Last week was ugly for the overall markets. Every day trended lower except Friday…

Some traders are struggling to find the right opportunities and setups when the market’s in a bloodbath…

However, traders in the SteadyTrade Team are thriving.

Even as the markets tank, there will always be one trade…

It’s as simple as it sounds.

You just have to know what to look for and how to trade it, then the profits can follow.

While I know the process I teach works…

I want you to see it for yourself.

So below, I’ll walk you through a case study. I believe that if you look it over and analyze it, it could point you to the next monster-winning trade.

Don’t miss my SteadyTrade Team webinar this morning! Get FREE limited-time access here.

Watch For This Bread and Butter Setup

Last week, Canoo Inc. (NASDAQ: GOEV) was the perfect example of a penny stock company that knows how to play the game…

On Tuesday the company announced that Walmart ordered 4,500 of the company’s EVs. The stock had a massive move in premarket gaining over 100%!

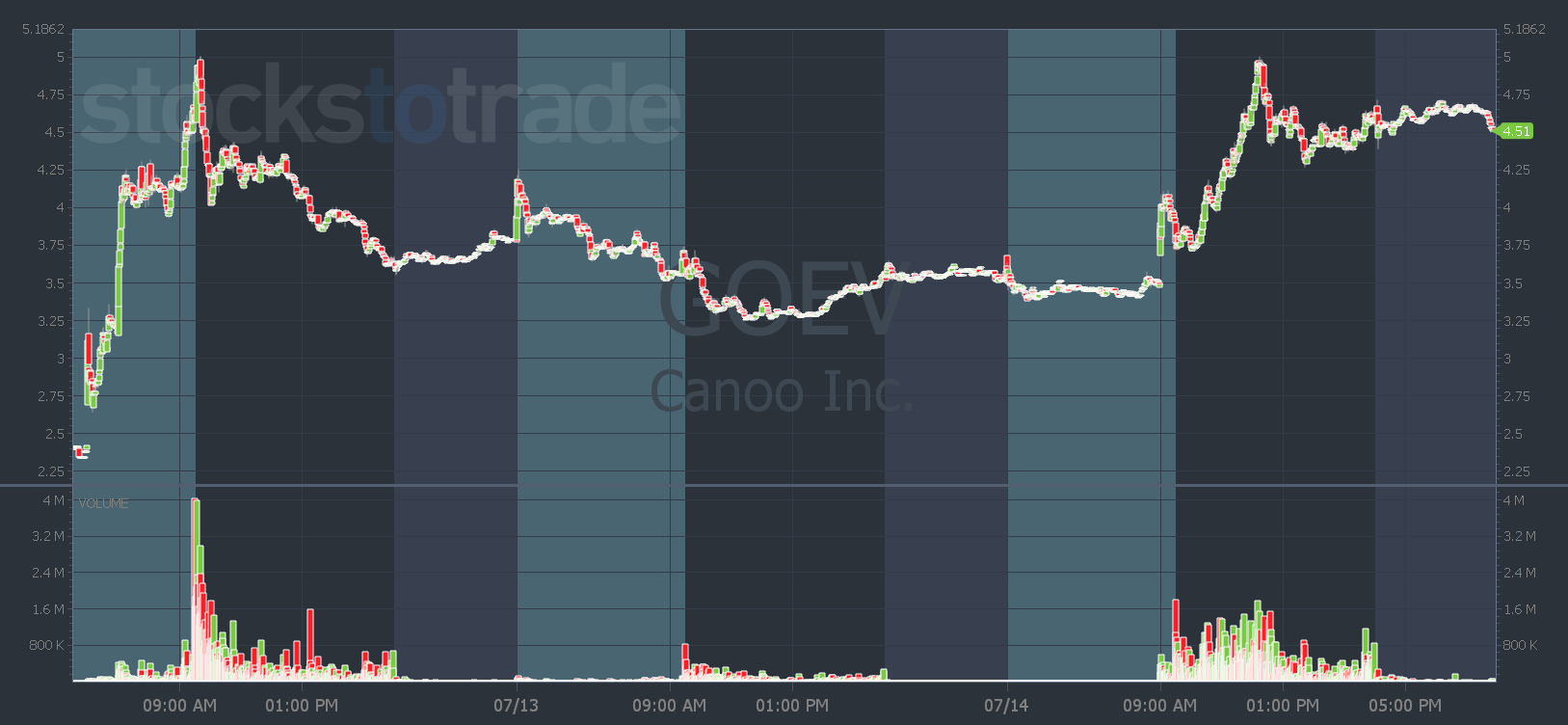

After that huge move, GOEV couldn’t hold its gains and it sold off for two days.

But on Thursday the company dropped another press release — the company won a U.S. Army contract … And they timed the PR perfectly…

When I talk about penny stock companies playing the game, it’s all about creating FOMO.

And a buzzworthy PR dropped at 8 a.m. Eastern gives traders plenty of time to see and spread the news.

Now, most regular brokers will allow trading at 8 a.m. That’s why we see premarket spikes…

But the traders who use Robinhood or similar apps can’t trade until 9 a.m. or later. So that extra hour gives the ‘make bank bros’ time to see the news and build up FOMO.

And when the market opens they throw in market orders and drive the stock price higher.

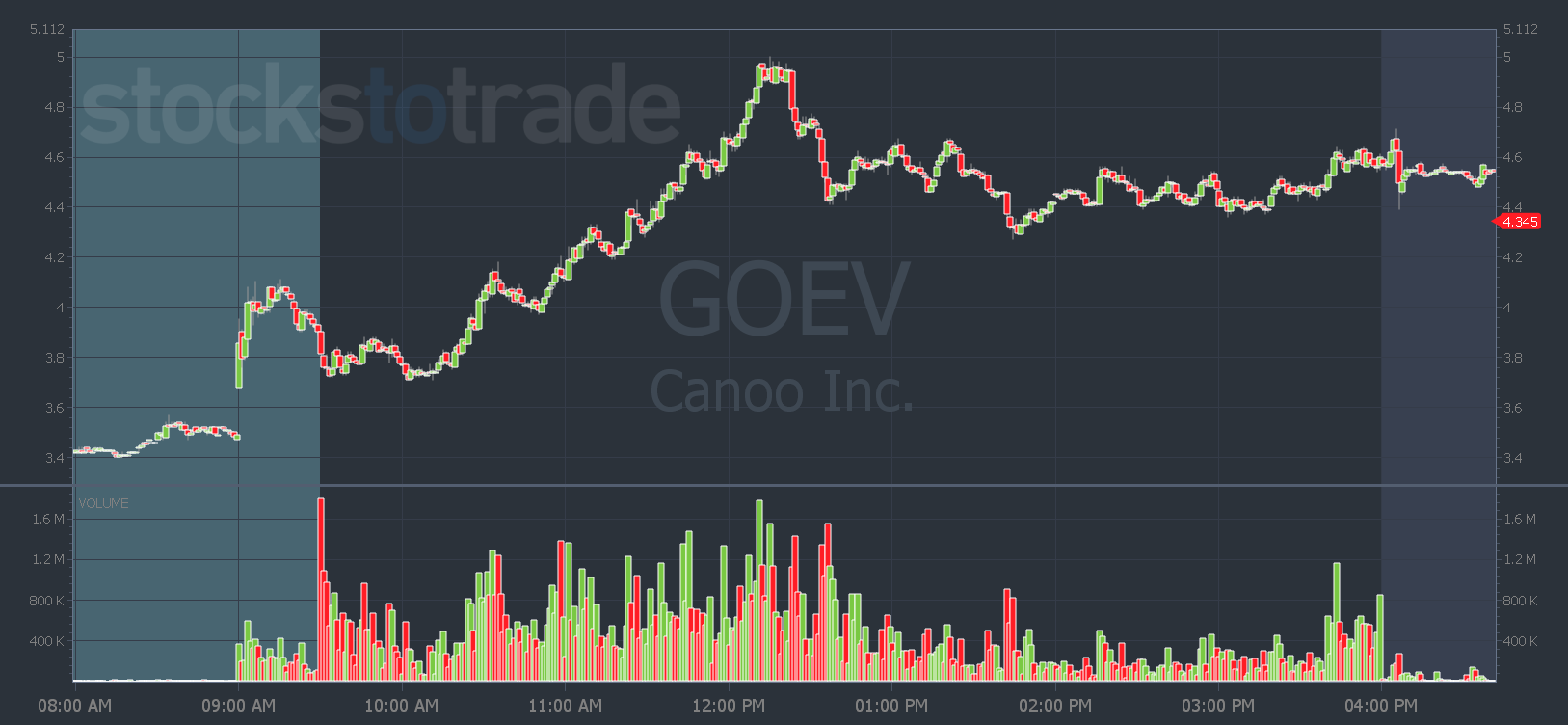

That can give you price action that creates moves like this…

My Favorite Morning Pattern

After the army contract news, GOEV didn’t have as big of a premarket move as it did on Tuesday. That gave it more room to run after the open…

And it had a lot of the criteria we like to look for:

- Volume.

- News.

- Multi-day runner (It was still up roughly 60% since the first PR.)

- It was loaded with shorts…

- It had that perfectly timed PR.

Now, GOEV didn’t spike right at the open. But that’s exactly the kind of price action we look for in our morning bread and butter setup.

Instead of spiking, it pulled back slightly and formed a base near the premarket lows. That’s the dip…

Then more volume came in, it reclaimed the high of the day and premarket high — and it ripped $1 per share higher.

See how you can find dip and rip patterns here.

The move also lined up with another one of our patterns — the day three surge. Look at the three-day chart and key levels…

So when I say, there will be one today, now you know what to look for.

If you want to know exactly what I’m watching today — and all week — get in my SteadyTrade Team webinars for FREE here.

I’m going LIVE soon!

Have a great Money Monday, everyone. I’ll see you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade