Table of Contents

Finding and Interpreting Stock Catalysts

Nothing moves without a good catalyst. But, how does a trader go about finding and interpreting catalysts to individual stocks?

Download the key points of this post as PDF.

A catalyst is a person or thing that precipitates an event, as the dictionary definition holds.

And, if you’ve found a stock that looks good to start trading because it’s a percentage gainer, but there’s no catalyst to bring it higher, it’s probably not the right stock—for now.

This is the vital Step 2 in the 5-step daily trading strategy of STT’s lead trainer, Tim Bohen. In the last piece in this series we took you through

Step 1—Finding Percentage Gainers. Now it’s time to see how things could actually move mountains.

The catalysts are where traders tend to get hung up.

“This is the biggest thing that so many traders often overlook,” says Tim. “They will see a stock that is moving on a specific day and there is no reason behind that movement. Then, they try to trade the stock the next day and they wonder why it’s not working.”

Perhaps the stock is up 50% and the next day it’s down 20%. A trader would logically get frustrated, step out and move on.

The problem, according to Tim, is that the stock had no catalyst.

If you get through Step 1 and find a list of percentage gainers, but none have catalysts, then it’s not a day for trading.

“We want a stock that has potential for multi-gain runs to maximize our edge,” says Tim. “Everything we are doing is to maximize the edge. You aren’t going to win every time, but if you can get 7 out of the 10 things in your favor, your potential for success is much greater.”

So what exactly constitutes a Stock catalyst?

Here’s our short-list, with examples to get you on your way:

Earnings Announcements

Keep in mind, though, that a company doesn’t have to have glowing earnings reports for a stock to move big. You absolutely should look for earnings announcements, and this is all built into STT.

“Quite frequently, a company will lose money, but it loses less money than the market anticipated—or less than the shareholders thought. And then, all of a sudden, the stock has the potential to spike, even though the company’s lost money,” Tim recently told STT Pro users in a webinar.

Any way you look at them, earnings are a catalyst, then—even if they aren’t earnings. Yes, even reported losses on an earnings report can be a positive catalyst. Stocks can gain even if a company merely reports losses that are lower than anticipated, which can reinvigorate investor confidence. This is an example of when a loss becomes a win, in terms of catalysts.

A press release, especially in the moment, on a low-price stock can really result in a huge move.

Here’s an example from August:

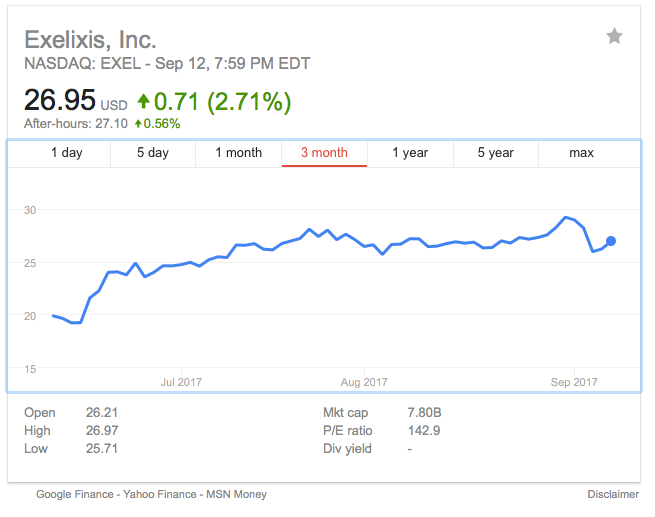

A biotech company called Exelixis (EXEL), which develops drugs to treat cancer, released its second-quarter earnings results, showing that demand for its lead drug, Cabometyx, is rapidly expanding and that sales were up exponentially. The stock gained $2 and its market cap gained $626 million on the news.

Contract Announcements & New Product Releases/Announcements

Announcements about a new contract secured by a company stock that you’re watching, or a new product release or announcement of a new product in the pipeline can also make stocks move. These types of announcements “bring eyeballs in,” says Tim—or traders, and that’s what ignites big moves.

There are examples of small providers of some sort of technology who have announced a deal with Apple, for example. In a case like this, you can be sure that a small-market-cap company stock will make huge moves. And, we’re talking about moves that can give us a motive to buy (for example) 1,000 shares of a $1 stock and watch that stock go up to $3 or $4 or more in a single day.

In today’s market, it’s not at all unusual to find stocks with these types of catalysts quickly making big moves. It’s not even that uncommon to see stocks in the past few months move 700% or 800% in a day. That’s our Holy Grail and we won’t find it without the right catalyst.

We talked about XOMA last week quite a lot, but it’s still traveling upwards beautifully. Biotech is a tricky sector, but certain catalysts have serious momentum. The question always is, can this momentum last more than a day?

In XOMA’s case, it definitely has had a good run. And the big catalyst was news of a licensing agreement:

On this news, the stock price shot up, and by 12 September, it was still on an upward trend. It went from $9 to over $20 in a week, before it started to pull back a bit under $18.

Another fresh example would be Kohl’s, which shot up 5% in the first week of September when it announced a deal with Amazon. Deals with Amazon tend to move stocks quite well, even if there’s not much to the deal.

Clinical Trials & FDA Approval

For biotech and pharma, the catalysts we’re interested in are clinical trial updates and results and the big money-maker—an FDA approval.

Last week, ABEO was a great story. ABEO shot up on a press release on a new treatment and an FDA approval. More specifically, ABEO got breakthrough therapy designation for one of its drugs.

This designation is huge in this sector and can really move the smaller companies in biotech.

Twitter Movement

Now, we don’t want to get hung up on using Twitter as a catalyst on its own, but a stock that has a lot of mentions on Twitter can see nice movement. Of course, there’s usually another catalyst behind those Twitter mentions as well.

At STT, we have built-in Twitter immigration, so you can see what everyone on Twitter is chatting about, in terms of the most active stocks.

Keeping these catalysts under control and following Tim’s 5 steps doesn’t mean you’re going to catch ALL of the big moves going on out there. But, if you do catch a stock that goes from $1 to $5 and buy it at $1.50 and sell at $5, that’s a huge gain—and that’s exactly the kind of setup we’re looking for at STT.

In Tim’s words: “We want the big moves, we may not be looking for a million dollars in a day, but we want the most active stocks with catalysts–and that includes earnings, product announcements and a lot of mentions on Twitter, for starters.”

When it comes to news in general, though, you must keep in mind that this is a tricky game, because it’s a slave to the news wire. News is your back up, not your sole catalyst: It’s what you use to support a theory, what you use to confirm and double-check. You take your technical indicators and then try to back them up with catalysts and news can be among those backup systems.

Later this week and next, we’ll take you through Tim’s Step 3, but we’ll also take you through three technical indicators you can use to determine whether the stock you have chosen has a chance of being your day’s winner.

Stick with us because we’ve got a lot more to discuss, and all of it will help you better utilize the tools STT offers, save time, increase efficiency and—ultimately—your bottom line.

So What Do We Recommend Next?

Try StocksToTrade for 14 Full Days for just $7.00! StocksToTrade was built by traders for traders. Cut the amount of time, stress, and anxiety you experience behind the keyboard and only deal with the handful of real trade opportunities daily. Find the stocks that matter!