Penny stock traders dread the D word…

It’s caused many traders to lose money — especially in premarket when it can be tough to exit a position.

But if you want to trade sketchy stocks, you have to be prepared for sketchy moves…

But believe it or not, there are cases where dilution isn’t necessarily bad news. In fact, it can be bullish…

Confused?

Then read on … Because today I’ll show you two examples of dilution.

And we’ll dig into why the stocks had completely different reactions to the news…

One of these offerings sent a stock off a cliff — losing $7 per share of value. While the other stock spiked to new 52-week highs…

Why Toxic Financing Kills Stocks

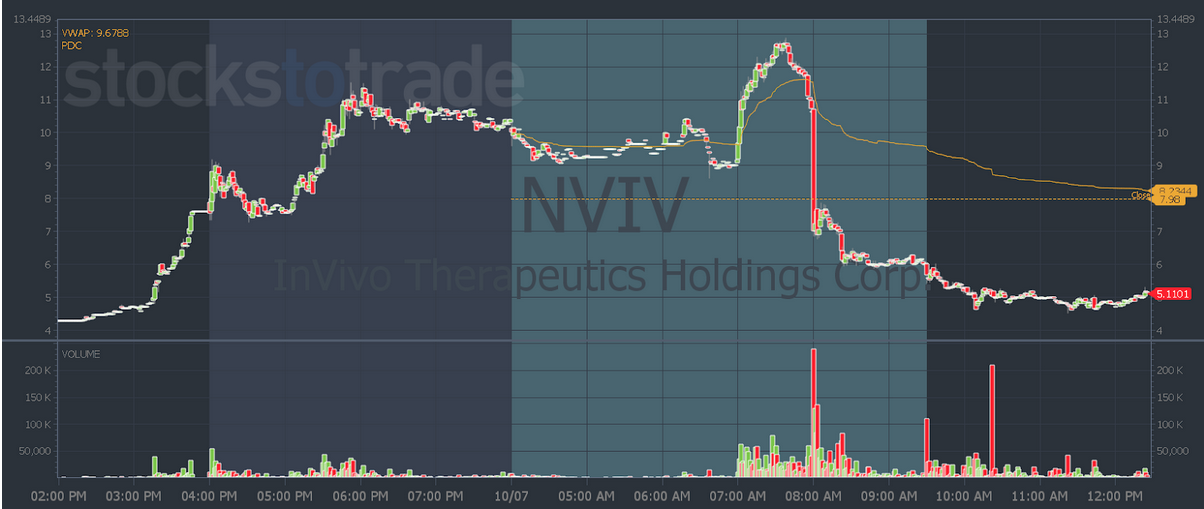

In Friday morning’s SteadyTrade Team webinar, a member asked me about InVivo Therapeutics Holdings Corp. (NASDAQ: NVIV). The stock was a big winner on Thursday when it went from $4.25 to almost $8…

Then early in premarket action, the stock squeezed higher and went to nearly $13. Then it fell off a cliff back to $7. (And continued lower later.)

Here’s what happened…

The company did toxic financing at $5.05 per share. That means they sold shares to a private investor for nearly 50% less than what the stock was trading at.

Not only does that dilute existing shares by adding more into circulation … It also undercuts any shareholder who bought on the open market at a higher price.

This adds more selling pressure in two ways …

First, the company just told the public that it thinks its shares are only worth $5.05.

So existing shareholders are going to want to get out while they can if they have any profits or a small loss.

Second, do you think the private investor who bought millions of shares at a deep discount is going to hold them?

No way.

They were already up more than double their money in premarket…

Even as we were talking about this stock in the webinar, when it was trading around $7, the investors were still up $1.50 per share.

Selling there still makes them millions from their position.

Key takeaway: When a company sells shares for a deep discount compared to where it’s trading, it will usually result in heavy selling.

Is All Dilution Bad?

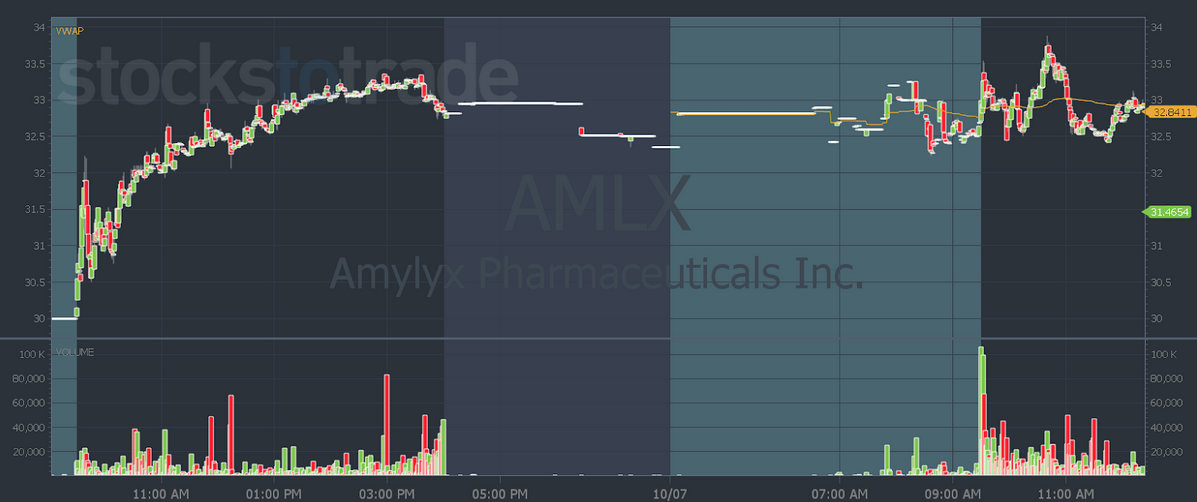

Later in the webinar, another member asked me whether Amylyx Pharmaceuticals, Inc.’s (NASDAQ: AMLX) offering news was bullish.

And it is…

The company diluted shares with an offering. But they offered shares only $1 below where the stock was trading.

And it was near 52-week highs. They even upsized it to offer more shares…

Now this crappy biotech company has $200 million in the bank to develop its drugs or treatments.

The news even spiked the stock briefly to new 52-week highs…

But even when a stock has what you think is bullish news, you still need buyers to get excited. You need that demand and volume to send the stock higher.

AMLX eventually failed Friday afternoon, but the overall markets were also hitting new daily lows at the same time.

But on a frothy market day with enough volume and buyers, this news could’ve sent AMLX on a bigger uptrend after making new 52-week highs.

Key takeaway: As with any trade idea, you can’t base your decisions on news alone.

A stock with financing news near 52-week highs and $200 million in the bank doesn’t mean you should buy it.

Combine multiple indicators with news and volume. Make sure your trade idea checks all the boxes.

If you want to do that with me live and interactively twice daily — join the SteadyTrade Team.

Have a great Money Monday, everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade