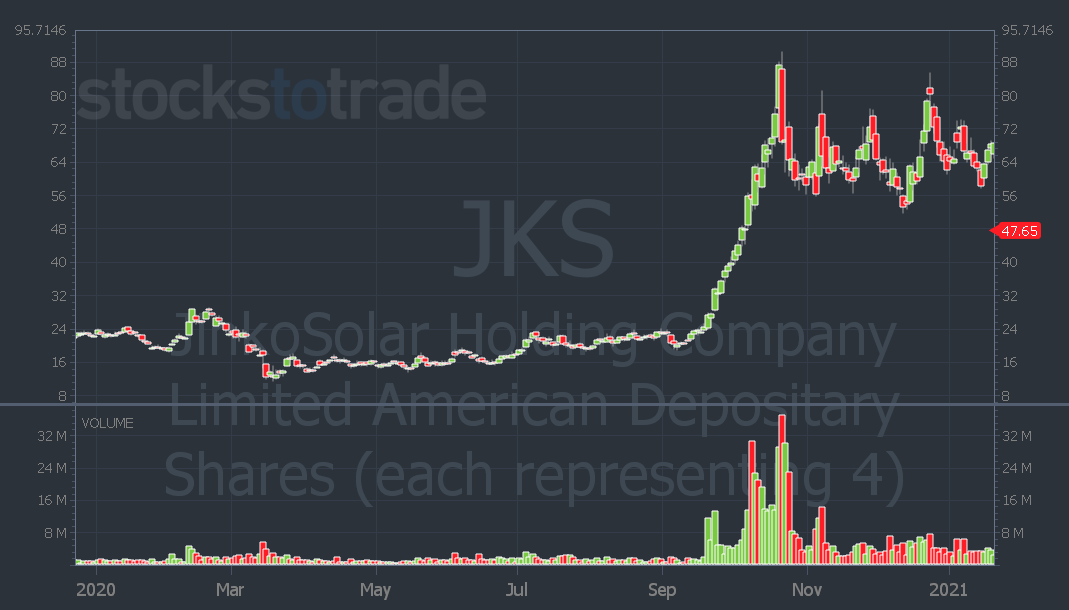

Look at the classic listed pump JinkoSolar Holding Co., Ltd. (NYSE: JKS) in 2020…

The stock went from roughly $20 to $90 in a run up that looks similar to GLYC. Nothing but green days…

Then it lost over $20 per share on its first red day.

Eventually, it went back down to where it started at around $30 per share. But 2020 was also a different market…

There were plenty of “make bank, bros” coming in to buy the dip.

That’s not the case anymore. So when the bottom falls out of GLYC, it could be more drastic.

Another reason to avoid these stocks is because they’re manipulated.

That means anything can happen.

You’re at the whim of pumpers who don’t trade by the rules.

Seriously, if you haven’t watched the market maker episode of the SteadyTrade podcast do it now!

Even if you’ve watched it — rewatch it.

It’s really unbelievable how these market manipulators operate behind the scenes.

And if you want my help navigating the sketchy world of penny stocks — join the SteadyTrade Team…

I give members trade ideas and warnings in real-time during my live webinars and in chat.

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade