Summary: This week has continued the early summer trend of low float stocks running fast and dropping fast. For sure the week was literally filled with opportunities to go long and short depending on your style. All of the stocks listed below are very similar in their fundamentals as well as chart wise. Something that we go over frequently in StocksToTrade Pro is being flexible and having a trader mindset. Even if you are not a full day trader looking to make a single trip in and out the same day, you still need to only trade what the price action tells you. Never get to biased long or short. If you are unfamiliar with the concept of “low float stocks” keep in mind we go into great detail in StocksToTrade Pro covering concepts like float and how it affects volatility.

Table of Contents

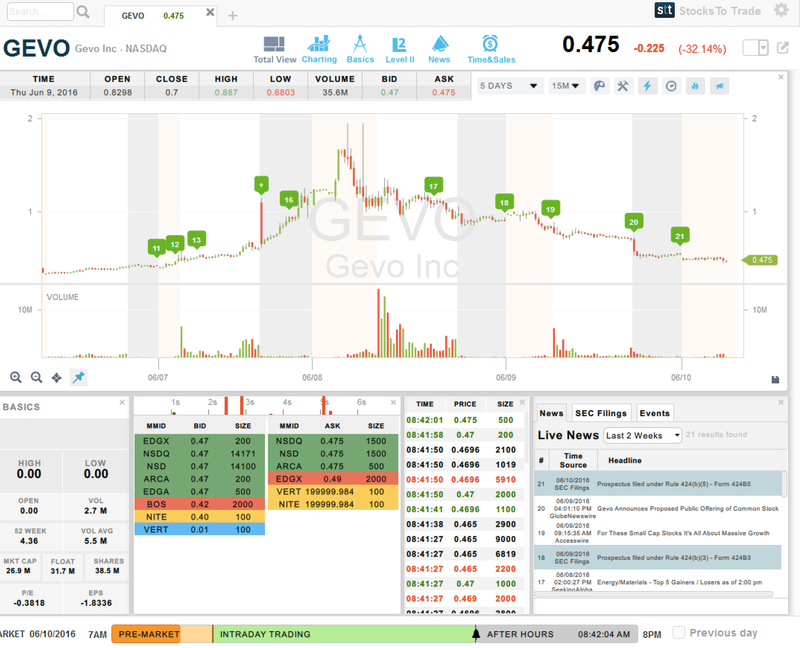

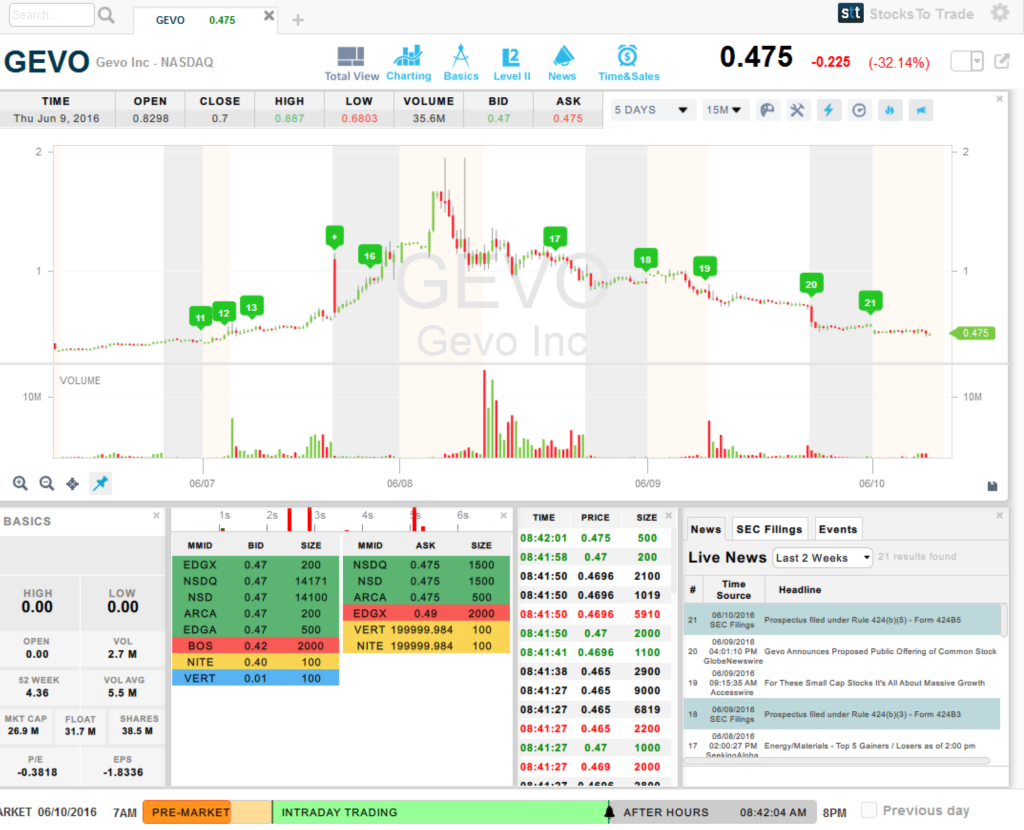

Gevo, Inc. (GEVO)–NasdaqCM

This stock was up huge on news of a contract win. Providing a great buy opportunity, it was quickly discovered that the deal was very dubious in nature creating a potential short opportunity. Then a stock offering came out after hours created a massive win for shorts. Perfect example of the type of stock day traders love.

Download a PDF version of this post.

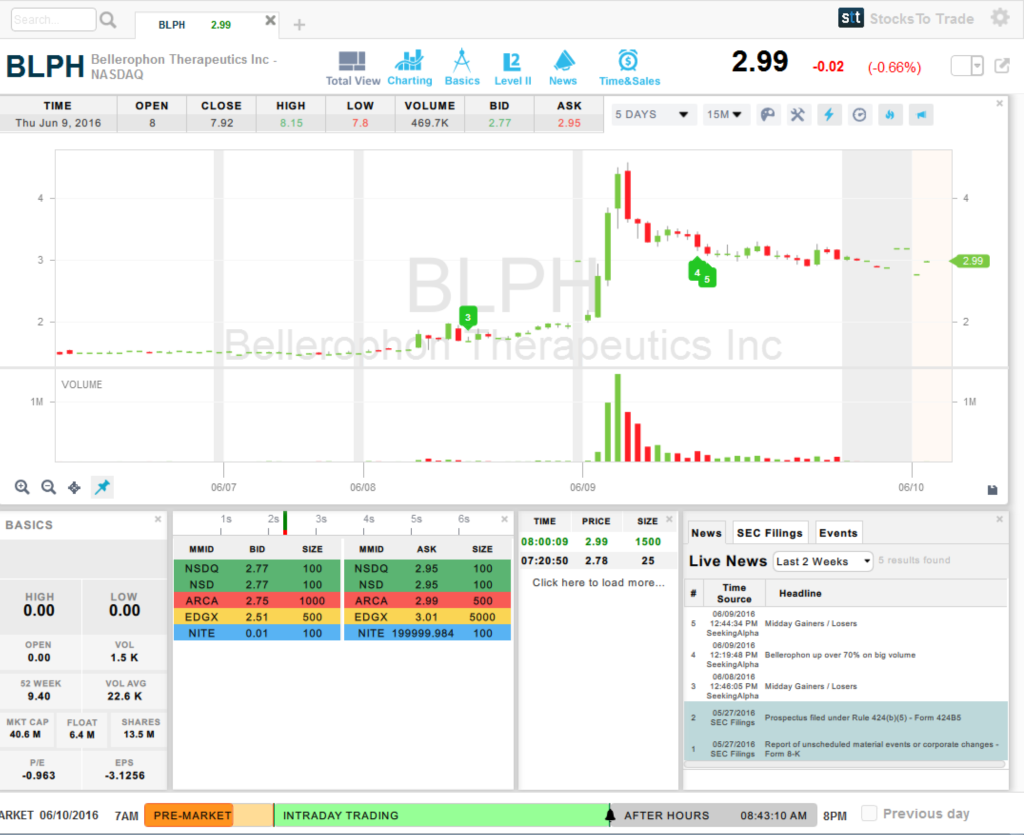

Bellerophon Therapeutics, Inc. (BLPH) –NasdaqGM

Bellerophon Therapeutics, Inc. (BLPH) –NasdaqGM

BLPH is the perfect example of a low float stock rocketing up simple because of stuck shorts and buyers tripping over themselves to get in the stock quickly. But like so many low priced momentum stocks, once the early shorts cover and the momentum fades they quickly become very solid fading setups.

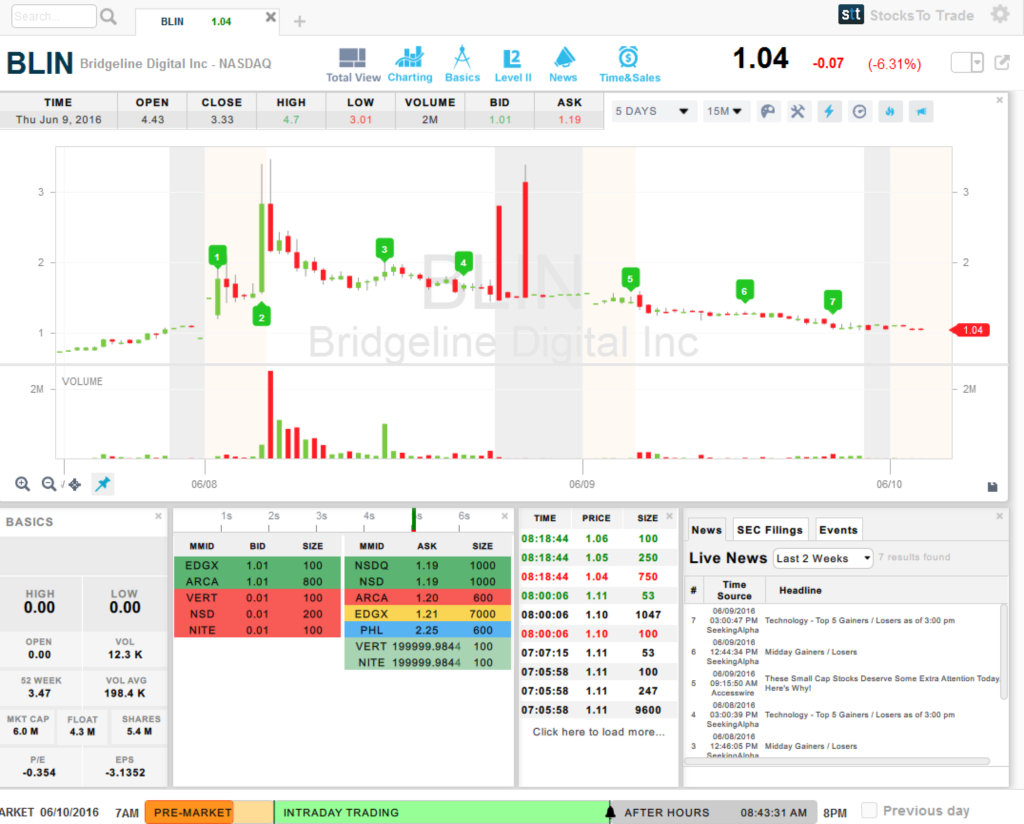

Bridgeline Digital, Inc. (BLIN) –NasdaqCM

Bridgeline Digital, Inc. (BLIN) –NasdaqCM

This stock was an “earnings winner” runner. Keep in mind the earnings do not need to be good in these types of stocks. Frequently ANY earnings announcement will set off a run. Especially in a stock like this with only 700K shares in the float. But again notice how this stock almost tripled, creating a solid buy, followed soon by a crack back to almost the exact price it started out at.

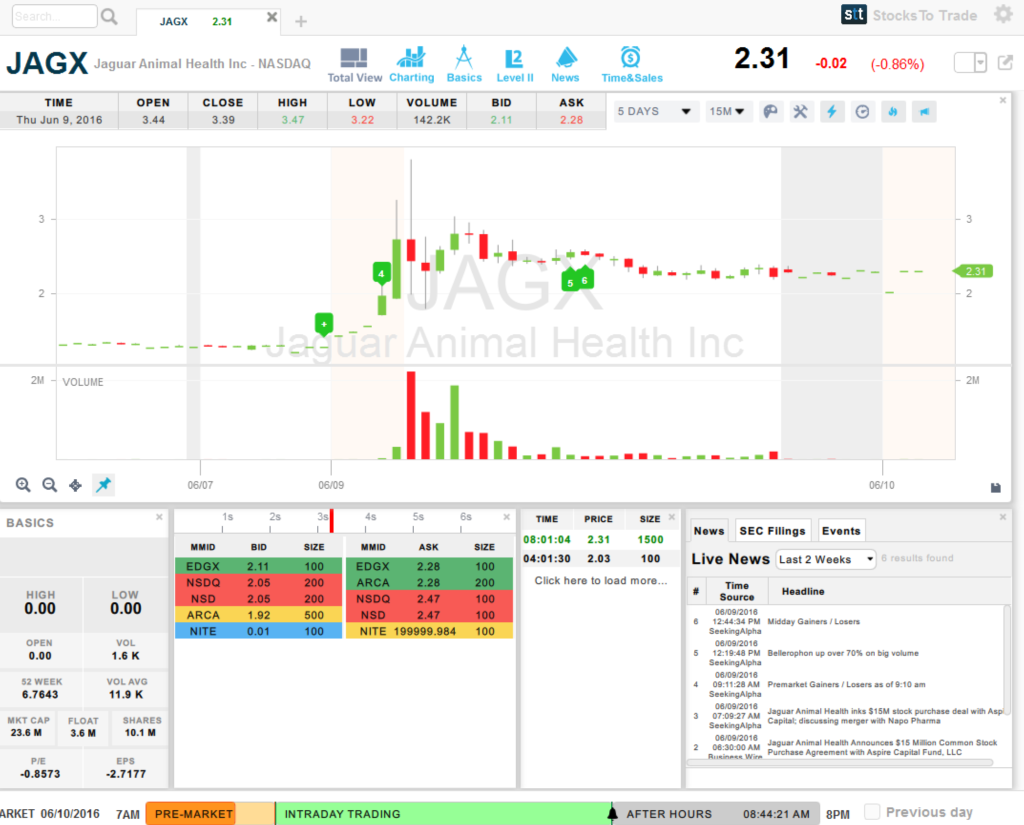

Jaguar Animal Health, Inc. (JAGX) –NasdaqCM

Jaguar Animal Health, Inc. (JAGX) –NasdaqCM

JAGX is the most recent runner, popping yesterday on some investment news. Great buy into this news as long as you were quick with a die hard trading mentality. The stock did hold its gains but is looking weak in pre market today and could fade going into next week.

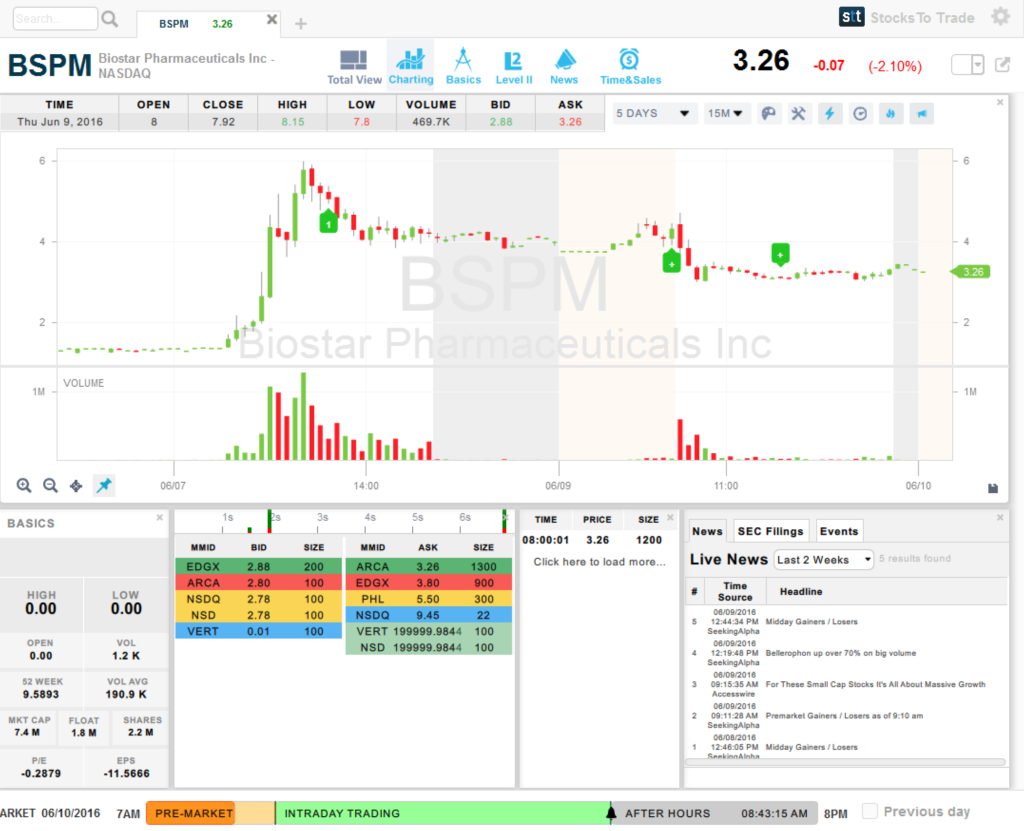

Biostar Pharmaceuticals, Inc. (BSPM) –NasdaqCM

Biostar Pharmaceuticals, Inc. (BSPM) –NasdaqCM

In a standard “sector play” BSPM ran up only becuase other similar tickers were running. While it can be difficult to locate this type before the run happens. One of the best strategies is to wait for the “backside” and short into fading price action. This stock actually pulled back so hard yesterday it was temporarily halted for volatility. This is a short term short sellers dream.