There’s nothing like an adrenaline rush. And, because we all love a good adrenaline rush, how often are you tempted to chase every potentially great trade that comes your way?

If the answer is ‘often’, or ‘always,’ you may be that kind of trader (and there are a whole bunch of us out there) who, from time to time, loves the adrenaline rush that comes with laying it all (or almost all) on the line.

Chasing, after all, is most of the fun! Not to mention that this frequent chasing of trades gives us the feeling that we’re the fast and furious kind, speeding our way down the road to making a quick buck.

Download a PDF version of this post.

Table of Contents

The Adrenaline Rush

But, did you know that adrenaline is actually a hormone that you have in your body? The hormone is secreted when you’re stressed, when you’re anxious or when you’re fearful. When this hormone is secreted, our body’s natural response is to arm itself for danger (fight!) or to avoid it (flight!). This is a preservation tactic that is quite awesomely built into us as a fail-safe.

And, doesn’t it make sense? Who doesn’t love a good scary movie? The reason why this adrenaline makes us feel good and why some seek it, to varying degrees, is multifaceted.

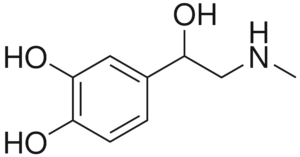

Technically, adrenaline is nothing more than epinephrine, and… it looks like this:

Wait! We’re traders, not scientists, man! We won’t bore you with that medical mumbo jumbo. Adrenaline is like a cocktail of sweet neurological happiness! (And yes, this is exactly what’s in the well-known Epi-Pen used to combat allergic reactions).

Adrenaline can be used as a pick-me-up or a boredom crusher. It can, even in measured amounts, be healthy for you.

First, the release of adrenaline into your system causes glucose to be released. In the absence of any real danger (like running from a bear, for example), this extra glucose is just an extra shot of energy. Yay, us!

Then, it causes your heart rate to increase and your blood pressure to increase (not so good if you already have high blood pressure or heart disease). It does all of this because it constricts those pesky little blood vessels that aren’t so important, allowing the bigger organs and muscles to utilize it (this is so that we can run from danger, should it be necessary).

This is what psychologists and scientists call the fight-or-flight response. All in all, it can feel pretty good. Again, we caution, this is only fun in metered doses. In mega-doses and on a routine basis, stress and fear are more akin to a serial killer, not to mention that this frame of mind makes you much more prone to making impulsive and/or irrational decisions.

And, how does “irrational” work out for the trader? Not so good, you’d probably say. And you’d be right.

Many traders love the frequent adrenaline rushes that come with trading. And, the more frequently they trade, the more they feel that they are hitting the fast forward button on their way to riches.

We’d beg to differ.

Still, traders tend to chase after this rush and wind up running willy-nilly into over-trading. They secretly hope that the more they trade, the more they will gain. Of course, there’s a bit more to it than just “betting” big.

Of course, you might gain, but that would be more from sheer one-off luck, rather than from sticking to your well-found and planned trading strategy. Chances are, you will sooner or later lose and lose big.

Every trader should ask themselves- is the cost of getting in over my head sustainable for me? Am I making wise trading decisions based on patterns or knee-jerk decisions based on fly-by-night glances at what appears to be a mouthwatering opportunity? The next question traders should frequently ask is, after calculating investments, profits and losses, have I made any profits at all? Or, am I just hitting buttons hoping for the million-dollar profit to fall into my lap?

Well, it doesn’t work that way. (And we know that you know it all too well). You won’t get rich overnight and you’re not going to get rich without doing some homework.

You need to think through your strategy carefully (which requires you to have one to begin with) to maximize profits and minimize losses. Otherwise, you may risk wiping out your entire trading account with one quick, impulsive hit of a button when you’re feeling the need for an adrenaline rush.

To help you along the way, here’s our Very Short Walk Through How To Avoid ‘Haste-Makes-Waste’ Trading

#1. Drop the ‘Get Rich Quick’ Mentality

Sure, you’re in this for the profit, but don’t expect that the more you trade, the more you win. Some people make a few trades a week, some trade daily—but every successful trader is in it for the long haul and has done his or her homework.

#2. Trade Objectively

Breathe in, breathe out. Trade when you’re not on an emotional high or low—when you can be objective. The longer you stick with it, the more objective you will become, thinking more of your trading like a business proposition rather than a roulette wheel. If you do bump into a sudden rush of anxiety or fear, adrenaline will mess with your rational thinking and cause you to make hasty decisions. So, no FOMO. Step away for a minute (or five) and then look at it again and make a rational decision.

This will save you tons of emotional bumps or regrets over things that are beyond your control. What’s done is done (Or not done). That’s it.

#3. Slow Is the New Fast

A step-by-step trading plan and strategy will move you more quickly along toward your goal to become a profitable, better trader, than a speedy drive in the fast lane in the hope that you won’t crash your car down the road.

Be as prepared as you can be. Learn from every trade, every mistake and every loss. Don’t ditch your strategy just because you want to get to Lamborghini Land faster. When you stick to your strategy, chances are, you’ll trade without fear. When you dump the fear, you won’t see every potential trade as a threat and rush to fight it (or flight it).

#4. Beware of Burnout

The frequent adrenaline rush might drain your brain and body. It’s not by chance that adrenaline flows to your body when you’re stressed out. If it were normal for humans to constantly ride the adrenaline wave, we would be endowed with a never-ending, ever-present supply of adrenaline. It’s just not meant to be an all-the-time kind of thing. Beware of exhausting your body and mind due to over-trading. It won’t help either your health or your trading account. Take a break whenever you’re starting to feel like the stress is too much.

In a Nutshell…

Spare yourself and take care of yourself. The more you trade with a rational attitude, the clearer you’ll see your trades and the more you’ll learn along the road. You’ve already walked the first few miles down that road. Just keep walking toward your dream destination.

If you’re still struggling to practice trading discipline, here are some tips for you! Happy Trading!